Buying and selling of the MYX token, the cryptocurrency of the MYX decentralized change (DEX), featured hallmarks of market manipulation, based on a report from AI infrastructure firm Rena Labs and market intelligence firm Insider.Money.

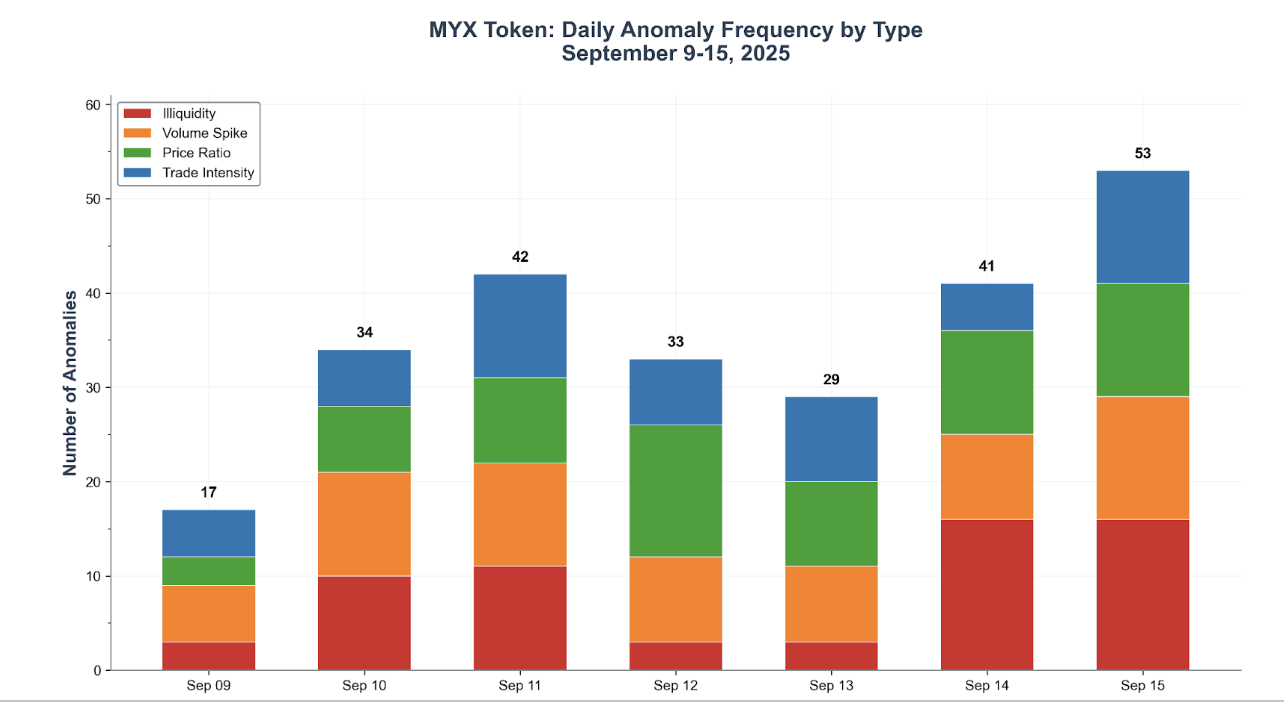

The report analyzed over 9,200 minute-by-minute knowledge factors between Sept. 9 and Monday, which discovered 249 buying and selling anomalies concerning illiquidity, quantity spikes, value ratios and commerce depth.

The researchers discovered that MYX liquidity anomalies on the Gate change spiked by 433% on Sept. 9, with a complete of 32 illiquidity occasions on Sunday and Monday, signaling both intentional market manipulation or the exit of market makers, which offer liquidity and cushion markets throughout instances of utmost stress.

A breakdown of the varieties of buying and selling anomalies detected within the evaluation. Supply: Rena Labs

MYX token common commerce sizes contracted by 67% in periods of “peak” illiquidity, and buying and selling frequency additionally fell by 45% in the course of the noticed buying and selling interval, falling to 86 trades per minute to 157, whereas bid-ask spreads contracted to eight.2% on Monday from 15.8% on Sept. 9.

Associated: What’s MYX Finance and why is it up 1,400% in seven days?

Bid-ask spreads, the distinction between purchase and promote costs, usually widen throughout heightened illiquidity and contract when liquidity is excessive. The “paradoxical” conduct of the bid-ask spreads throughout peak illiquidity was additionally a crimson flag for the researchers. They wrote:

“The temporal synchronization of those excessive deviations throughout in any other case unbiased market microstructure metrics strongly suggests coordinated, multi-vector manipulation methods, quite than natural buying and selling exercise pushed by elementary information or pure market forces.”

A desk of bid-ask spreads for the MYX token in the course of the noticed interval. Supply: Rena Labs

Spokespersons from Rena Labs informed Cointelegraph that the chance of all of the anomalies throughout all 4 market dimensions — illiquidity, quantity spikes, value ratios and commerce depth — occurring concurrently was beneath 0.001%, successfully making the chance of natural buying and selling exercise “a mathematical impossibility.”

Cointelegraph reached out to MYX Finance however was not capable of obtain a response by the point of publication.

BubbleMaps sounds the alarm on MYX token airdrop

On Sept. 9, Blockchain analytics platform Bubblemaps claimed that the current MYX token airdrop could have been the topic of the most important Sybil assault in crypto historical past.

Bubblemaps claims a Sybil assault impacted MYX token airdrop. Supply: Bubblemaps

A Sybil assault is a sort of malicious exercise by which the menace actor creates a number of accounts which are all managed by a single entity, giving the impression of natural community exercise.

Bubblemaps stated that one entity, controlling 100 newly funded wallets, claimed over 9.8 million MYX tokens and made a $170 million revenue from the token airdrop.

Journal: What do crypto market makers really do? Liquidity, or manipulation