The tokenization of real-world belongings (RWAs) is accelerating a basic shift in world finance, with blockchain-based U.S. Treasuries, equities, commodities, and personal credit score poised for exponential development this 12 months, in accordance with a report by market maker Keyrock and tokenization platform Centrifuge.

Keyrock and Centrifuge Evaluation: Tokenized RWAs May Seize 10% of Stablecoin Market by 12 months’s Finish

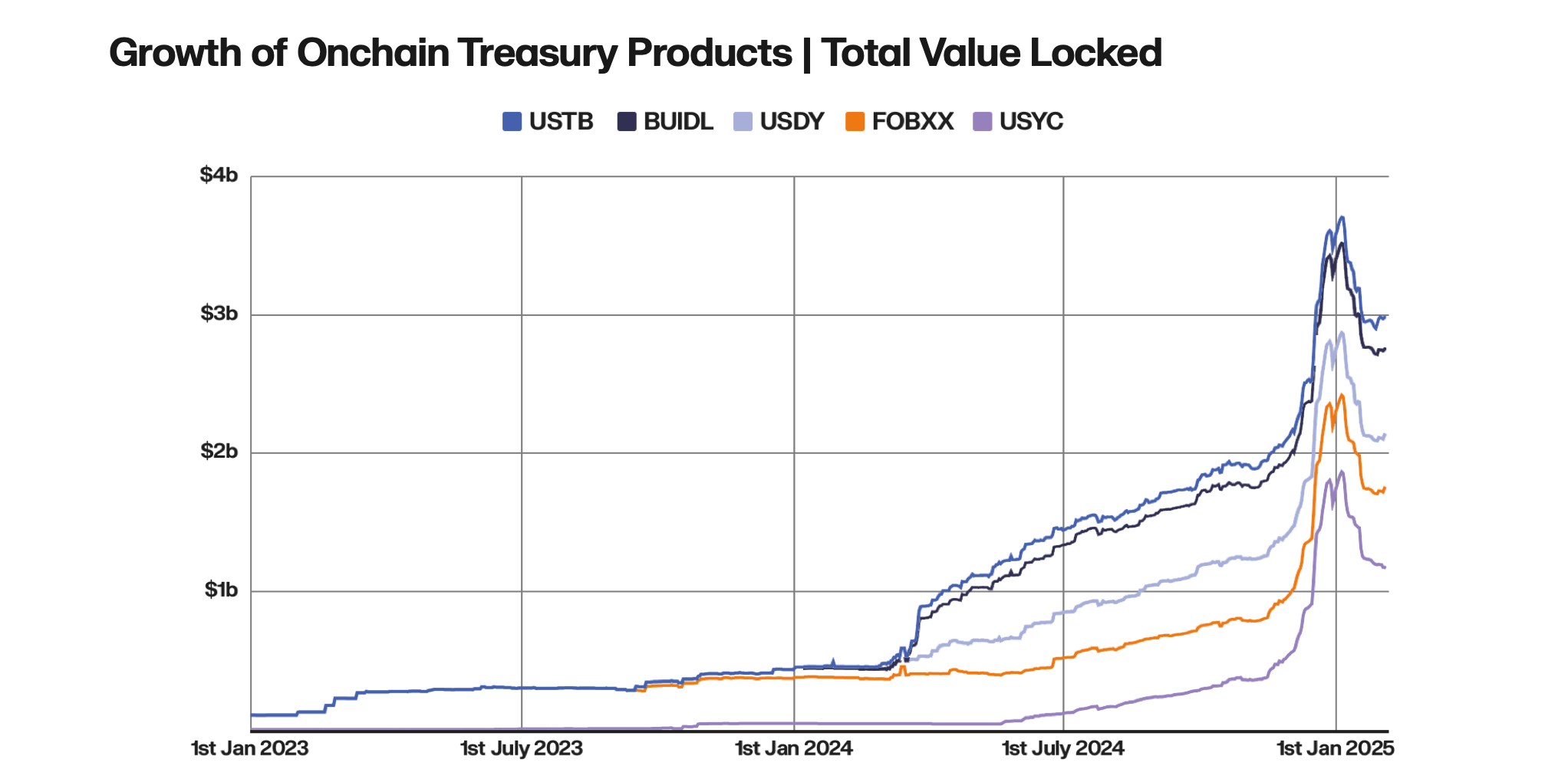

Tokenized U.S. Treasuries have surged 415% year-over-year, pushed by yield-seeking stablecoin holders and institutional adoption, the 2 companies report. Keyrock and Centrifuge undertaking that this sector may attain $28 billion if tokenized merchandise seize 10% of the $210 billion stablecoin market. “We count on tokenized Treasuries to evolve from a distinct segment innovation right into a core infrastructure element of world digital finance,” the report notes.

The evaluation explains that tokenized equities lag at $15 million TVL however face a pivotal 2025 as regulatory readability expands. Backed Finance and Ondo International Markets now allow permissionless entry to tokenized S&P 500 exchange-traded funds (ETFs) and company shares.

“The democratization of subtle monetary instruments by non-KYC, permissionless protocols guarantees to unlock trillions in untapped market potential from beforehand underserved areas and populations,” the Keyrock and Centrifuge research particulars.

The report highlights that commodities like gold wrestle with liquidity gaps regardless of $1.2 billion in tokenized provide, although artificial platforms like Ostium Labs intention to seize speculative demand. Personal credit score leads with $12.2 billion TVL, as Centrifuge’s institutional swimming pools slash securitization prices by 97%.

Regulatory hurdles persist, notably for equities, however Keyrock and Centrifuge be aware that bipartisan U.S. laws and European frameworks like MiCA are easing pathways. The report forecasts that whole tokenized RWAs may hit $50 billion in a 2025 bull case, fueled by institutional uptake and vital decentralized finance (DeFi) integration.

“This motion envisions restructuring world finance by democratizing entry, rising effectivity, and enhancing transparency throughout asset lessons,” the tokenized RWA evaluation explains. “As a substitute of sluggish settlement pipelines, markets may function on blockchain rails with near-real-time settlement and verifiable possession information, decreasing counterparty dangers and back-office friction.”

With tokenized Treasuries modernizing settlements and personal credit score democratizing entry, Keyrock and Centrifuge place 2025 because the inflection level for blockchain’s $30B–$50B breakthrough.