Michaël van de Poppe, a well known cryptocurrency analyst, shared a bullish outlook on Ethereum (ETH) in a publish on X dated Could 17, 2025.

He claimed that any ETH worth underneath $2,400 is a “steal” following the latest surge, suggesting Ethereum may proceed its upward trajectory. His publish included a chart exhibiting Ethereum’s sharp rebound after bottoming out under $2,000 earlier.

Chart Exhibits ETH Excessive Help and Key Resistance Zones

The TradingView chart shared by Van de Poppe illustrates Ethereum’s worth motion in opposition to Tether (USDT) on the Binance change. It exhibits ETH rallied sharply in early Could 2025 after a chronic downtrend. The chart marks a transparent excessive timeframe assist zone for ETH close to $2,100 and a resistance space recognized between roughly $2,600 and $2,800, with Van de Poppe particularly noting $2,750 as a resistance level.

Ethereum $2,400 Purchase Zone Highlighted. Supply: X

Van de Poppe labels the $2,400 stage as a “vital alternative,” implying that present costs nonetheless provide worth earlier than potential continuation of the uptrend. His projection signifies a doable consolidation close to resistance, adopted by additional upside.

Ethereum Eyes Upside Breakout

Van de Poppe’s evaluation aligns with rising optimism throughout the crypto market. Ethereum’s present construction means that merchants may monitor the $2,100 to $2,400 vary for indicators of assist and accumulation.

The chart implies a bullish setup, the place a confirmed breakout above the resistance zone could result in additional positive factors. The directional arrow on the chart factors towards new highs, although no precise timeframe is offered.

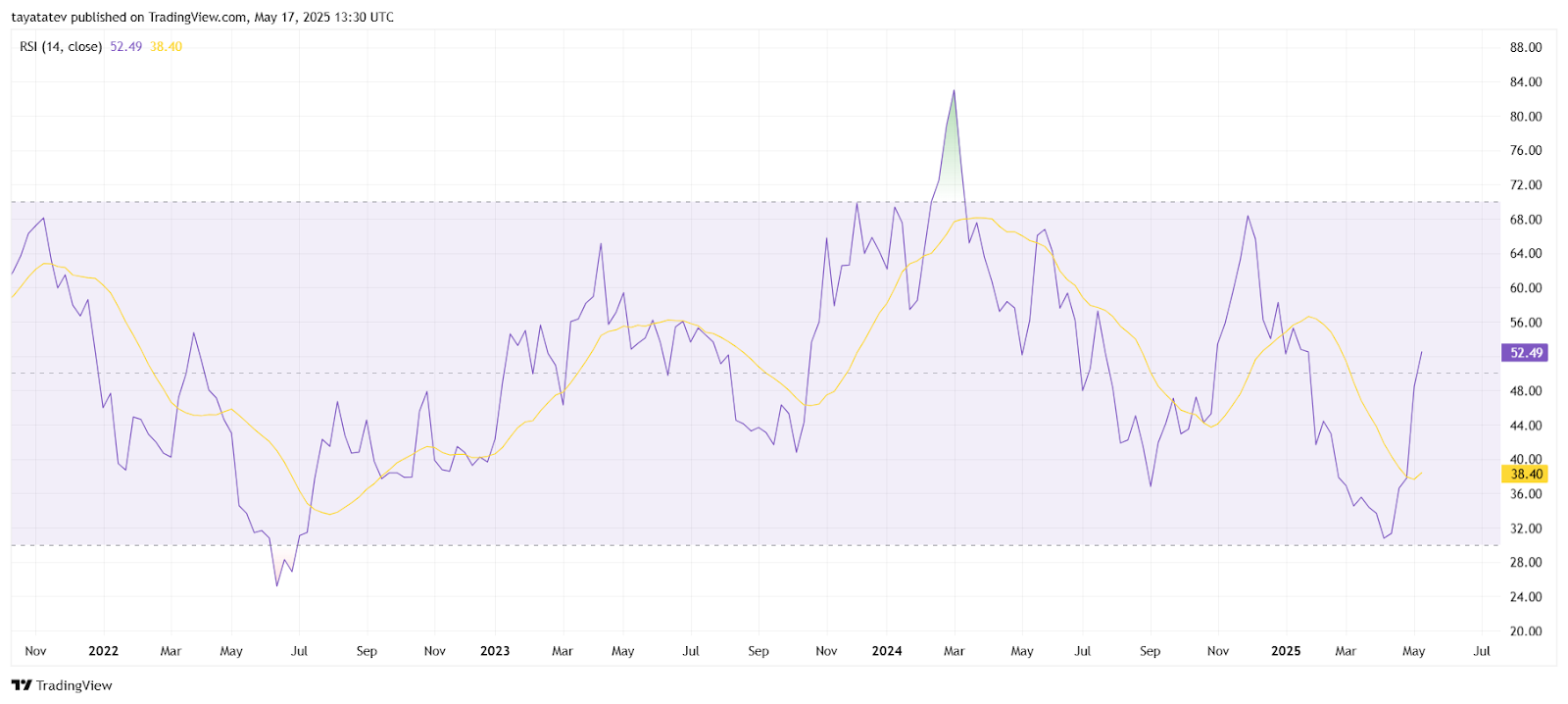

Ethereum RSI Breaks Key 50 Midpoint

In the meantime, Ethereum’s Relative Energy Index (RSI) has climbed to 52.49, breaking above the impartial 50 mark for the primary time since March 2025. The shifting common of the RSI at present stands at 38.40, reflecting earlier weak point.

Ethereum RSI Breaks Above 50 for First Time Since March. Supply: TradingView

This upward transfer signifies growing shopping for momentum. The RSI measures the pace and power of worth adjustments on a scale from 0 to 100. Ranges above 70 are thought of overbought, whereas these under 30 recommend oversold circumstances. A place above 50 sometimes indicators bullish stress.

Ethereum’s RSI stayed under 50 all through latest months, reflecting vendor management. The present breakout shifts this dynamic. The final significant upside occurred in early 2024, when RSI briefly surged to 85 earlier than reversing.

The current rise exhibits a renewed development shift with out excessive circumstances. Not like earlier failed makes an attempt, this transfer has additionally cleared its shifting common.

The RSI’s advance above each its common and the midpoint stage indicators a possible development reversal. It highlights a rising change in sentiment. This will assist additional positive factors if broader market circumstances align.

With RSI route turning upward, merchants now have an early sign to observe worth continuation, particularly if quantity confirms the momentum.

Disclaimer: The knowledge introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any type. Coin Version will not be liable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.