Hyperliquid is exiting the age of high-profile whales and transferring again into airdrop season. The platform might evolve, boosting its exercise with new TGE and airdrop incentives.

Hyperliquid might transfer past being a easy by-product platform and return to the age of airdrops. The creation of a local USDH ticker and stablecoin might have further results within the ecosystem, relying on how the charges are allotted. The USDH competitors was extremely contested, however exterior groups didn’t achieve traction, and a few, like Ethena, gave up.

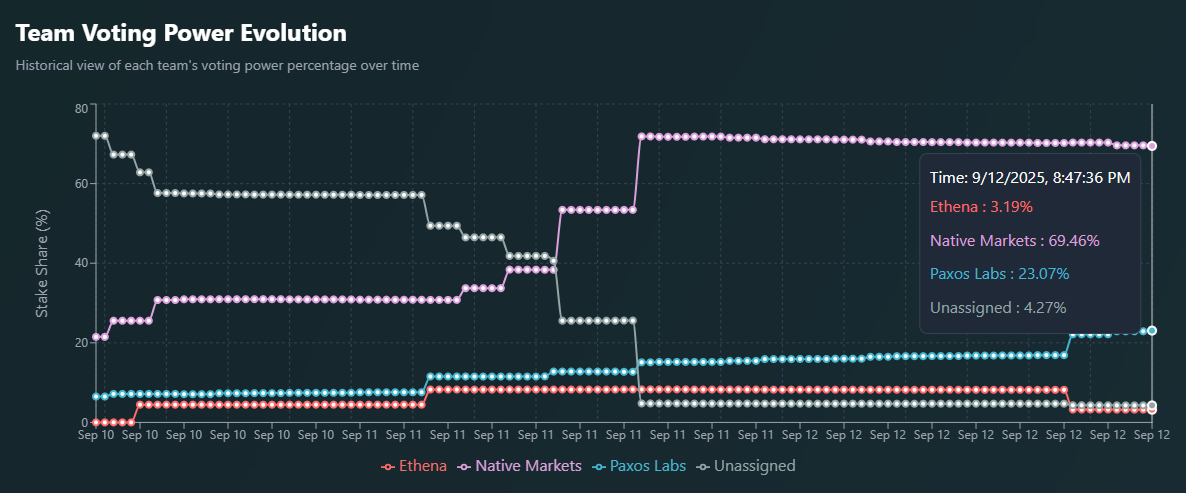

Native Markets continues to be the chief in validator voting energy, and its plan to spice up airdrops on Hyperliquid could also be realized after the tip of the vote. | Supply: USDH Tracker

One of many expectations was that Native Markets, the platform’s personal workforce, wouldn’t solely create USDH but in addition construct a complete new ecosystem of incentives. The neighborhood is already relying on the potential airdrops, which is able to attain probably the most energetic crypto communities and plenty of high-profile whales.

Hyperliquid has been rising steadily, with its perpetual futures volumes reaching 12.2% of the exercise on Binance. The chain carries 672,034 customers, with over 1,500 new customers each day flowing in usually. All adjustments and perks might enhance Hyperliquid volumes to a brand new vary. As open curiosity recovered above $13.3B, Hyperliquid is as soon as once more within the highlight.

The native HYPE token additionally rallied, not too long ago breaking above $57. The asset traded at $55.56, with extra hikes anticipated, as customers and whales amassed HYPE and ready to carry for the long run.

USDH exercise could also be used for airdrop incentives

The neighborhood expects that USDH exercise could also be used as a farming mechanism, with new tokenized incentives.

As Native Markets wins the USDH ticker put together for:

– New Native Markets token airdrop farm

– Vampire assault on USDC/USDTWhy? As a result of NM proposed:

– 50% of yield goes to HYPE buybacks.

– 50% goes to ecosystem development.That second half is mainly a brand new HL airdrop farm. Who… pic.twitter.com/Y59qvRZKyH

— Ignas | DeFi (@DefiIgnas) September 12, 2025

A second HYPE airdrop can be seen as a risk. The Hyperliquid ecosystem at the moment has a particularly restricted checklist of tokens, as a lot of the focus was on HYPE and on buying and selling BTC, ETH, and SOL, in addition to smaller, riskier tokens.

The Hyperliquid blockchain carries solely round $2.7B in natively minted tokens, together with wrapped belongings. PURR stays the one meme token, particularly created for the Hyperliquid neighborhood.

Doubtlessly, as much as 29 new tasks are growing their tokenomics and eventual airdrops, getting ready to show Hyperliquid right into a hub for added DeFi actions. The airdrops might invite whales, whereas additionally boosting the participation of retail merchants.

HYPE and UNIT are thought-about essentially the most in-demand belongings, with tickers starting from elite to speculative or meme-based.

Circle received’t hand over on USDC on Hyperliquid

Circle, the issuer of USDC, goals to retain its belongings on the Hyperliquid ecosystem. On-chain information exhibits a pockets linked to Circle can be extremely energetic on the Hyperliquid ecosystem.

The pockets injected $4.6M to amass 80K HYPE tokens utilizing the Hyperliquid spot market. Circle additionally experimented with mints and burns on the native Hyperliquid community, suggesting the corporate could also be on the lookout for a technique to launch native, not bridged USDC. If Hyperliquid chooses one other most important stablecoin, Circle’s position might diminish, sending the bridged USDC again into the ecosystem.