Ethereum has continued its regular climb, presently buying and selling close to $2,600 after bouncing off the $2,220 demand zone in late June. The asset is now testing a robust provide space whereas sustaining its construction, suggesting bullish momentum continues to be in play. But, warning is warranted close to the present highs.

Technical Evaluation

By ShayanMarkets

The Each day Chart

ETH is presently hovering close to $2,600 mark because the day by day chart reveals, after rebounding strongly from the $2,220 demand zone earlier. The value has managed to reclaim the 200-day transferring common, situated across the $2,400 mark, and is buying and selling barely above it, a key signal of medium-term energy.

Beforehand, the latest rally stalled close to $2,800, the place ETH ran a transparent liquidity hunt earlier than sharply reversing, forming a short-term decrease excessive. Now, the asset is as soon as once more consolidating beneath the important thing $2,800 provide zone, making an attempt to interrupt by way of lastly. So long as ETH holds above the 100 and 200 transferring averages and doesn’t break beneath $2,400, the construction stays bullish.

Furthermore, momentum is progressively constructing, however a clear day by day shut above $2,700 continues to be wanted for affirmation. The RSI is holding round 57–60, reflecting reasonable bullish momentum with out indicators of exhaustion. If the present consolidation resolves to the upside, ETH may revisit the $2,880 highs and probably problem the $3,000 zone. Nevertheless, failure to interrupt above may lead to a rejection again towards the $2,400 help vary.

The 4-Hour Chart

On the 4-hour chart, ETH is forming a rising wedge slightly below the bearish order block fashioned across the $2,700 mark, which makes this a high-stakes consolidation. Worth has tapped into the order block and is urgent towards the wedge’s higher boundary. The 4H RSI can be close to 61, exhibiting bullish momentum, however with rising wedge formations, a breakdown is at all times a danger if bulls can’t push by way of resistance.

The important thing intraday degree to observe is the $2,500–$2,550 area, which aligns with the latest low and the decrease boundary of the wedge. If ETH breaks beneath this zone with sturdy quantity, it may sign a drop towards the $2,300 liquidity pool and honest worth hole. On the flip aspect, a clear breakout above $2,700 with rising quantity would invalidate the wedge breakdown situation and open up a path towards the $2,900 excessive and even additional.

On-Chain Evaluation

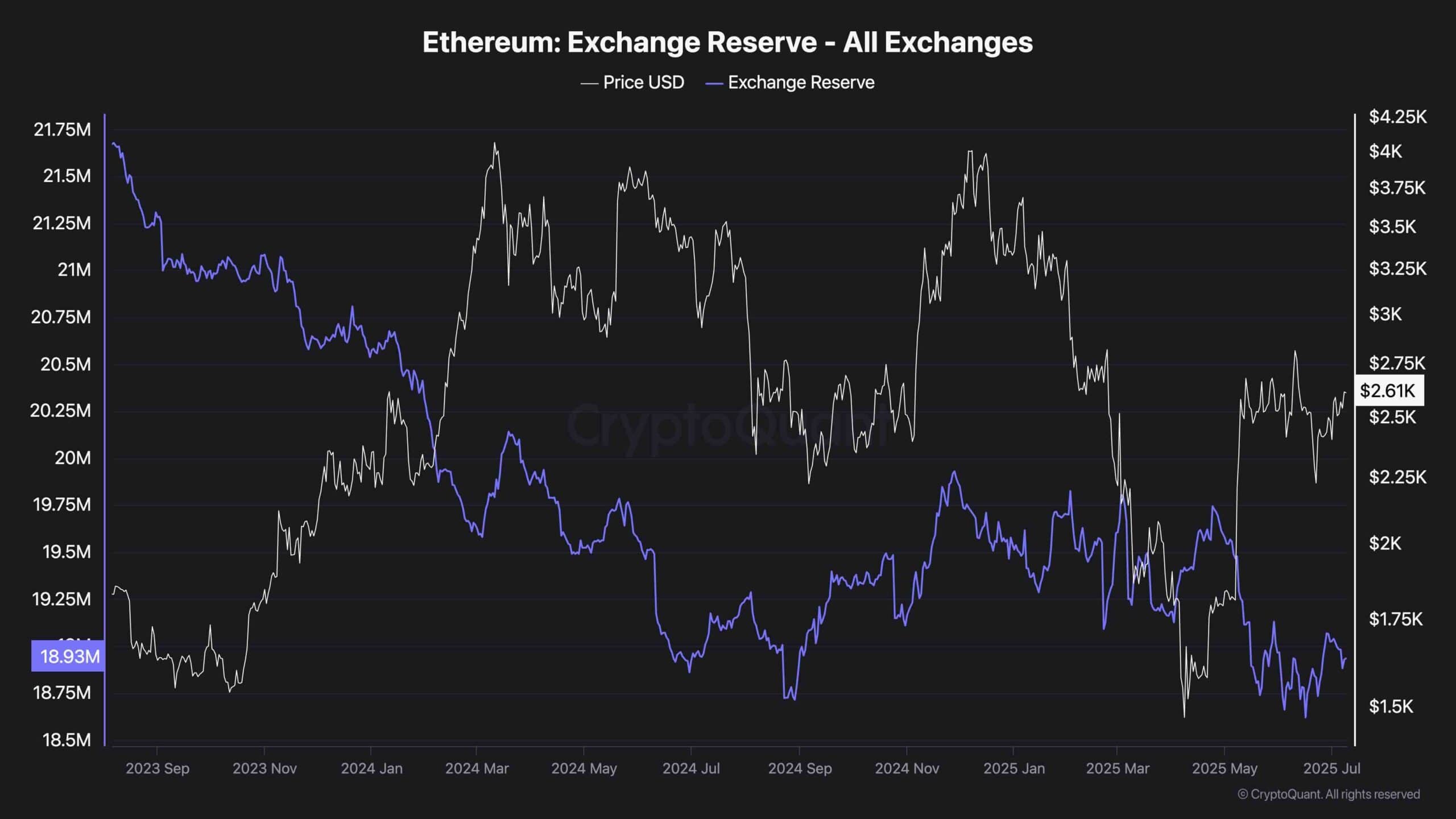

Ethereum Alternate Reserve

Ethereum’s on-chain knowledge stays supportive. Alternate reserves have dropped to 18.93M, reaching one of many lowest ranges lately. This means a continued development of accumulation and self-custody, lowering the fast promote stress from centralized exchanges. Traditionally, such drops in change balances have coincided with bullish worth phases, offered macro sentiment aligns.

Market sentiment has shifted barely bullish, with ETH reclaiming its key transferring averages and funding charges remaining impartial. Nevertheless, the absence of explosive demand from retail or whales suggests {that a} breakout will seemingly require a catalyst, which will be within the type of a brief liquidation cascade, to accompany the spot market demand and push the value greater within the quick time period.