Hyperliquid answered the problem of the rising new perpetual DEX by opening infrastructure for user-created markets. The DEX will flip right into a platform for builder-deployed perpetuals, with their separate liquidity and margin guidelines.

Hyperliquid, the main perpetual futures DEX, answered the problem of its rivals by evolving right into a platform for brand new market creation. The change’s founder Jeff Yan, offered the HIP-3 infrastructure, which might enable the creation of builder-deployed markets.

As Cryptopolitan reported earlier, Hyperliquid continues to be struggling to maintain the enchantment of its platform and increase the native HYPE token. Upgrades and additions could preserve Hyperliquid forward of its rivals. The HIP-3 markets could arrive as early as subsequent month, permitting the buying and selling of extra numerous property, together with tokenized RWA. The platform will enable builders to show any market right into a perpetual futures pair, tapping a wider array of property even exterior crypto.

The brand new infrastructure of builder-deployed perpetuals, often called HIP-3, was offered on one in every of Hyperliquid’s Discord channels. The preliminary launch would require a staking of 500K HYPE, decreased from the preliminary intention of a 1M HYPE stake. Because the infrastructure matures, the requirement to deploy a brand new perpetual market will lower.

Initially, deployers will have the ability to launch one DEX with its particular margin guidelines and remoted liquidity. Sooner or later, Hyperliquid intends to construct the chance for a number of perpetual markets per deployer. The HIP-3 infrastructure is offered on testnet, with a bug bounty program for locating a number of flaws earlier than mainnet deployment. Hyperliquid is conscious of the bugs and has ready fixes, however makes use of them to drive group engagement.

Hyperliquid to supply extra numerous markets

Hyperliquid plans to promote the rights to a HIP-3 market in a Dutch public sale. Every new market will launch with as much as three property without spending a dime, holding auctions for every extra perpetual pair.

New markets will probably be extra numerous, taking any asset as collateral. The builder-deployed DEX will even have double the charges, although Hyperliquid will take a 50% minimize.

The brand new markets could develop the choice of property and create remoted liquidity for particular initiatives that additionally need their very own perpetual DEX. The platform will evolve with added stablecoins, which will probably be decided sooner or later.

Perpetual DEX develop volumes to each day new data

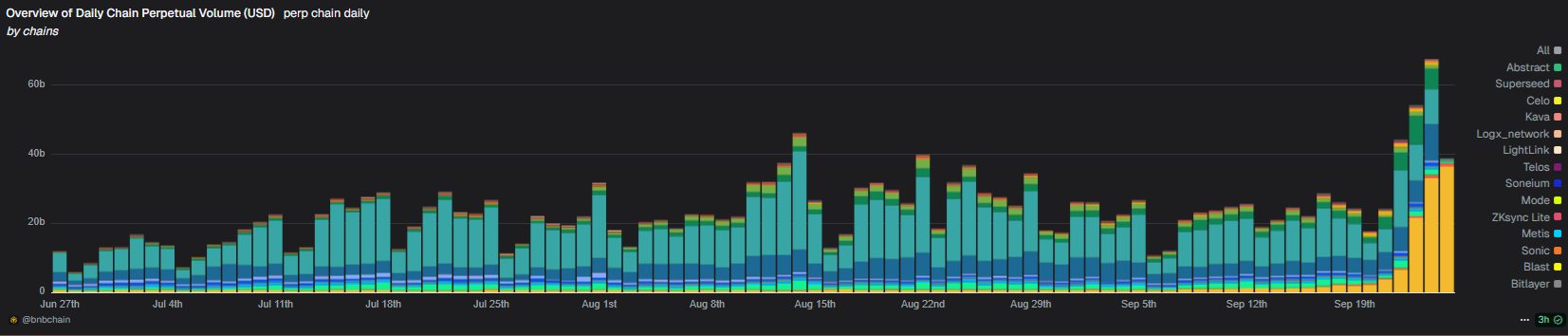

Up to now week, the perpetual DEX narrative unfold quickly, pushed by the success of Aster. The pattern affected even smaller markets, with a number of older perpetual DEXs rising their volumes.

Perpetual futures DEX picked up their exercise, boosted by the success of Aster DEX. Some smaller exchanges elevated their each day volumes by 80% inside days. | Supply: Dune Analytics

Aster put BNB Good Chain within the highlight as a venue for perpetual futures buying and selling. Up to now days, complete volumes for the main 24 DEX markets reached over $67B, with Aster, Lighter, and Hyperliquid attaining the very best share.

A number of the rising perpetual DEXs elevated their volumes by 80% in day, sparking doubts concerning the natural nature of the amount progress. Smaller markets like EdgeX and Paradex are additionally attempting to trip the wave and compete with the extremely seen markets.

The competitors introduced down the HYPE token to $42.45, whereas ASTER additionally dipped to $1.92. Perpetual DEX should additionally face one other market downturn, as main property are transferring to a lower cost vary.