After what many merchants are calling a protracted “bear winter,” there are early indicators that the crypto market could possibly be warming up. Regardless of record-low social media engagement and widespread frustration over months of sideways worth motion, knowledge factors to a budding restoration, led by Ethereum’s stunning energy.

The “Ethereum Cycle” Emerges

Inside this gloom, a report by Willy Woo has recognized a key turning level: the market is getting into an “Ethereum cycle.” Traditionally, when Ethereum begins to outperform Bitcoin, it indicators that wider altcoin energy is constructing.

Prior to now few weeks, ETH has certainly outpaced BTC by 40%, whilst many smaller cash proceed to slip. Huge names aren’t ready on the sidelines, BlackRock bought $36.7 million price of Ethereum in a single day.

Supply: CarlHawley

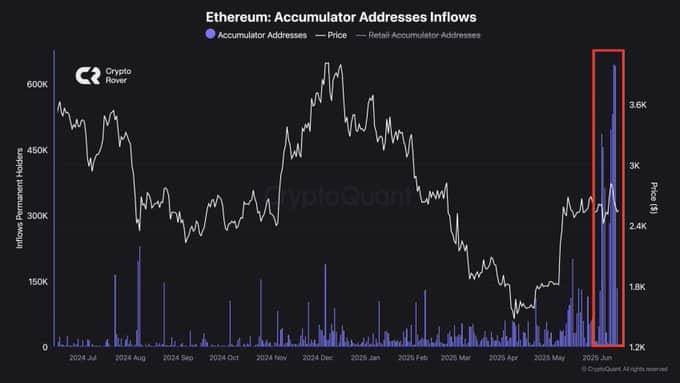

Ethereum’s worth has bounced strongly from its April low however has since been buying and selling sideways. Nonetheless, Ethereum accumulator addresses at the moment are shopping for at among the highest charges ever, despite the fact that the value stays under $4,000. This degree of accumulation hasn’t been seen for the reason that market’s peak and This fall seems set to be extraordinarily bullish for ETH.

Associated: These Altcoins Are Defying the Crypto Droop with Double-Digit Beneficial properties

Supply: TradingView

A more in-depth have a look at the full crypto market cap (excluding Bitcoin) reveals it quietly carving out greater lows—the identical sample that marked previous market bottoms. This reveals that the worst could also be behind, and {that a} breakout could possibly be constructing momentum below the floor.

Can Cardano Spark the Broader Rally?

All eyes are additionally turning to Cardano (ADA). Regardless of ongoing market weak point, ADA has quietly rallied nearly 200% from its bear-market lows.

Associated: Whales Accumulate ETH and ADA as Retail Sells in Worry, Information Reveals

If Ethereum’s management indicators a thaw, Cardano’s sturdy efficiency may make it one of many first altcoins to “bloom” on this new cycle.

Previous Playbooks Don’t Apply

In response to analyst Michael Van De Poppe, a part of the issue for altcoin traders has been clinging to outdated market cycles from 2017 or 2021. Right this moment’s crypto atmosphere is extra advanced and pushed by big-picture forces, like rising or falling rates of interest, inflation tendencies, and the weakening U.S. greenback. These components now form crypto strikes as a lot as on‑chain exercise.

Disclaimer: The knowledge offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any sort. Coin Version is just not chargeable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.