Bitcoin’s volatility has dropped to its lowest degree in practically a decade, an indication of a serious structural shift available in the market’s habits. In keeping with new knowledge visualized by Ecoinometrics, Bitcoin’s 30-day realized volatility sits close to the tenth percentile, that means present market fluctuations are calmer than 90% of all weekly durations since 2015, suggesting Bitcoin is maturing right into a extra secure asset even because it continues its robust upward development.

This dramatic decline in volatility, which comes regardless of a pointy rally in Could and the asset reaching new all-time highs, marks a big change in Bitcoin’s threat profile and will make it much more engaging to a brand new class of institutional buyers.

A New Period of Stability: Bitcoin’s Threat Profile Is Altering

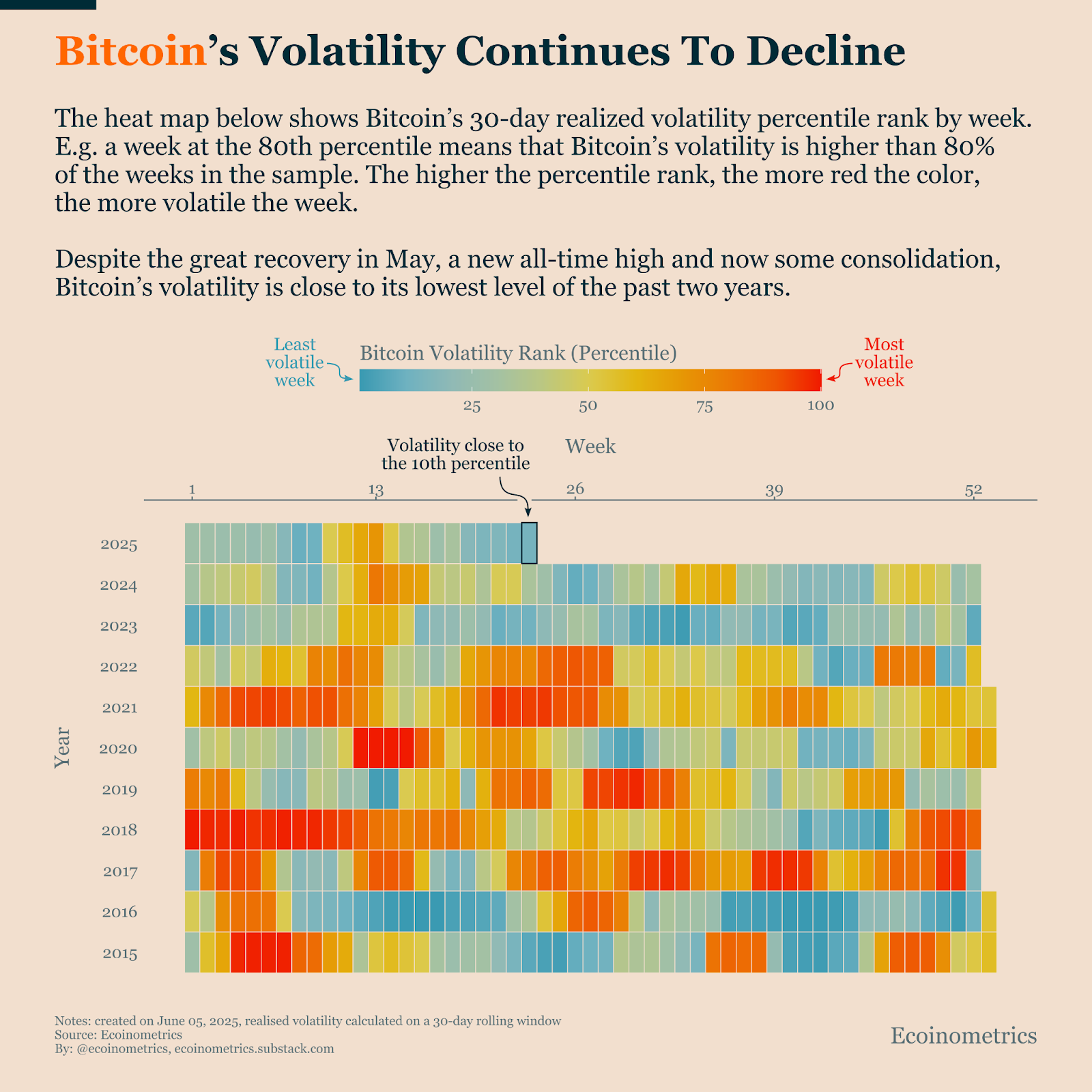

The heatmap, primarily based on percentile rankings of Bitcoin’s weekly volatility over a 30-day rolling window, illustrates this clear development towards calmer market situations.

In previous years, notably between 2016 and 2021, the chart confirmed deep crimson zones, indicating quite a few extremely risky weeks. In distinction, the chart for late 2024 and 2025 is dominated by blue and inexperienced zones, representing sustained durations of decrease volatility.

Bitcoin’s Volatility Continues To Decline. Supply: X

This shift suggests Bitcoin is beginning to behave extra like a maturing monetary asset, one able to delivering robust returns with out the extraordinary, short-term value swings that beforehand outlined it.

Associated : Bitcoin Asia Rolls Out Free Normal Admission to Broaden Entry to 2025 Convention

For portfolio managers centered on managing threat, this development is essential. Bitcoin’s newfound stability permits for its inclusion in diversified portfolios with out breaching conventional threat thresholds, probably unlocking broader capital from institutional finance.

Value Motion Confirms Bullish Pattern Inside Ascending Channel

This backdrop of lowering volatility is going on whereas Bitcoin’s value carves out a strong, bullish sample on the weekly chart. As of June 9, 2025, Bitcoin (BTC) is buying and selling at $107,841 and has shaped a transparent ascending channel on the weekly chart. This sample is marked by two upward-sloping parallel trendlines, capturing greater highs and better lows since late 2022.

BTC/USD Weekly Chart – Ascending Channel Sample. Supply: TradingView.com

An ascending channel is a bullish continuation sample that exhibits constant upward momentum inside an outlined vary. The 50-week Exponential Shifting Common (EMA), presently at $85,136, has been appearing as strong dynamic help, with each vital dip since mid-2023 discovering a ground at this key indicator.

Associated: Bitcoin (BTC) Value Prediction for June 10: Volatility Builds Close to $106K as Bulls Eye Breakout Ranges

If this construction confirms with a breakout towards the higher boundary, Bitcoin’s value might climb roughly 46% from the present degree. This could deliver the goal close to $156,730, as indicated by the highest of the projected channel.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any variety. Coin Version will not be answerable for any losses incurred because of the utilization of content material, merchandise, or companies talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.