MLG crypto noticed a dramatic worth spike however shortly gave up most of its beneficial properties after allegations of an influencer-led pump-and-dump scheme surfaced. Must you put money into MLG?

Abstract

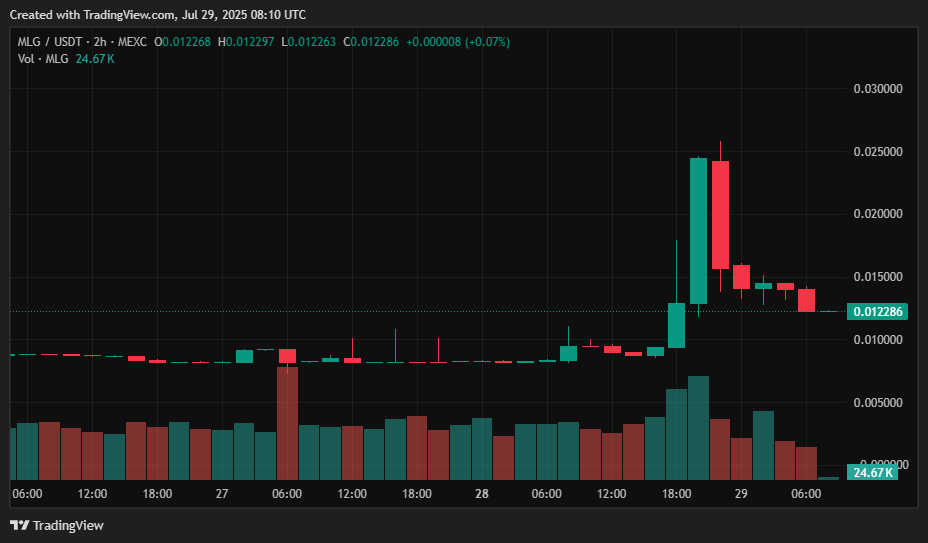

- MLG crypto jumped over 180% on July 29 earlier than falling again to $0.013.

- A lot of the hype was pushed by controversy round an alleged pump-and-dump scheme involving MLG.

- The Solana-based meme token trades totally on decentralized exchanges like Raydium and LBank.

In keeping with information from crypto.information, the token surged greater than 180% to achieve an intraday excessive of $0.023 on Tuesday, July 29. Nevertheless, the rally was short-lived. The value quickly pulled again and stabilized round $0.0122 on the time of writing.

Supply: crypto.information

Regardless of the current spike, MLG stays practically 92% under its all-time excessive of $0.162, recorded earlier in January 2025.

What’s MLG?

MLG is the ticker image for 360noscope420blazeit, a Solana-based meme token launched in April 2024. The title “MLG” is a nod to Main League Gaming and attracts inspiration from the early 2010s Name of Obligation and aggressive gaming tradition, usually referred to by followers because the “golden period” that the MLG crypto pays homage to.

Nevertheless, it’s essential to notice that MLG crypto has no official connection to Main League Gaming or its mother or father firm, Activision. Whereas the token makes use of related visuals and themes, these are a part of its nostalgic meme enchantment, not a licensed model partnership.

You may additionally like: Cathie Wooden’s ARK Make investments faucets SOL Methods for Solana staking

Why did MLG rally?

The most recent rally seems to have been pushed by a surge in social media hype and buying and selling exercise, notably after it was allegedly promoted by high-profile influencers, together with FaZe Banks, co-founder of the esports group FaZe Clan.

Buying and selling volumes spiked throughout platforms like Raydium and LBank, with the MLG/SOL pair changing into one of the vital lively on Solana-based decentralized exchanges.

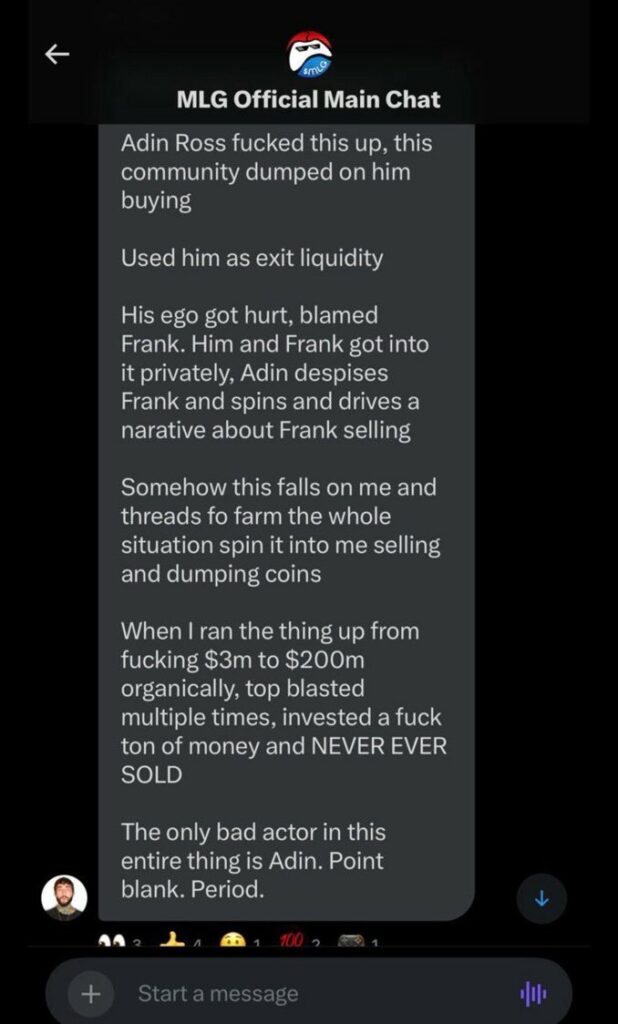

The controversy intensified after Banks and streamer Adin Ross had been accused of manipulating the token’s worth for revenue. Each denied any wrongdoing, although Banks introduced he was stepping down as CEO of FaZe Clan, citing emotional burnout and injury to his status.

In a screenshot that has been making rounds on X, Banks was seen accusing Ross:

Supply: Chris on X.

The backlash contributed to the token’s sharp retracement shortly after peaking.

This isn’t FaZe’s first brush with crypto controversy. In 2021, a number of FaZe Clan members had been concerned in selling the “Save the Youngsters” token, which shortly collapsed after launch.

FaZe Kay was faraway from the group, whereas others had been suspended, following allegations of insider buying and selling and misleading advertising. That historical past has added additional skepticism round MLG’s current pump.

Must you put money into MLG?

At current, MLG stays a extremely speculative asset. Its worth will not be backed by any formal utility, income, or product roadmap, however as a substitute is determined by neighborhood momentum, nostalgia, and influencer-driven hype. Whereas it could supply alternatives for short-term beneficial properties, its long-term funding prospects are extremely unsure.

A serious concern for potential buyers is the character of its buying and selling atmosphere. MLG is primarily traded on decentralized and calmly regulated exchanges akin to Raydium, LBank, XT.COM, and Meteora.

These platforms are likely to have tighter liquidity controls and fewer restrictions, which makes it simpler for whales or coordinated teams to govern worth motion with out oversight. This will increase the token’s volatility and makes it weak to pump-and-dump cycles, notably throughout hype-driven rallies.

For merchants with a excessive danger tolerance, MLG could supply publicity to fast-moving worth swings and the cultural novelty of meme coin buying and selling. However for cautious or long-term buyers, the dearth of transparency, excessive volatility, and historical past of influencer-linked manipulation ought to be seen as severe purple flags.

Learn extra: Plasma stablecoin layer 1 raises $373M in oversubscribed token sale

Disclosure: This text doesn’t signify funding recommendation. The content material and supplies featured on this web page are for instructional functions solely.