The perpetual DEXs development is shifting to Solana, with Pacifica rising as an up-and-coming market. The DEX, launched by former FTX executives, is now rising its buying and selling volumes.

On Solana, perpetual DEXs exercise principally relied on the Jupiter and Drift protocols. Nevertheless, a brand new star is rising, one which may be linked to the bankrupt FTX centralized alternate.

Pacifica has been making the rounds on social media a couple of months after launching. The perpetual futures DEX makes use of the Solana stack, and has been gaining on the final hype round Hyperliquid and Aster.

However what pushed Pacifica to the forefront was a current publish from Sam Bankman-Fried’s X account. As Cryptopolitan reported earlier, the SBF account posted a brief message, sending the FTT token on one other rally. The reawakened profile additionally pointed consideration to former FTX and Alameda Analysis alumni, who walked free and at the moment are on the helm of their very own initiatives.

Solana DEX achieve assist from former FTX, Alameda hires

Simply days earlier than Pacifica gained consideration, Armani Ferrente, an early Alameda Analysis rent, defended on-chain perpetual DEXs for being safer than the FTX centralized mannequin. Ferrente is already selling his personal Backpack alternate, reaching over $10B in weekly volumes.

On-chain and clear buying and selling is seen as a transparent protection in opposition to the non-transparent asset actions between FTX and Alameda Analysis.

Nevertheless, there’s nonetheless an ongoing dialogue if a DEX can have some management of consumer funds for the sake of buying and selling.

At this stage, Pacifica additionally emerged as a safer model, providing a complicated buying and selling venue with out the danger of FTX. The chapter has not stopped influencers from taking on Pacifica and even selling it for its connection to FTX.

Pacifica boasts of connection to FTX

The Pacifica perpetual futures DEX remains to be a comparatively small newcomer to the current perp DEX hype. The alternate solely accrued $16.6M in worth locked within the first 10 days of exercise.

Influencers are already on the duty, with a few of them specializing in the hyperlink to FTX. Pacifica has been launched by Constance Wang, former COO at FTX till November 2022.

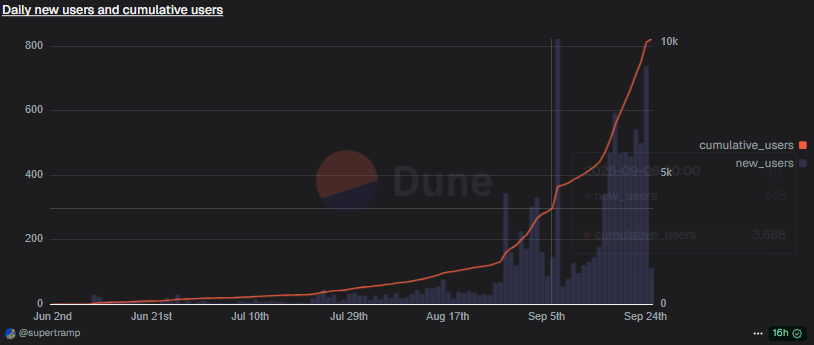

The Pacifica perp DEX claims to have gathered 10K customers, with one other 6K flowing in for the previous week.

1/ gm

As of now, Pacifica has now reached:

$8,000,000,000+ Whole Quantity 💹💹

(up 50% since final week)10,000+ Lively Customers 🐳🐳🐳

(+6,000 since final week)600m+ 24h quantity 📈https://t.co/wt4vESPDDchttps://t.co/4RDJnAbkJF

We don’t cease. 💪

— Pacifica (@pacifica_fi) September 26, 2025

The DEX stories over $34M in open curiosity, and posts every day information in deposits and new customers. For now, the market has round 4,120 every day lively customers, a far cry from the success of FTX and even smaller perpetual DEXs.

Pacifica stories document inflows of customers and deposits, because it rides the final perp DEX hype. | Supply: Dune Analytics.

A few of the influencers are leaning into the rumor that Pacifica will even achieve enter from Google expertise and different former FTX staff, together with enter from Bankman-Fried.

Within the brief time period, Pacifica is enticing for its early-stage level farming season. The DEX arrived comparatively late, and is presently in Season 1, whereas different markets are already nicely into their second stage. The chance for airdrops is driving visitors to all markets, and all new perp DEXs are but to show the present hype is sustainable.