Gold surges to greater than $3,390 on April 21 as extra traders flock to safe-haven belongings amidst financial uncertainty. A lift in gold might sign the same sample in crypto, particularly Bitcoin.

In response to the most recent information from Buying and selling Economics, gold has hit a brand new all-time excessive amidst international financial volatility. On April 21, gold went up 2%, reaching effectively above the $3,390 threshold and hitting as excessive as $3,395 round 7:30 UTC. Analysts predict that the rise in efficiency may very well be attributable to rising international commerce tensions and a results of the U.S. greenback rising weaker.

Only a week prior, President Donald Trump ordered an investigation into potential new tariffs on U.S. crucial mineral imports. This marks a big escalation within the commerce dispute between the U.S. and different nations, notably China. As well as, traders are beginning to lose confidence in conventional fiat currencies because the U.S. greenback plummeted to a three-year low.

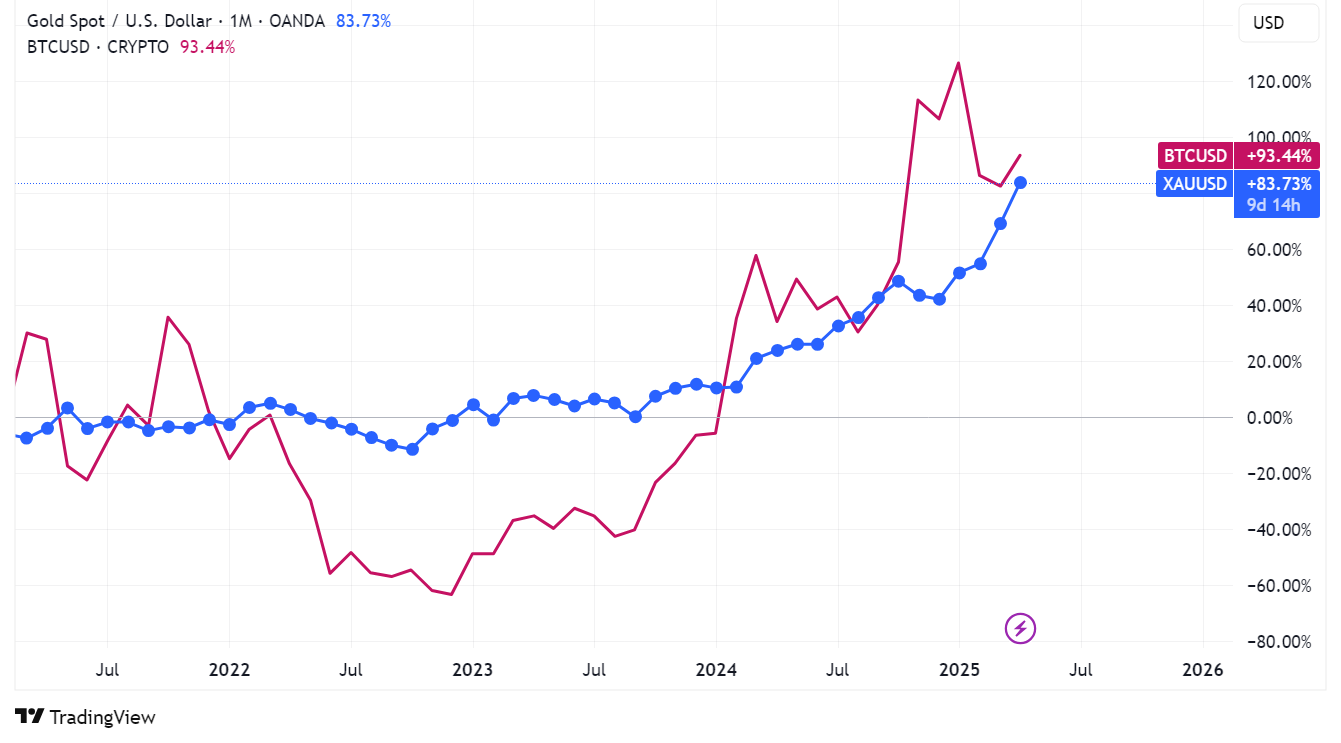

Then again, gold’s meteoric rise might sign the beginnings of a bullish rally for the crypto market. Merchants have famous the the worth of gold and Bitcoin (BTC) typically go hand-in-hand, contemplating each are “safe-haven” belongings.

Worth chart evaluating the actions of Bitcoin and gold available on the market, April 21, 2024 | Supply: TradingView

You may additionally like: Tokenized gold spot and futures buying and selling coming to Bitget Pockets

In actual fact, on the identical day, Bitcoin reached a brand new monthly-high of $87,570. At press time, BTC has gone up greater than 3.2% previously 24 hours of buying and selling. It’s at the moment buying and selling arms at $87,538. The final time BTC reached above $87,400 was again in March 28, earlier than it skilled a stoop in early April.

What’s the historic relationship between gold and crypto?

Bitcoin has typically been likened to “digital gold” by market merchants and traders alike. Federal Reserve Chair Jerome Powell mentioned that Bitcoin was a competitor for gold attributable to how each belongings are used as a retailer of worth quite than as a fee possibility.

Equally, founder and CEO of ARK Funding Administration, Cathie Wooden predicted Bitcoin’s $2 trillion market cap might sooner or later surpass gold’s $15 trillion over time. Regardless of having been round longer, it evidently took gold an extended time to succeed in $2 trillion, one thing that took Bitcoin solely 15 years.

“At $2,700, gold is a $15 trillion market, in comparison with Bitcoin at solely $2 trillion. Even after breaking by means of $100,000, Bitcoin nonetheless is in early innings,” mentioned Wooden.

Traditionally, constructive market actions in gold are sometimes adopted by a lift in Bitcoin costs not lengthy after. Except for the truth that each belongings are seen as “protected havens” that shield traders towards the volatility of conventional fiat currencies, each even have finite provides that should be mined.

Regardless of these similarities, a Bloomberg evaluation discovered that gold nonetheless has a a lot decrease volatility price in comparison with Bitcoin; with gold’s annual volatility price being round 10% to twenty%, whereas Bitcoin typically exceeds 50%. Although this can be the case, analysts have additionally famous that macro Bitcoin traits tend to observe gold’s inside a number of months.

You may additionally like: Gold hits new all-time-high at $2,700 amidst bullish Bitcoin