- Binance dominates CEX stablecoin reserves and inflows, reflecting deep market belief and constant institutional exercise.

- Coinbase leads in complete reserves, however lacks public Proof-of-Reserves, not like Binance which supplies on-chain transparency.

While you wish to retailer massive funds in crypto, your selection is probably not removed from CEX resembling Binance or Coinbase. These two names do dominate the centralized crypto trade business, particularly with regards to asset reserves and fund inflows. However behind these large numbers, there may be one other story that’s no much less vital.

Transparency vs. Dimension: Binance and Coinbase Take Totally different Paths

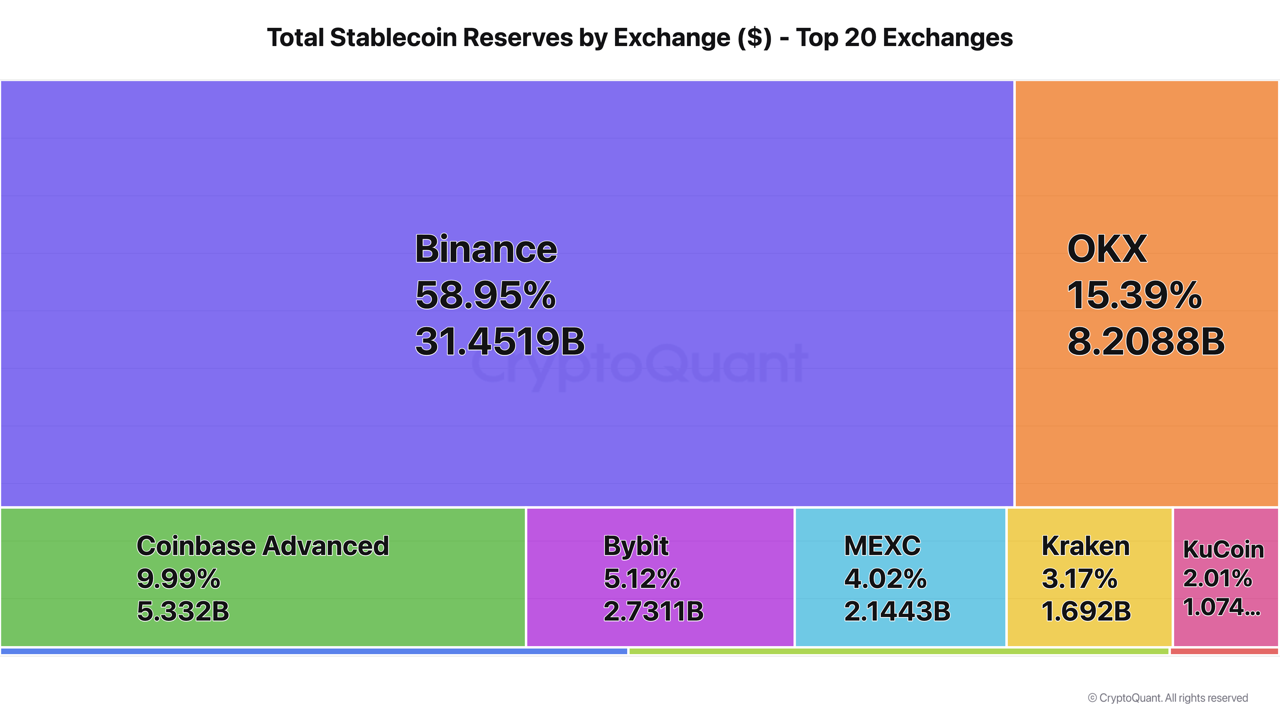

Knowledge from CQ Analysis reveals that Binance leads by way of stablecoin reserves, with complete USDT and USDC deposits value $31 billion. Which means nearly 60% of all stablecoin reserves on CEXs on the planet are on this CEX. In the meantime, Coinbase is superior in complete reserves, reaching $129 billion, in comparison with Binance which is at $110 billion.

Supply: CQ Analysis on CryptoQuant

Nevertheless, by way of transparency, Binance is definitely extra open as a result of it supplies Proof-of-Reserves full with pockets addresses. Coinbase, though bigger in worth, doesn’t open this data to the general public. Within the eyes of crypto customers who’re on-chain literate, this might be a reasonably vital differentiator.

Moreover, stablecoin inflows all through 2025 additionally present an fascinating story. Binance has attracted $180 billion thus far this 12 months, and in Might alone, it has already reached $31 billion—barely forward of Coinbase’s $30 billion. This reveals the market’s confidence in Binance’s capacity to accommodate and handle massive funds, particularly from institutional gamers.

CEX Nonetheless Busy, However Not With out Issues

Nevertheless, that doesn’t imply the whole lot is easy crusing within the CEX world. A current report from CoinGecko famous that spot buying and selling quantity on centralized crypto exchanges through the first quarter of 2025 reached $5.4 trillion.

Whereas this quantity seems to be large, it really decreased by round 16.3% in comparison with the earlier quarter. The rationale? It might be as a consequence of market volatility, or maybe additionally as a consequence of more and more stringent rules.

Alternatively, there may be additionally a brand new motion that’s fairly fascinating. CNF beforehand reported that the SunPump mission has launched an initiative known as the CEX Alliance. This initiative is right here to assist TRON-based meme tasks attain extra customers by massive exchanges.

Some names like BingX and HTX have even joined in to assist this neighborhood. It’s certainly a bit uncommon to see meme cash turn out to be the explanation for cross-platform collaboration.

Again to CEX, Binance can be a favourite place for giant holders. On Might 22, when the BTC value hit a file excessive of $112,000, the common deposit per transaction on Binance rose to 7 BTC. Examine that to Coinbase, which is simply 0.8 BTC, or Kraken with 0.7 BTC. This means that Binance remains to be a spot the place large gamers collect who’re critical about capital.