For a 12 months, Ethereum, the second largest blockchain, has lived within the shadows of its rivals, as cryptocurrencies like bitcoin and solana jumped in value and dominated the dialog. Amid criticism from traders and a few group members, ETH languished at ranges beneath $1500 as lately as April.

However on Monday ETH was close to $3800, up 13% year-to-date, and analysts pointed to quite a few indicators of a turning level for the venture.

Some have identified that the momentum of the ecosystem has returned partially because of the explosion of stablecoins and tokenization on Ethereum.

“For establishments trying to get publicity, Ethereum is the first on-chain possibility, main in real-world asset (RWA) tokenization with $7.8 billion in tokenized belongings, or practically 60% of the whole RWA market cap,” mentioned Jake Koch-Gallup, a analysis analyst at Messari, to CoinDesk.

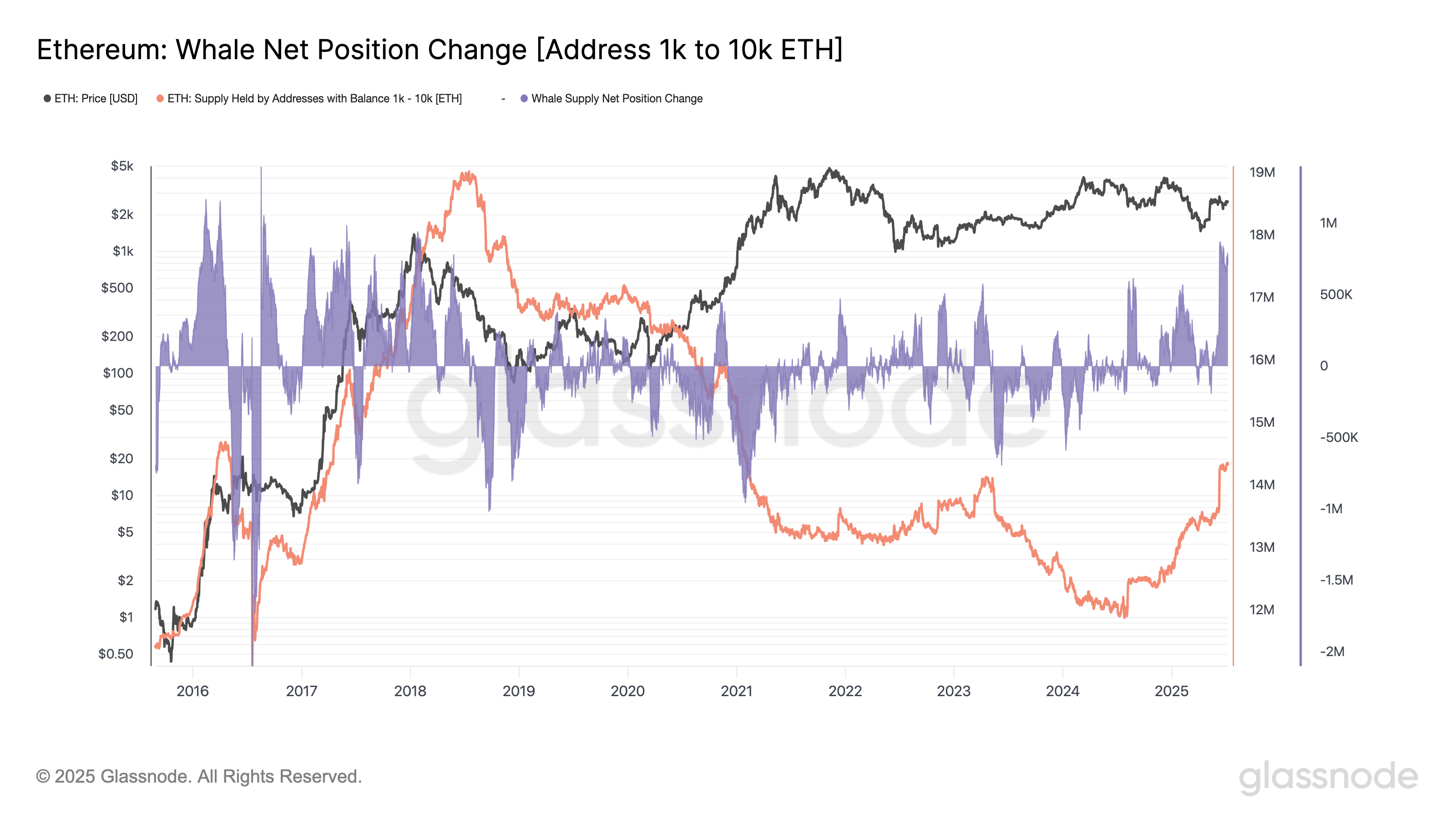

As of the start of July 2025, Whales with addresses that maintain between 1,000-10,000 in ETH have elevated their holdings of the token, based on information from Glassnode. Collectively they maintain about 14 million ETH models, up from roughly 12 million on the finish of 2024.

Whales information of ETH holdings July 2025 (Glassnode)

Vivek Raman, who based Etherealize and spends his time talking with establishments to market ETH as an asset class, believes that ETH must be seen like BTC as “a retailer of worth,” evaluating it to “digital oil.”

The layer-2 ecosystem, that are auxiliary blockchains atop of Ethereum used to transact for sooner and cheaper, have appeared en masse over the previous few years, and establishments have began to additionally construct with them. JP Morgan lately introduced they launched a proof-of-concept for tokenizing their deposits on Coinbase’s Base chain, whereas Robinhood, the retail buying and selling large, shared its plans to construct its personal layer-2 with the Arbitrum stack. If it really works, it may deliver Ethereum’s expertise to a good broader mainstream viewers and deepen its place because the spine for a brand new technology of monetary purposes.

Some consider layer-2 networks had been taking away worth from the Ethereum base layer and making person expertise extra disconnected, however Raman argues that establishments view them otherwise. In keeping with Raman, the customizability of a layer-2 community is a plus for these establishments.

“You is usually a landlord and get entry to the liquidity of Ethereum,” mentioned Raman in an interview. “So the validation of the L2 ecosystem is now fairly plain.”

Koch-Gallup, at Messari, believes that protocol adjustments that improve the scaling of Ethereum as a base layer will place the community nicely for the long run.

“A 100-1,000x throughput bounce collapses gasoline charges, reopens the house for consumer-grade apps, and refutes the “L2s are consuming the L1” narrative,” he mentioned. “Concurrently, larger blocks and extra exercise feed again into base-fee burn, tightening ETH’s provide in periods of excessive demand.”

Ethereum can also be benefitting from the company treasury development, with a rising variety of firms adopting ETH as a strategic treasury asset. That’s, not only for holding, however for staking to generate yield, signaling a shift from conventional treasury methods, typically restricted to money or bitcoin, to 1 that leverages Ethereum’s staking rewards, programmability, and integration into DeFi and stablecoin ecosystems.

SharpLink Gaming, a NASDAQ-listed sports activities betting agency, BitMine, and BitDigital, each crypto mining corporations, have all shifted their crypto treasury methods to this.

“SharpLink Gaming (SBET) noticed its inventory value [rise 412%] after saying its ETH treasury technique, exhibiting there’s a transparent market urge for food for publicly traded firms holding ETH on their stability sheets,” Koch-Gallup advised CoinDesk. The corporate is chaired by Joseph Lubin, one of many founders of Ethereum.

BitMine, which lately noticed Wall Road persona Tom Lee be part of, additionally shared that it holds over 300,000 ETH in its treasury.

“Collectively, these tendencies counsel a deeper institutional re-rating of Ethereum, not simply as infrastructure, however as a yield-bearing, balance-sheet-worthy asset and a directional guess on the way forward for on-chain finance,” Koch-Gallup mentioned.

Learn extra: The Node: Is Ether Again From the Lifeless?