BULLA surged practically 50% since Thursday, however many outstanding neighborhood members assume Hasbulla is working one other rug pull rip-off. Regardless of regarding developments, BULLA has turn out to be one of many prime gainers within the BNB ecosystem this week.

Most blockchain analysts wrote off this meme coin as a rip-off because of the influencer’s shady historical past. Nonetheless, a Binance Alpha itemizing has helped the token achieve some legitimacy.

Hasbulla and BULLA Defined

Hasbulla, a Russian crypto influencer, has an extended monitor report of launching meme cash, most of which led to rip-off allegations.

Subsequently, when he first started a presale for the brand new BULLA token, the neighborhood was very skeptical of a rug pull. Hasbulla’s BULLA token has been buying and selling for a lot of the final month, but every part stays ambiguous.

To be clear, the asset’s complete historical past has been punctuated by huge drops. When Hasbulla launched BULLA on June 8, it had a $100 million market cap. 5 days later, $70 million evaporated.

For probably the most half, BULLA exhibited a continuing downward pattern, however a couple of occasions saved bumping it again up.

On June 22, Binance Alpha introduced that it was that includes Hasbulla’s latest asset, rising BULLA’s prominence. This included a large airdrop, which the trade is especially notable for.

This instantly attracted heavy criticism, with analysts fearing a rug pull. Shortly after, the token’s worth dropped 50%:

And but, this drop doesn’t appear to totally match with the rug pull principle. Relatively, if there’s a rip-off, it hasn’t ended but. 5 days later, BULLA started trending once more, inflicting Hasbulla himself to brag concerning the token’s success.

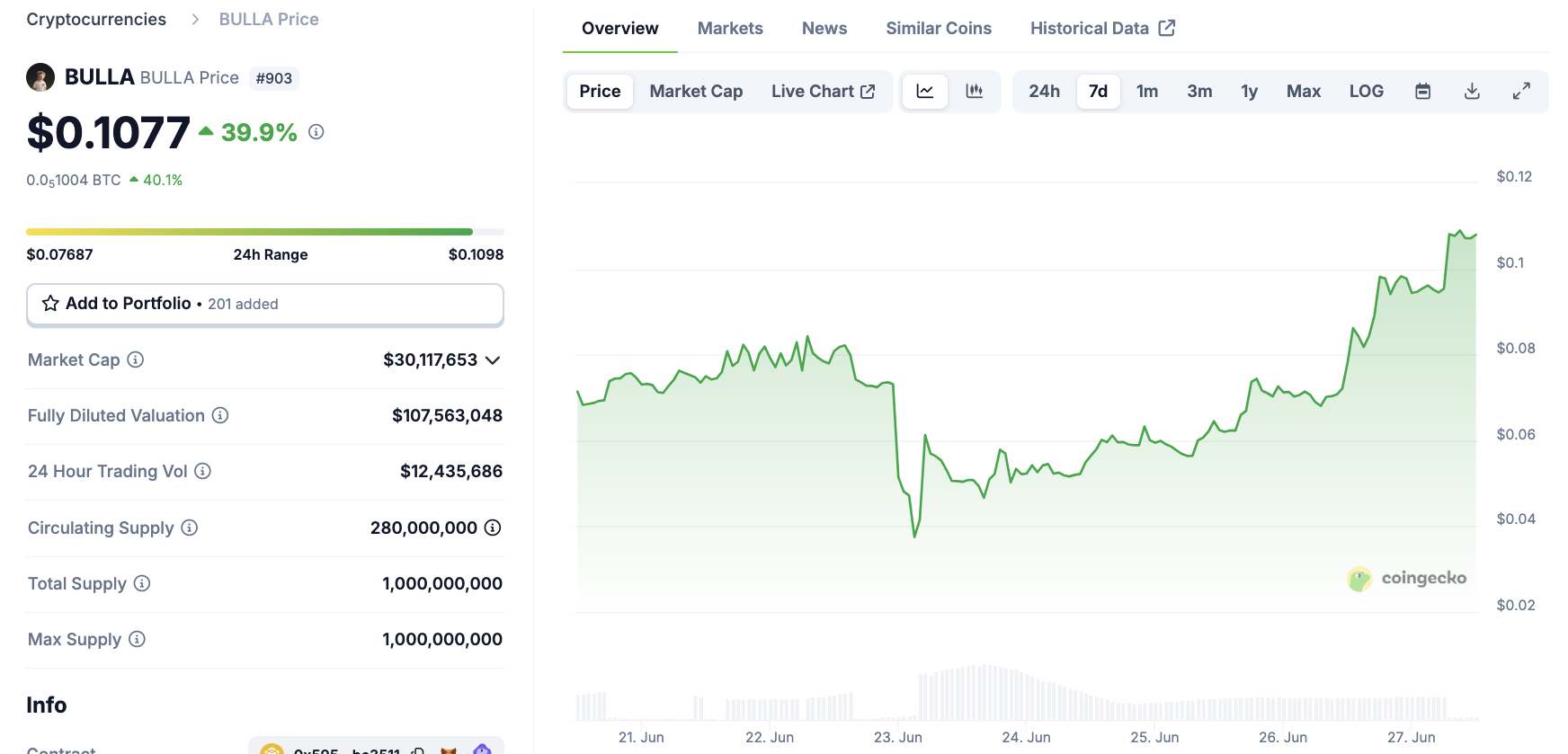

In comparison with the Binance itemizing drop, BULLA recuperated all these losses and posted recent good points, leaping 40% right this moment.

BULLA Value Efficiency. Supply: CoinGecko

So, what occurred? The neighborhood stays satisfied that BULLA is a rip-off, particularly contemplating Hasbulla’s monitor report. Nonetheless, blockchain analysts haven’t clearly confirmed this but.

For instance, some skeptics theorized that DWF Labs could have powered BULLA’s good points, because the agency labored with Hasbulla earlier than.

Moreover, DWF Labs has been concerned in a number of controversies, making it a straightforward scapegoat. To be clear, although, there isn’t a shred of concrete proof.

After all, Hasbulla’s personal crew may’ve managed to pump BULLA with out exterior assist. The extra direct downside appears clear: no severe analyst desires to trouble circulating exhausting proof of a pump and dump.

Consultants have been denouncing BULLA since earlier than it launched, however Hasbulla supporters maintain shopping for it anyway. A number of analysts have advocated for letting them get scammed.

This apathy and contemptuous perspective gained’t produce any advance warnings, however it could yield fascinating postmortems.