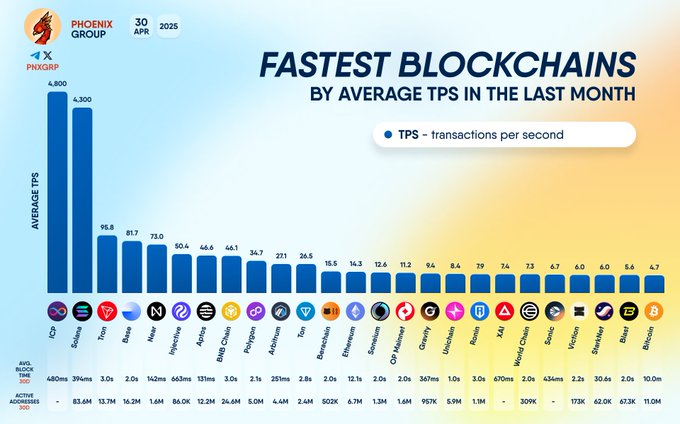

- ICP and TON lead April with highest TPS, supported by quick block instances and powerful consumer exercise.

- Solana, Close to, and Avalanche present mid-tier efficiency, far behind prime two in transaction velocity.

- Ethereum and Bitcoin rank low in TPS, highlighting scalability gaps versus newer blockchains.

New blockchain efficiency information from Phoenix Group reveals that Web Laptop (ICP) and Toncoin (TON) achieved the best common transactions per second (TPS) in April 2025, surpassing all different networks. The figures present an in depth view of how main blockchains are scaling in response to rising consumer exercise and utility demand, with clear disparities rising in throughput capabilities.

FASTEST #BLOCKCHAINS BY AVERAGE TPS IN THE LAST MONTH

#ICP #Solana #Tron #Base #Close to #Injective #Aptos #BNBChain #Polygon #Arbitrum #Ton #Berachain #Ethereum #Soneium #OPMainnet #Gravity #Unichain #Ronin #XAI #WorldChain #Sonic #Viction #StarkNet #Blast #Bitcoin pic.twitter.com/fWVFHBU41r— PHOENIX – Crypto Information & Analytics (@pnxgrp) April 30, 2025

Based on the information, ICP led all networks with a mean TPS of 4,800. TON adopted carefully with 4,300 TPS. These outcomes place each blockchains properly above their opponents concerning transaction throughput. The report attributes a part of this effectivity to speedy block instances: ICP averaged 480 milliseconds per block, whereas TON accomplished blocks in simply 390 milliseconds.

Equally, the outcomes confirmed a excessive stage of consumer engagement within the TON case. This introduced its lively handle rely to 13.7 million in April, the best amongst all of the tracked blockchains. Solana, for example, has 3 million lively addresses, which is unsurprising because it barely makes it to the TPS listing.

The excessive velocity and exercise ranges on TON and ICP point out that these networks are dealing with large-scale operations with consistency, possible enabled by optimized consensus protocols and infrastructure.

Vital Drop in Mid-Tier Efficiency

The TPS outcomes indicated that the performing blockchains had been on the prime, whereas the remaining blockchains ranked beneath the highest two. Concerning AATP, Solana carried out the third greatest with 95.8 TPS, Close to Protocol was second with 81.7 TPS, and Avalanche was third with 70.4 TPS. Each these networks have been buying and selling within the decentralized utility growth and good contract platforms, however their throughput signifies an enormous disparity within the transaction charges.

Sui took second place on this regard, with a transaction per second ratio of 66.6, adopted by Polygon, with a TPS of fifty.4, and Arbitrum, with a TPS of 46.6. Each assist a number of decentralized finance (DeFi) and Web3 environments; nevertheless, the information point out that they don’t seem to be even near ICP and TON when it comes to the variety of transactions per second.

Supply: X

Notably, Ethereum, the second-largest blockchain based mostly on market capitalization, has a TPS of solely 3.5. This places it significantly decrease within the velocity stakes than newer opponents. The penalty highlights that Ethereum continues to deal with its throughput bottleneck whereas transferring towards scaling options like rollups.

Bitcoin, equally, was among the many lowest-ranked networks, with a reported TPS of 4.7. Although extensively used as a retailer of worth, its fundamental transaction throughput lags behind chains optimized for velocity.

Tron, BNB Chain, and Cardano additionally posted reasonable TPS values, indicating a extra balanced trade-off between velocity, safety, and decentralization. Whereas these chains didn’t expertise a efficiency enchancment metric sufficient to make the highest ten listing, they’re nonetheless concerned in different community developments.

The info out there at Phoenix Group additionally entailed parameters aside from TPS. Common block time and lively addresses gave higher insights into every community’s exercise. These indicators point out that TPS is a vital causal indicator, however doesn’t exist in isolation. Incorporating views from TON and Solan, respectively, high-speed block instances and lively customers put clamps on end-to-end velocity throughout blockchain programs.