As merchants flock to tokenless perpetuals exchanges in pursuit of “the following Hyperliquid airdrop,” buying and selling volumes hit a report $1 trillion in September, and because the sector heats up, the Lighter trade’s activity-based factors have hit an all-time excessive on over-the-counter (OTC) markets.

The Lighter factors system has been stay since its closed beta launched in February, however valuations have skyrocketed during the last month.

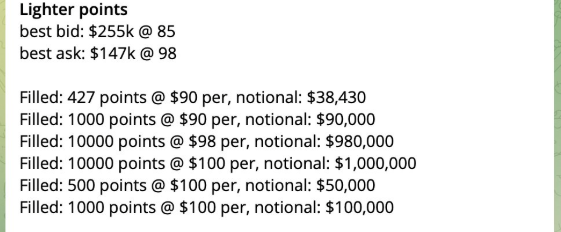

The main Lighter OTC market, SOTC, cleared its first seven-figure transaction on Oct. 7, which additionally marked the primary sale at $100 per level. Lighter factors had been buying and selling for as little as $30 simply weeks in the past.

Screenshot – SOTC

Factors are down barely as of in the present day, with the highest bid at $90. Present costs indicate a valuation of round $5 billion for the long run LIGHT token, based on Delpi Digital’s estimates.

Lighter’s progress has been catalyzed by the latest shift in consideration in direction of different perpetual spinoff exchanges, because the house has been dominated by Hyperliquid because the HYPE token launched in November 2024.

The rise of Aster has sparked a mania within the sector, and now Lighter and Hyperliquid are neck and neck when it comes to whole quantity. Over the past week, Hyperliquid has processed $65 billion in perpetuals quantity, whereas Lighter did $60 billion. It’s value noting that Hyperliquid nonetheless instructions the vast majority of open curiosity, with $15 billion in comparison with Lighter’s $2.5 billion.

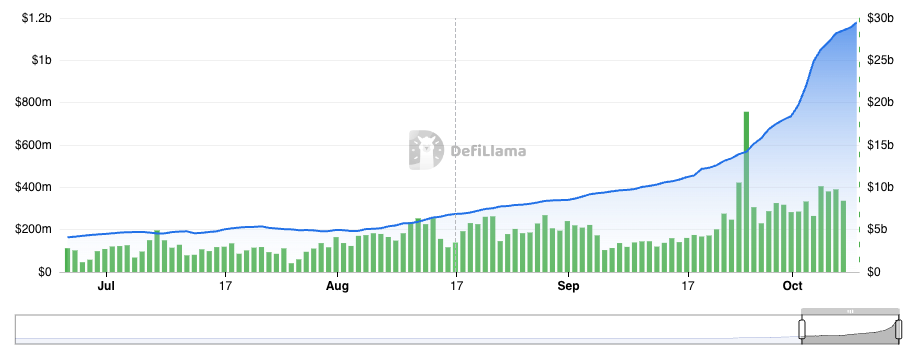

Lighter’s whole worth locked (TVL) has surged alongside its factors to $1.18 billion in the present day from $340 million initially of September.

Lighter TVL and Perps Quantity – DeFiLlama

The valuation of the factors stays speculative, because the LIGHT tokenomics haven’t been publicly disclosed. Customers are speculating on a big distribution, nonetheless, starting from 25% to 50% of the token provide, based mostly on official workforce communications in an X house held over the summer season.

The talk over the worth of the factors is heating up, with Lighter bulls touting options Hyperliquid lacks, comparable to place privateness and nil charges. In the meantime, skeptics declare that Hyperliquid, which presently instructions a $43 billion valuation, derives a majority of that valuation from the truth that it is a Layer 1 blockchain, whereas Lighter doesn’t function its personal blockchain, not less than for now.