Morning Minute is a every day e-newsletter written by Tyler Warner. The evaluation and opinions expressed are his personal and don’t essentially replicate these of Decrypt. Subscribe to the Morning Minute on Substack.

GM!

As we speak’s high information:

- Crypto majors fall as China commerce warfare rhetoric escalates; BTC at $111k

- Gold hits one other new ATH as Bitcoin and crypto lags

- Larry Fink leans into tokenization, says BlackRock is constructing tech

- Elon praises Bitcoin’s power basis in shocking about face

- MetaMask companions with Polymarket to carry prediction markets in-wallet

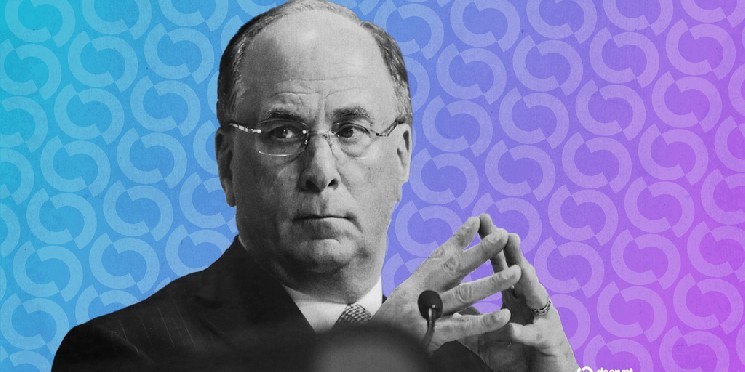

🧭 Larry Fink on Crypto: ETFs now, tokenization subsequent

BlackRock’s Larry Fink had lots to say about crypto yesterday.

And the first takeaway – we’re simply getting began.

📌 What occurred

On CNBC yesterday, Larry Fink praised how spot Bitcoin ETFs opened the door for mainstream traders.

Then he received particular on how tokenization is the longer term.

The world he envisions consists of mutual funds, non-public credit score, cash markets, even real-world belongings issued as tokens, settling near-instantly, with compliance baked into the token (who can maintain it, the place it might probably transfer, when it might probably commerce).

He stated BlackRock is constructing the tech to drop these merchandise immediately into digital wallets, lower settlement frictions, slash switch/record-keeping prices, and provides shoppers 24/7 portability.

He additionally burdened that Bitcoin nonetheless has a task, however sized responsibly.

🗣️ What They’re Saying

“We’re simply at the start of the tokenization of all belongings, from actual property to fairness to bonds, throughout the board.” — Larry Fink, CEO of BlackRock, on CNBC

CEO of world’s largest asset supervisor…

“We’re simply at the start of the tokenization of all belongings.”

Sure, consists of ETFs.

Larry Fink on his positively evolving perspective in the direction of crypto: “I develop & study.”

Good lesson right here.

And a few of you *nonetheless* assume crypto is a rip-off. pic.twitter.com/GJ8oxWF3vK

— Nate Geraci (@NateGeraci) October 15, 2025

🧠 Why it issues

ETFs are the on-ramp right this moment; the larger story is tokenizing just about the whole lot tomorrow.

That is the playbook from the world’s greatest asset supervisor:

- Proper now: ETFs preserve regular demand flowing into BTC and make advisors snug recommending it.

- Subsequent up: tokenization makes each sort of asset buying and selling higher – sooner, cheaper, and wallet-friendly

- Web impact: higher tech, extra entry, much less friction.

General, this implies extra folks getting access to these funding merchandise, which is a win. And so they’ll have the ability to commerce extra effectively through blockchain with decrease charges – win win.

However it won’t be an entire win.

Ethereum was largely anticipated to be the house of RWA tokenization.

If that occurs on BlackRock’s personal rails (and different banks / establishments comply with go well with), that does damage one side of the Ethereum bull case.

However there additionally could also be a world the place bringing that quantity of belongings and asset varieties onchain is extra web bullish general than it’s bearish to the Ethereum tokenization bull case.

Time will inform…

🌎 Macro Crypto and Memes

A couple of Crypto and Web3 headlines that caught my eye:

- Crypto majors are inexperienced after yesterday morning’s dump; BTC +1% at $112,000, ETH +3% at $4,100, BNB even at $1,190, SOL +3% at $203

- ZEC (+15%), XPL (+14%) and Morpho (+9%) led high movers

- Gold hit one other new ATH over $4,240 in a single day

- Jerome Powell stated that Quantitative Tightening (QT) might finish within the coming months, alluding to tightening in markets

- Larry Fink stated that BlackRock is specializing in tokenization and constructing their very own tech to allow it

- Elon Musk commented favorably about Bitcoin on Tuesday, praising its power basis and saying “it’s not possible to faux power”

- MetaMask introduced a partnership with Polymarket to carry prediction markets in pockets

- Binance pledged one other $400M for these impacted by final week’s crash, with $300M for retail merchants and $100M in low curiosity loans for institutional gamers

- Japanese regulators moved to ban crypto insider buying and selling, concentrating on a 2026 legislation to police nonpublic info abuses

- New York Metropolis created a Digital Property and Blockchain Workplace by govt order, formalizing a crypto coverage hub as Mayor Eric Adams exits

- A brand new Republican invoice would codify Trump’s crypto-in-401(okay) govt order, pushing retirement-plan suppliers towards permitting regulated digital-asset publicity

- PayPal’s stablecoin PYUSD has surged from $5M to $452M in only a month on Kamino, making it the quickest rising stablecoin in Sol and ETH DeFi

In Company Treasuries / ETFs

- The Bitcoin ETFs noticed $102.7M in web inflows on Tuesday regardless of Blackrock’s first day of outflows in weeks; ETH noticed $236.2M in web inflows

- VanEck filed an up to date S-1 for its spot Solana ETF, setting the administration charge at 0.30%, in an indication that approval could also be across the nook

In Memes

- Memecoin leaders are principally inexperienced; DOGE +1%, Shiba +2%, PEPE +2%, PENGU +1%, BONK +4%, TRUMP +1%, SPX +1%, and FARTCOIN +4%

- USELESS jumped one other 20% to $420M and near flipping Fartcoin

- 4 rebounded 36% to $186M after its Reload Airdrop program went dwell

💰 Token, Airdrop & Protocol Tracker

Right here’s a rundown of main token, protocol and airdrop information from the day:

- Monad launched its airdrop declare portal, permitting recipients to see their tier and energy degree (social, EVM and Solana energy utilization have been rewarded)

- Aster accomplished its section 2 airdrop, returning USD accounting for charges spent by customers; additionally they shared updates for section 3 scoring

- BNB issued the primary spherical of its $45M Reload Airdrop, randomly rewarding customers who traded BNB memes with BNB tokens, with 3 extra waves to come back

- Myriad shared new information on its Perpetual Sentiment Markets, a brand new type of “ballot” that by no means resolves and displays present state of person views

- MegaETH introduced a public ICO approaching Sonar

- Ethena introduced that USDtb has change into the primary stablecoin in compliance with Genius Act after transition to Anchorage Digital

- Kinetiq introduced that its ultimate kPoints snapshot has been taken, ultimate distribution tomorrow

🚚 What is occurring in NFTs?

Right here is the record of different notable headlines from the day in NFTs:

- NFT leaders have been principally flat; Punks -4% at 44.5 ETH, Pudgy even at 7.6, BAYC even at 7.95 ETH; Hypurr’s +2% at 1,228 HYPE

- Chimpers (+11%) and Good Vibes Membership (+5%) have been high movers

- Magic Eden introduced that RWA and NFT packs are coming to its platform