Key bitcoin

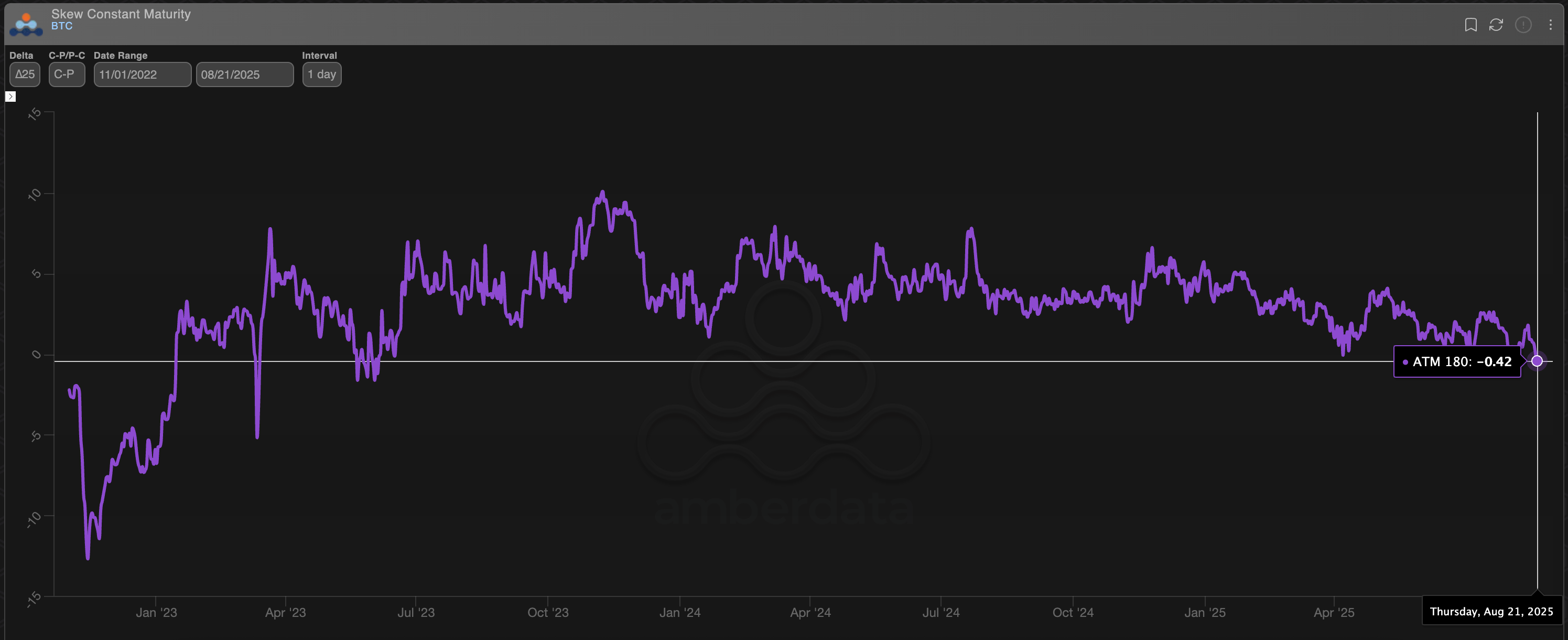

The primary one is the 180-day call-put skew derived from choices buying and selling on Deribit, the biggest crypto choices alternate by quantity and open curiosity.

As of writing, the 180-day skew was damaging 0.42, the bottom since June 2023, in line with information supply Amberdata. A damaging call-put skew means that merchants are pricing in better demand for put choices (which provide safety towards value declines) relative to name choices. The info could be interpreted as rising market warning or bearish sentiment over the medium time period.

“BTC longer dated skew flipping into put premium might be an indication of regime shift,” Imran Lakha, founding father of Choices Insights, stated on X.

BTC’s 180-day skew. (Deribit/Amberdata)

The damaging studying comes throughout as a regime shift, because it follows two years of persistently constructive values, which mirrored a bias towards bullish name choices.

Extra importantly, BTC has solely pulled again by roughly 8% from its document highs above $124,000, which have been reached every week in the past. But, the long-term sentiment has flipped bearish.

In keeping with Lakha, the value pullback has triggered demand for put choices.

“BTC and ETH skews are pulling towards put premium as markets appropriate. BTC doesn’t present a name premium once more till March 2026. The transfer decrease triggered shopping for of August/September places across the $110,000 strike. Calls and name spreads are being offered as longs de-risk into Powell’s Jackson Gap speech on Friday,” Lakha stated in a weblog put up.

Federal Reserve Chair Jerome Powell is scheduled to talk on the central financial institution’s annual Jackson Gap Symposium on Friday. Most merchants count on Powell to sign fee cuts ranging from September and if he provides what’s anticipated, the market could appropriate, in line with Nansen’s analysis analyst Nicolai Sondergaard.

“At this stage, the market broadly expects cuts, a lot of that’s already priced in. If Powell delivers precisely what’s anticipated, crypto may see sideways to barely bearish motion, a traditional “promote the information” dynamic. Against this, if the Fed indicators a deeper or quicker chopping cycle than anticipated, that might spark recent threat urge for food and set the stage for the subsequent bullish leg in crypto,” Sondergaard stated.

Inventory merchants chase places

The demand for draw back safety in BTC is in step with the exercise on Wall Road, the place merchants have been getting ready for a sell-off within the main expertise shares.

“Merchants are shopping for ‘catastrophe’ places on the Invesco QQQ Belief Sequence 1 ETF, which tracks the Nasdaq 100 Index,” Jeff Jacobson, head of spinoff technique at 22V Analysis Group, instructed Bloomberg.

Guppy a number of transferring common indicator

The second indicator pointing to a bearish shift within the regime is the Guppy a number of transferring common (GMMA) indicator.

Developed by Australian dealer Daryl Guppy, the indicator is used to establish reversals and assess development energy by analyzing the bands shaped by short-term and long-term transferring averages. A bullish cross happens when the inexperienced band representing short-term transferring averages crosses above the pink band of long-term transferring averages, indicating that upward momentum is gathering tempo.

BTC’s day by day chart. (TradingView)

BTC’s value has crossed beneath the Guppy transferring common bands, an indication that bulls are dropping management and the long-term sentiment could also be turning bearish. That is typically thought-about a warning signal that draw back momentum is about to strengthen, paving the way in which for pronounced value weak point.

Different indicators, such because the MACD histogram, additionally recommend a strengthening of the draw back momentum.

Learn extra: Bitcoin Hovers at $113K; Solana and Dogecoin Lead Beneficial properties Forward of Powell’s Jackson Gap Speech