Ethereum is as soon as once more within the highlight as institutional demand continues to form the market’s route. After weeks of bullish momentum that pushed ETH into contemporary all-time highs, the value is now consolidating beneath this stage, holding above crucial help zones. Regardless of the short-term slowdown, Ethereum stays one of many strongest gamers on this cycle, with clear proof that huge cash is flowing in.

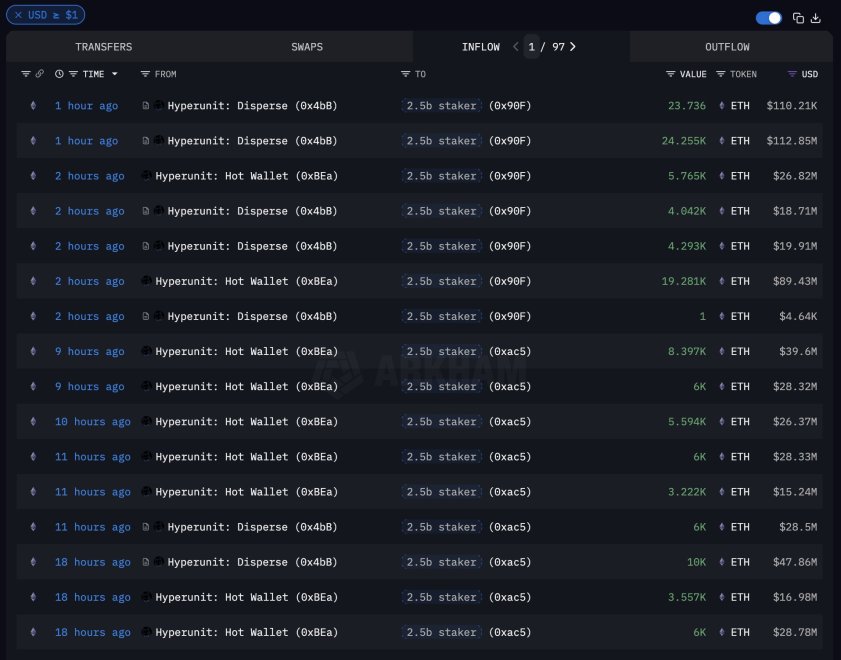

Arkham Intelligence has revealed a placing onchain improvement: a whale simply bought $2.5 billion price of ETH inside hours and instantly staked your complete place by a single contract. The timing of this transfer highlights how aggressive accumulation is aligning with Ethereum’s rise because the dominant chain for DeFi and institutional publicity. Whereas retail merchants usually react to volatility, whales and establishments are inclined to place themselves strategically after main reversals, validating the broader uptrend.

The market now faces an vital check. With ETH consolidating slightly below its highs, buyers are asking whether or not this wave of whale exercise will probably be sufficient to set off a continuation towards $5,000—or if the market first wants a deeper correction earlier than resuming its bullish part.

Whale Accumulation Reinforces Ethereum’s Power

In keeping with Arkham Intelligence, an enormous whale has executed one of many largest onchain strikes of this cycle—shopping for $2.55 billion price of ETH from Hyperunit and staking all of it by a single staking contract. Arkham even requested on X: “Will he hold shopping for?”—a query that completely captures the temper amongst merchants and analysts.

This kind of accumulation isn’t just about measurement, however timing. Ethereum has been holding agency above crucial help ranges at the same time as Bitcoin faces difficulties sustaining momentum close to its highs. BTC has repeatedly examined demand across the $110K–$115K zone, signaling shopping for exhaustion, whereas ETH’s resilience suggests relative power. Analysts are starting to argue that the market is witnessing a capital rotation part, with some giant buyers favoring ETH and altcoins as Bitcoin consolidates.

What makes this occasion much more notable is that the whale staked the whole thing of the acquisition, demonstrating a long-term conviction relatively than a short-term speculative commerce. Staking locks cash out of circulation, decreasing sell-side strain and reinforcing Ethereum’s basic worth.

The broader implication is obvious: if whales proceed this stage of aggressive positioning, Ethereum couldn’t solely maintain its beneficial properties above $4,400 but in addition prolong its rally towards the symbolic $5,000 mark. In the meantime, Bitcoin’s incapacity to push increased could cement ETH because the outperformer within the brief to mid-term.

ETH Displaying Power Round Key Ranges

Ethereum’s every day chart reveals the asset holding above the $4,400 stage, a crucial help zone following days of excessive volatility. After not too long ago reaching new highs near $4,900, ETH confronted a pointy pullback, however consumers have thus far defended this stage, suggesting it might act as a powerful base for the subsequent transfer.

The value construction stays bullish general, with ETH buying and selling effectively above its 50-day ($3,837), 100-day ($3,184), and 200-day ($2,634) transferring averages. This alignment of the transferring averages displays sustained bullish momentum, although the steep climb of latest weeks has elevated the danger of volatility. The wick rejections close to $4,900 point out that sellers are taking earnings at increased ranges, however demand close to $4,400 is preserving ETH from deeper corrections.

For bulls, reclaiming $4,700 and pushing again towards $4,900 will probably be crucial for resuming the uptrend and doubtlessly concentrating on the psychological $5,000 stage. On the draw back, a breakdown beneath $4,400 might expose ETH to additional declines, with secondary help close to $4,200.

Ethereum stays in a powerful uptrend, however the market is coming into a decisive part the place both consolidation above $4,400 prepares the bottom for continuation, or a deeper correction unfolds earlier than the subsequent rally.

Featured picture from Dall-E, chart from TradingView

Editorial Course of for is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent evaluate by our workforce of high know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.