Spark (SPK), the cryptocurrency native to the Spark decentralized finance (DeFi) protocol, has seen its worth rise by roughly 100% over the previous week amid rising anticipation of the second part of the Ignition airdrop.

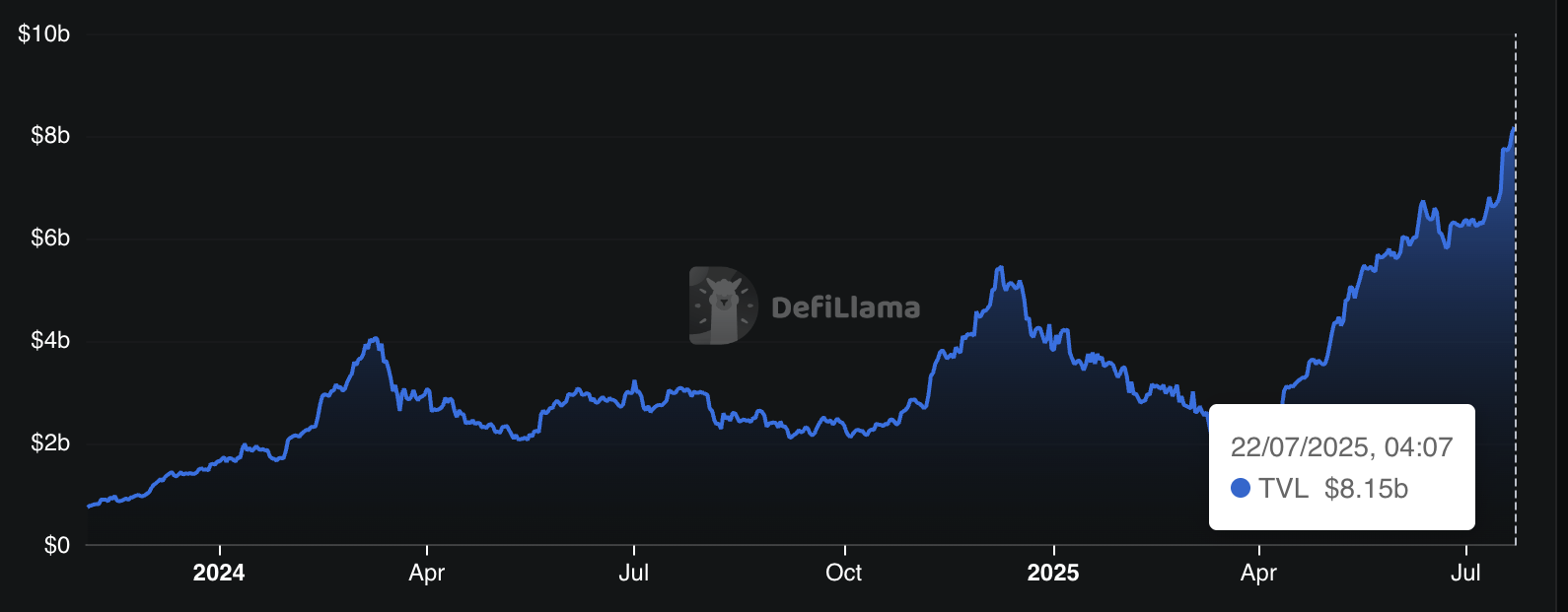

Along with the worth surge, the protocol has additionally skilled important progress, with its Complete Worth Locked (TVL) reaching an all-time excessive (ATH).

Why is Spark (SPK) Value Surging?

BeInCrypto knowledge confirmed that SPK’s value has elevated round 100% over the previous week, reaching highs that had been final seen when it launched. The token’s market capitalization has additionally doubled from round $30 million to over $62 million.

Over the previous day alone, the worth has appreciated 45.73%, bringing SPK to commerce at $0.061. The buying and selling quantity additionally highlighted robust investor exercise because it surged 403.90% to $486 million.

Spark (SPK) Value Efficiency. Supply: BeInCrypto

The surge in exercise appears to be primarily pushed by the venture’s airdrop. Section 1 of the airdrop, which permits customers to assert tokens, concludes in the present day.

The subsequent part, ‘Overdrive,’ can be nearing a vital deadline. Throughout this part, contributors have the chance to qualify for a second airdrop.

“Overdrive is for those who staked, stayed & believed. It’s the 2nd part of the airdrop, the place you possibly can stake your SPK by way of @symbioticfi and get a share of the unclaimed Ignition SPK,” the protocol posted.

In line with the official announcement, customers should stake their Ignition airdrop by July 29, 2025, and keep it till August 12, 2025, to get rewarded. Moreover, those that save no less than $1,000 in USDS or USDC repeatedly throughout this era can earn a 2x enhance on their Overdrive items.

The staking requirement, a vital element of the Overdrive initiative, seems to be a major issue behind the current value pump as customers rush to fulfill the deadline. Staking tokens reduces the circulating provide.

This, in flip, places upward strain on the worth. The joy surrounding the airdrop is also boosting market sentiment, resulting in extra curiosity within the token. This doubtless explains SPK’s newest behaviour.

Nonetheless, as soon as the staking interval ends and the tokens are distributed, some recipients may promote them. This might create promoting strain and probably decrease the worth within the brief time period after August 12. An analogous sample was noticed when the token launched in June.

Regardless of this, some analysts are more and more optimistic about SPK’s prospects.

“There’s nonetheless loads of room for progress. I imagine Spark’s progress trajectory might see it hit $0.10 – $0.15 inside the subsequent 12 months, doubtlessly even reaching $0.50 or extra within the subsequent two to 3 years because it expands its partnerships, explores cross-chain alternatives, and develops new DeFi merchandise,” an analyst predicted.

Spark TVL Hits All-Time Excessive

In the meantime, progress isn’t simply restricted to cost. In line with DefiLama knowledge, Spark’s TVL reached a brand new peak of $8.15 billion in the present day.

Spark TVL Efficiency. Supply: DeFiLama

The platform’s merchandise, resembling Spark Financial savings providing a 4.5% APY, and SparkLend, which now holds $4.9 billion in TVL, are main the cost.

The Spark Liquidity Layer (SLL), liable for managing liquidity, additionally has $3.98 billion in allotted belongings. Moreover, Token Terminal knowledge confirmed that the worth of lively loans throughout the market reached a brand new excessive in July. Notably, Spark ranks third alongside Aave and Morpho as a frontrunner on this house.

These metrics spotlight the rising demand for decentralized options and the position that platforms like Spark play in supporting the broader DeFi ecosystem.