As Bitcoin (BTC) consolidates across the $110,000 stage, technical indicators recommend that the asset’s present bull cycle could also be nearing its conclusion.

In response to distinguished on-line analyst TradingShot, the maiden cryptocurrency is approaching a possible market peak in late 2025, to be adopted by a major correction into 2026.

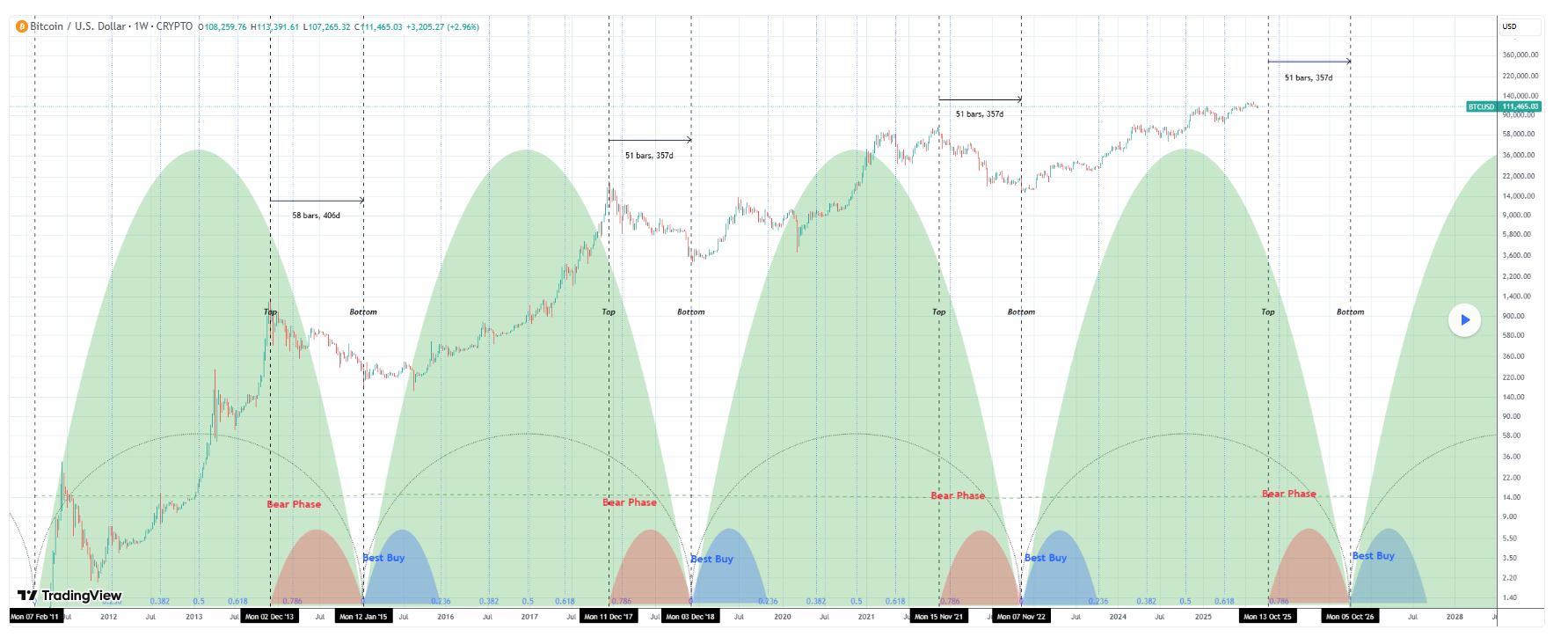

In a TradingView put up on September 5, the analyst famous that historic knowledge reveals Bitcoin’s market construction typically follows a recurring rhythm of tops, bear phases, and cycle bottoms. Every tremendous cycle has tended to high out close to the 0.786 Fibonacci time extension earlier than coming into a chronic downturn.

Primarily based on present cycle measurements, the subsequent main high might happen in the course of the week of October 13, 2025. This timing aligns with earlier cycles that peaked shortly earlier than transitioning into their respective bear phases.

The evaluation additional means that the bear part could start after December 1, 2025, when the 0.786 Fibonacci marker is reached. If cycle symmetry holds, the bear market might lengthen till the projected tremendous cycle backside on October 5, 2026.

At that time, one of the best long-term shopping for alternative is anticipated to emerge, per previous patterns the place cycle lows offered favorable entry factors forward of the subsequent main rally.

Bitcoin key worth ranges to observe

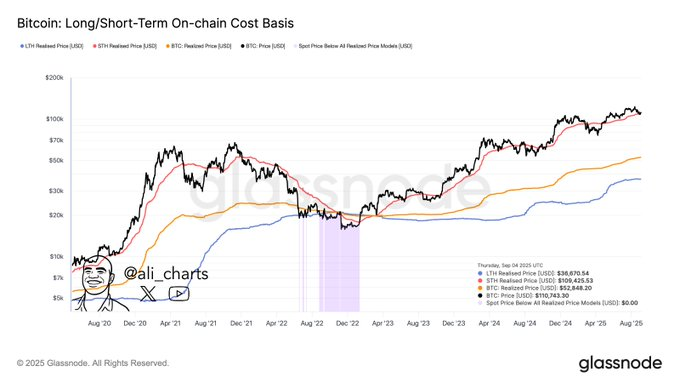

Then again, on-chain knowledge shared by Ali Martinez highlighted key metrics for assessing the well being of Bitcoin’s present bull market.

Traditionally, downtrends start when the worth falls under the Brief-Time period Holder realized worth, with deeper reversals forming as soon as it slips below the Lengthy-Time period Holder realized worth. These ranges signify the typical price foundation of current patrons versus long-term traders.

As of September 6, 2025, Glassnode knowledge reveals the Brief-Time period Holder realized worth at $109,400 and the Lengthy-Time period Holder realized worth at $36,700.

With Bitcoin buying and selling just under document highs, $109,400 has grow to be the crucial help to observe, whereas $36,700 stays the deeper structural flooring that has traditionally aligned with cycle bottoms.

Bitcoin worth evaluation

By press time, Bitcoin was buying and selling at $110,774, down about 1.7% within the final 24 hours, although nonetheless up 1.5% on the week.

For markets to realize reassurance that the rally is sustainable within the coming weeks, Bitcoin should maintain the $110,000 help, an important stage to observe.

Featured picture by way of Shutterstock