Ethereum’s worth is rebounding aggressively after the current decline from the $4,800 space. Buyers at the moment are hopeful for one more push towards the $5,000 stage and past within the coming weeks.

Technical Evaluation

By Shayan

The Day by day Chart

ETH has efficiently defended the $4,000 help zone, bouncing from the world. This zone overlaps with the 100-day shifting common and a earlier demand block, making it a technically vital stage.

The RSI has additionally recovered from the oversold area and now sits at 50, suggesting momentum is shifting again towards the bulls. The asset is at the moment pushing towards the $4,800 resistance stage and the midline of the big ascending channel. A breakout from this space would open the doorways for a historic ETH rally within the coming months.

The 4-Hour Chart

On the 4H chart, ETH has printed a textbook head and shoulders restoration. After bouncing from the help zone close to $3,850, it reclaimed the $4,100 stage and fashioned the next low. It’s now approaching the $4,400–$4,500 provide zone, which initiated final week’s decline.

General, the short-term construction is now bullish. If ETH breaks above the $4,500 stage, the subsequent goal might be the $4,800 excessive. Nevertheless, a rejection from right here might result in a brief consolidation section earlier than continuation.

Sentiment Evaluation

Funding Charges

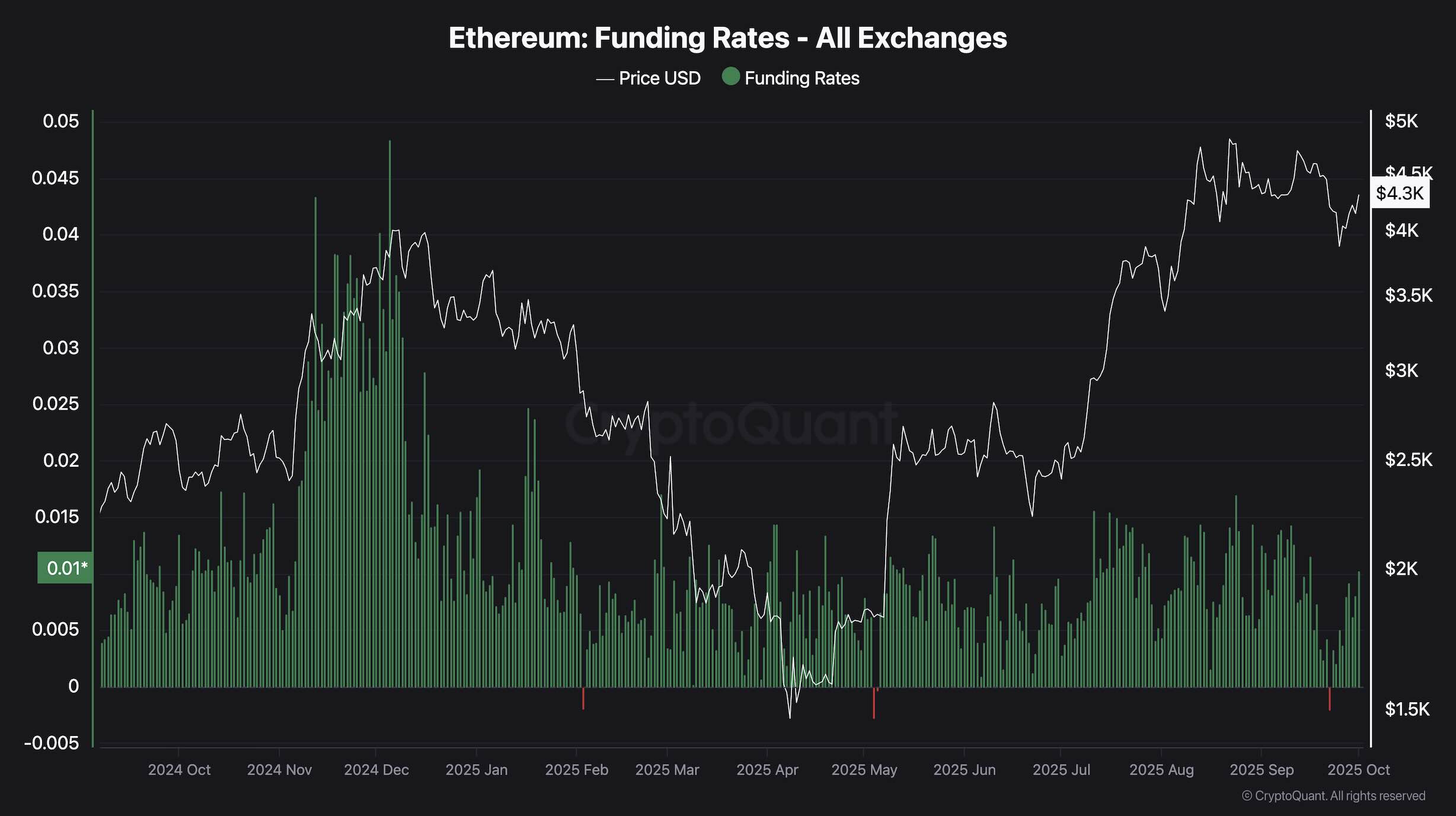

Ethereum funding charges have just lately bounced again into optimistic territory after briefly turning detrimental in the course of the newest worth drop. This detrimental dip confirmed that brief sellers had taken management, pushing funding charges beneath zero because the market leaned closely bearish.

However the fast restoration suggests these shorts had been both closed or liquidated, and merchants are slowly regaining confidence. The return to optimistic funding signifies a rising urge for food for lengthy positions, though that curiosity nonetheless seems cautious for now.

In comparison with earlier cycles, the present funding stays effectively beneath euphoric ranges. There’s no signal of extreme leverage or overcrowded longs, which is usually a wholesome signal. When funding resets like this with out spiking too rapidly, it typically displays a extra steady buying and selling surroundings. If this regular climb in funding continues, it might help a extra sustained worth restoration quite than a short-lived pump.