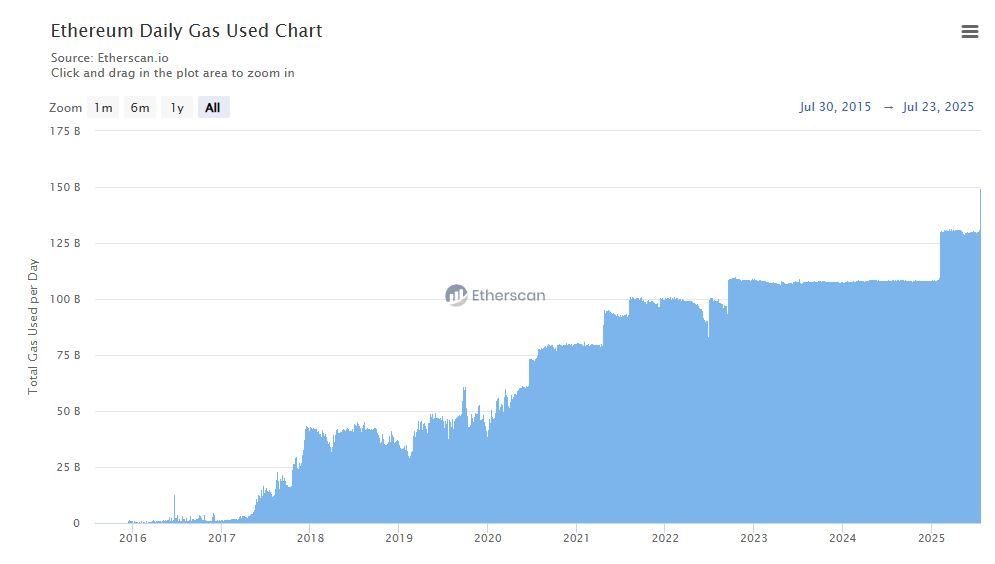

The Ethereum community reveals unprecedented demand, not too long ago marking a brand new report of day by day fuel used. The metric reveals peak on-chain exercise, whereas particular person transactions stay comparatively low-cost.

Exercise picked up up to now few days, with day by day fuel use rising to a report degree. The metric reveals Ethereum is vital to on-chain exercise, and that customers are returning throughout bull markets for a number of apps and use instances.

Ethereum fuel utilization spiked to a report up to now weeks, on a mixture of whale shopping for, retail demand, and total hype for the ETH market rally. | Supply: Etherscan

The community carries round 1.6M transactions day by day, originating from over 500K day by day energetic wallets. Exercise facilities round stablecoin transfers for USDT and USDC, in addition to uncooked ETH transfers.

Community exercise already spiked to the next degree in early 2025, when ETH traded nearer to $4,000. This time round, fuel utilization rallied to a brand new vary, based mostly not on anomalies however typically elevated on-chain exercise. Gasoline utilization is just not linked to particular occasions, however reveals the rising DeFi utilization and transfers.

ETH returns to 2021 ranges, however with out the hype

Regardless of the report utilization, common transactions nonetheless value lower than $0.15, and NFT transfers are the costliest at $2.48. Not like earlier intervals of heightened ETH utilization, transactions should not prohibitive.

The current improve in utilization raises the query of scaling the community, going past the at present present L2 chains. ETH has proven its mixed use instances, each as helpful collateral and as a utility token for energetic transfers.

The present Ethereum exercise and fuel utilization ranges are near the 2021 exercise spike. The earlier bull market was linked to peak NFT mania, mixed with Web3 video games, memes and DeFi.

After an extended bear market, on-chain exercise is recovering, with higher infrastructure and liquidity. The largest change comes from DeFi, the place initiatives have constructed instruments to keep away from cascading liquidations.

The rise of Aave additionally set the gold customary for lending, unlocking further liquidity on the community. Aave expanded its worth locked to over $29B, whereas the general community carried greater than $82B in worth locked. The chain now carries related liquidity to early 2022, earlier than the crash triggered by FTX.

Stablecoins increase Ethereum exercise

Ethereum nonetheless carries over 80% of stablecoin site visitors, benefiting from the elevated provide in 2025. The chain carries $128.5B in stablecoins, with round 2.5M energetic addresses particularly devoted to stablecoin exercise.

Ethereum additionally carries the largest quantity by way of worth transferred, with a big share originating from whale transactions. Previously three months, stablecoins have been a part of the extremely energetic influx into the community.

Elevated utilization and liquidity, in addition to bridging from unused L2 chains, meant Ethereum added $20B up to now three months. The chain was a frontrunner of inflows, as exercise returned to the L1 chain.

Even with the report utilization of L2 like Base, ultimately a number of the earnings have been bridged again to Ethereum. A number of chains confirmed that bridges have been used to lock in beneficial properties and revert them to the unique ETH ecosystem, as a consequence of its connection to DEX and common exchanges.

Ethereum provides Arbitrum, Polygon, Unichain and Base with liquidity, whereas receiving the largest returns from Base and Arbitrum, based mostly on Artemis information. Previously week, L2 chains despatched a internet whole of $104M to Ethereum, from $1.7B in gross inflows. The fixed switch reveals Ethereum stays a key hub for consolidating earnings and particularly stablecoins.