A publicly-traded logistics agency has struck a $20 million take care of an institutional investor to buy Official Trump memecoins, changing into one of many first corporations to anchor its digital asset technique across the U.S. president’s controversial crypto enterprise.

Freight Applied sciences CEO Javier Selgas pitched the transfer as a part of an effort to develop U.S.-Mexico commerce—although how a memecoin suits into provide chains stays unclear. The funding additionally comes because the U.S. Workplace of Authorities Ethics examines whether or not President Donald Trump violates federal ethics guidelines by providing unique entry to his coin’s high traders.

What Is Fr8Tech?

Freight Applied sciences, which refers to itself as Fr8Tech, is a Houston-based firm launched in 2015 and trades on NASDAQ. The corporate goals to make use of new applied sciences like synthetic intelligence for the optimization of the provision chain processes.

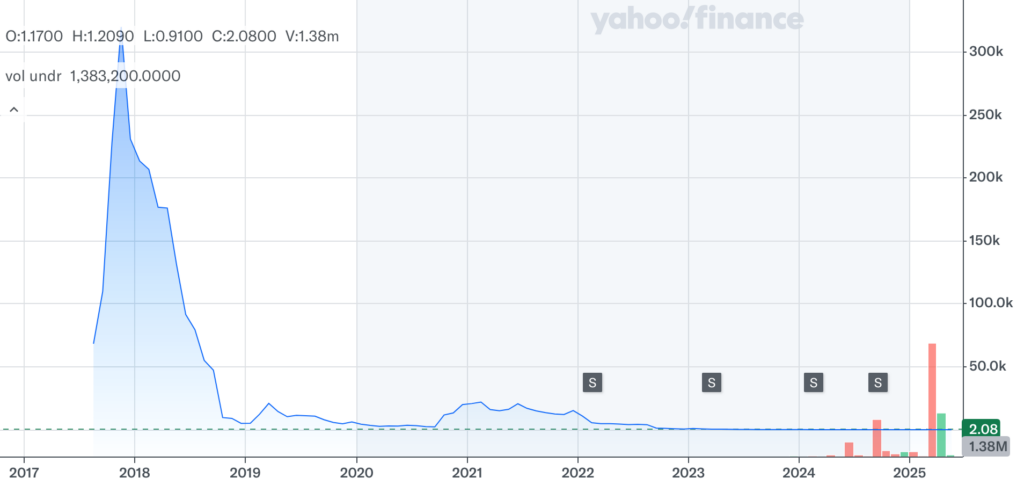

The corporate’s inventory, which trades on the Nasdaq underneath the ticker FRGT, noticed its value plummet again in 2018, throughout Trump’s first time period. Like many different corporations, Freight Applied sciences is now shifting ahead with a digital asset reserve, deviating from the norm of creating Bitcoin (BTC) the first asset and embracing a memecoin as an alternative.

Social media affect and crypto commentator Mario Nawfal referred to as it the “first-ever” Trump treasury.

No main headlines but, however $FRGT’s transfer to again a treasury with $TRUMP is catching CT’s eye—social buzz round $TRUMP is robust, even whereas the token’s value motion is cooling and buying and selling exhibits short-term draw back danger. $FRGT remains to be underneath the radar, with little quantity or information…

— Alva (@AlvaApp) April 30, 2025

Pricey gimmick?

On April 30, Freight Applied sciences introduced the creation of a crypto treasury.

The corporate agreed to challenge convertible notes price as much as $20 million with an institutional investor. The capital is secured completely for purchasing Official Trump (TRUMP) tokens. The primary tranche will quantity to $1 million.

Selgas, in a ready assertion, referenced Trump’s “America First” precept and tied it to commerce efforts between Mexico and the U.S. See under:

On the coronary heart of Fr8Tech’s mission is the promotion of productive and energetic commerce between america and Mexico. Mexico is america’ high items buying and selling associate, with Mexico being the main vacation spot for US exports and the highest supply for US imports. As US Treasury Secretary Scott Bessent lately acknowledged, “I want to be clear: America First doesn’t imply America alone. On the contrary, it’s a name for deeper collaboration and mutual respect amongst commerce companions.”

Shopping for TRUMP is printed as “an efficient option to advocate for honest, balanced, and free commerce between Mexico and the U.S..” Nonetheless, the corporate doesn’t elaborate on how a Trump memecoin acquisition will assist commerce between the 2 nations or warn readers in regards to the potential dangers.

In spite of everything, the Trump token — like most memecoins — is very unstable. Though its value has been up roughly 2% previously 24 hours, it’s been on a downward trajectory since its launch in January.

Supply: CoinGecko

Trump memecoin a wierd selection

As company crypto treasuries develop into stylish, big-name companies like BlackRock advocate allocating as much as 2% of company property in Bitcoin. They argue that BTC is a greater retailer of worth than most different digital property.

In accordance with the Bitcoin Treasuries web site, 101 public corporations maintain Bitcoin.

Contemplating Bitcoin’s deflationary design and long-term worth appreciation, which have been demonstrated all through its 15-year historical past, it’s comprehensible why some corporations could select Bitcoin as one in all their company property.

Up to now, Official Trump has no use case aside from incentivizing traders to purchase extra to be invited to a non-public dinner with Trump on Might 22. $TRUMP noticed its worth spike over 50% following the promotion.

Critics additionally warn that the “pay to play” side of Official Trump raises ethics considerations and will even be used as a bribery software.

“One thing that hasn’t been a lot mentioned — making a bunch of private memecoins opens the door to secretive international consumers making an attempt to curry affect with our leaders,” Nic Carter of Citadel Island Ventures mentioned on X again in January. “When you hated Hunter Biden’s nameless artwork gross sales, it’s best to hate this too.”

One thing that hasn’t been a lot mentioned – making a bunch of private memecoins opens the door to secretive international consumers making an attempt to curry affect with our leaders. When you hated hunter biden’s nameless artwork gross sales, it’s best to hate this too.

— nic carter (@nic__carter) January 20, 2025

Final month, Democratic Senators Adam Schiff and Elizabeth Warren referred to as for a federal ethics investigation into Trump’s promotion of the coin. In a letter to the U.S. Workplace of Authorities Ethics, the senators allege that Trump could have violated federal ethics guidelines by providing entry to his administration in alternate for monetary funding.

Freight Applied sciences has not indicated that it seeks entry to the White Home by holding Trump memecoins. Within the days following the corporate’s announcement, the FRGT inventory value grew 111.21% on Might 2. The inventory closed Friday at $2.08 per share.

The Trump memecoin value appears unaffected by the information.

You may additionally like: Trump Household’s twin coin launch attracts fireplace for conflicts of curiosity and money grabs

Indicators of a bubble?

Bubbles make sense after they burst, so it’s untimely to state that company crypto treasuries are the bubble. Nonetheless, some observers really feel {that a} sudden spike of curiosity in crypto amongst public corporations attracts comparisons with the dot-com bubble.

Value reminding the one *actual* public corporations which have adopted bitcoin as a company treasury are $TSLA, $COIN and $XYZ

All people else sits someplace on the spectrum between Charles Ponzi and https://t.co/3CghbTay3b

— Pledditor (@Pledditor) Might 2, 2025

If we glance intently, we are going to see that it’s early to discuss a robust development or any notable crypto fever amongst public corporations. As extra corporations purchase Bitcoin, most are comparatively small corporations that spend humble quantities on it.

Technique, an organization holding over 500,000 bitcoins, began to build up BTC in 2020. Tesla made a Bitcoin funding in 2021, driving the asset’s value. Technique grew to become the dominant Bitcoin purchaser amongst public corporations. The remainder of the general public corporations maintain smaller BTC luggage—no must panic.

As for the Fr8Tech information, the corporate at present has the financing “earmarked” for buying Official Trump, so we’ll see what occurs when the acquisition is formally made.

Learn extra: Increasingly more corporations select Bitcoin because the prime asset for company reserves