-

Gold hits document highs, fueling hypothesis Bitcoin might comply with with explosive This autumn rally.

-

Markus Thielen suggests Bitcoin mirrors gold, probably making ready for its strongest breakout quickly.

-

Bitcoin choices present stability benefit over Ethereum, sparking renewed investor curiosity in BTC.

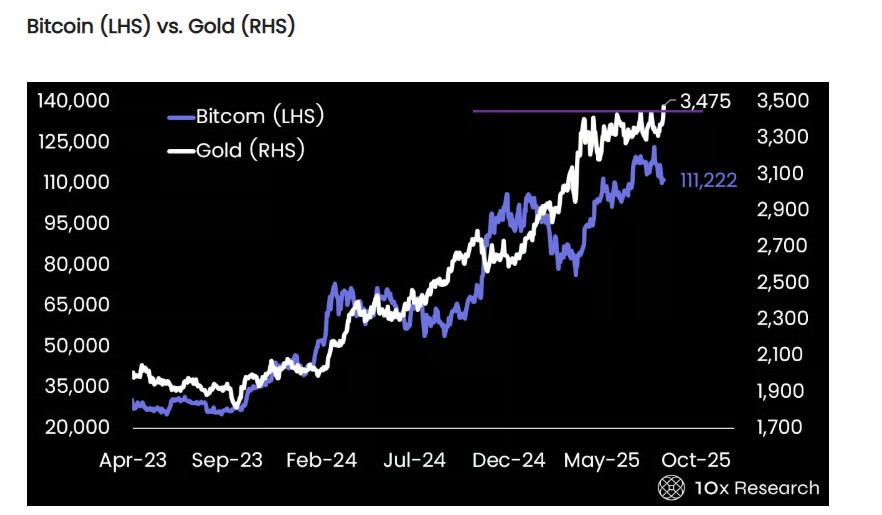

As gold edges close to document highs $3475 this August 2025, crypto merchants are watching intently. The world’s oldest safe-haven asset is hovering once more, and its rise may set the tone for Bitcoin’s subsequent massive transfer.

The query now’s whether or not this gold rally is only a safe-haven play or the quiet sign that Bitcoin’s strongest quarter is about to start.

Gold’s Breakout and the Bitcoin Connection

Gold not too long ago touched an all-time excessive of $3,475 per ounce, fueled by sticky inflation, anticipated fee cuts, and international tensions. Whereas the steel has seen brief pullbacks, it stays nicely supported close to document ranges of $3416.

Markus Thielen, the top of 10x Analysis, exhibits how this regular breakout may grow to be a mirror for Bitcoin. Whereas each belongings are sometimes considered as secure havens in unsure occasions, and when gold strikes first, Bitcoin typically follows with extra pressure.

His chart evaluating the 2 means that Bitcoin could possibly be making ready for the same breakout if macro circumstances proceed to accentuate.

Bitcoin Mirrors Gold’s Strikes

Bitcoin, usually known as “digital gold,” has proven a transparent correlation with bodily gold in 2025. Each belongings have climbed in parallel, with Bitcoin hitting $124,000 in July earlier than correcting to round $111,000.

Analysts like Markus Thielen of 10x Analysis argue that gold’s quiet breakout may quickly echo in Bitcoin, given how each react to macroeconomic shifts similar to U.S. debt issuance and financial easing.

Crypto Rotation Again To Bitcoin

On the similar time, choices markets are flashing uncommon alerts. The hole between Ethereum’s volatility pricing and Bitcoin’s is now at one of many widest ranges seen in years.

Such excessive spreads usually mark a turning level, hinting that merchants count on extra stability in Bitcoin in comparison with Ethereum.

With macro circumstances tightening and merchants rotating into new narratives, This autumn may mark the start of Bitcoin’s subsequent sturdy rally.