Ethereum has prolonged its bullish rally, rising sharply towards a essential multi-timeframe resistance zone. The asset is displaying sturdy momentum, but it surely’s now approaching a confluence of technical obstacles that would both set off a continuation breakout or a wholesome retracement.

Technical Evaluation

The Day by day Chart

ETH has pushed via a number of resistance zones and is now testing the $2.6K—$2.7K area. It aligns with the 200-day transferring common and the decrease boundary of the long-term channel, which was damaged to the draw back weeks in the past.

The RSI can be now in overbought territory, printing above 75, hinting at potential exhaustion. A day by day shut above $2.7K would verify a bullish breakout and open the door to $3K+, whereas rejection from this stage may pull ETH again towards the $2.2K assist stage.

The 4-Hour Chart

The 4-hour chart exhibits a textbook breakout from a descending channel adopted by sturdy bullish follow-through. The asset is consolidating simply above the $2.6K zone after a vertical leg greater.

There’s nonetheless room to stretch towards the $2.8K space, however the present sideways worth motion mixed with a declining RSI suggests cooling momentum. A break beneath $2.6K may set off a short-term correction towards $2.1K earlier than the subsequent leg.

Sentiment Evaluation

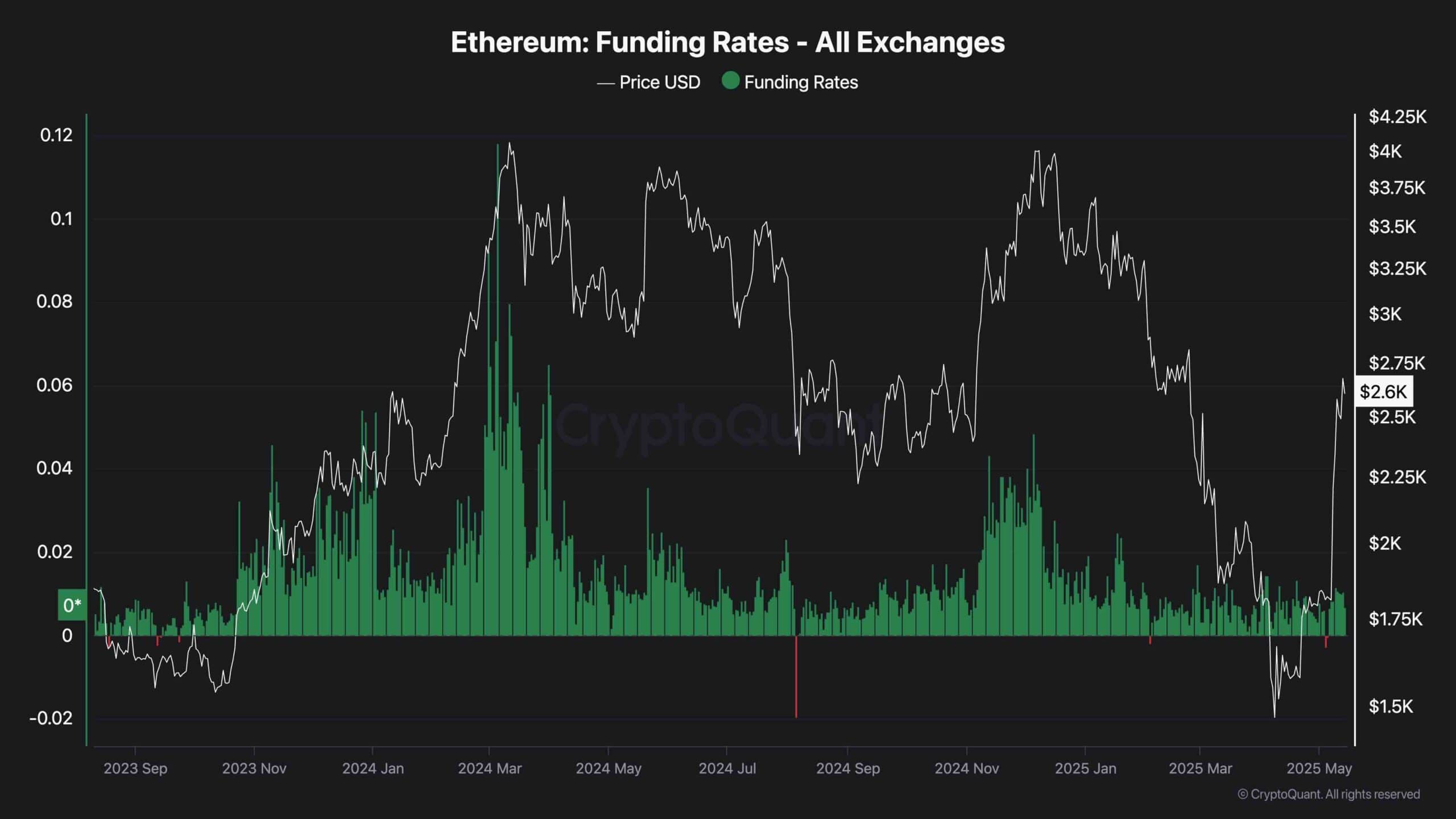

Funding charges throughout all main exchanges stay barely optimistic, reflecting bullish market sentiment. Nevertheless, they don’t seem to be but at excessive ranges, indicating the rally should have gasoline left. Ethereum’s open curiosity has additionally climbed considerably alongside the worth, suggesting new positions are getting into the market relatively than closing out shorts, usually an indication of real momentum.

That mentioned, merchants ought to stay cautious. The elevated RSI on the day by day chart and crowded positioning proven by the rise in funding charges may set the stage for a short-term flush if ETH will get rejected at key resistance. Traditionally, such sentiment surges have been adopted by native tops or consolidation phases.

Monitoring funding spikes and open curiosity habits over the subsequent 24–48 hours shall be essential to gauge whether or not this rally can lengthen additional or if a pullback is on the horizon.