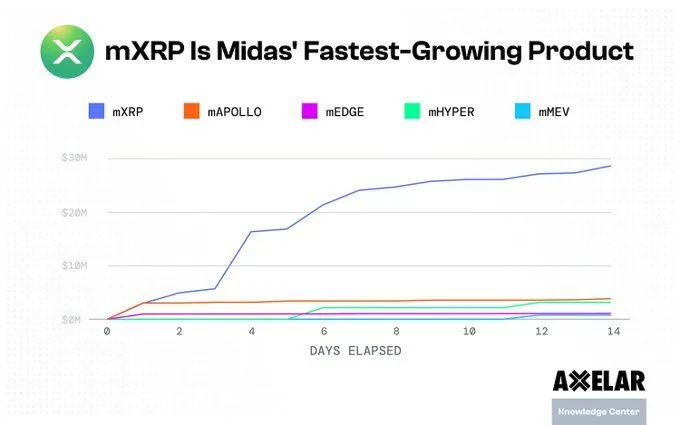

mXRP Breaks Data as Quickest-Rising Midas RWA Product with $30M in Two Weeks

In accordance with Axelar Community, mXRP has formally damaged a main launch report, turning into the fastest-growing Midas Actual-World Asset (RWA) product ever.

In simply two weeks since launch, mXRP has attracted almost $30 million in deposits, underscoring the rising investor urge for food for $XRP-based yield alternatives and signaling a brand new wave of adoption for tokenized belongings.

The milestone highlights rising enthusiasm round RWA tokenization, a quickly increasing sector on the intersection of conventional finance and decentralized finance (DeFi).

By means of Midas, mXRP allows customers to achieve yield publicity to XRP, a cryptocurrency lengthy related to environment friendly cross-border funds, whereas leveraging the safety and interoperability of Axelar’s cross-chain infrastructure.

mXRP’s fast progress indicators a shift within the digital asset panorama. Traders are favoring yield-bearing, blockchain-backed alternatives over speculative tokens.

By integrating XRP liquidity into the Midas ecosystem, customers can earn sustainable returns in a decentralized surroundings, combining real-world asset stability with DeFi flexibility.

Subsequently, this surge indicators a renewed curiosity in XRP as asset tokenization goes mainstream. With main monetary establishments exploring RWA integrations and platforms like Midas streamlining yield entry, momentum round XRP-linked belongings is ready to speed up.

Moreover, mXRP’s success solidifies Midas as a high RWA participant, the place transparency, liquidity, and effectivity gas adoption, whereas reaffirming XRP’s enduring utility in powering next-generation monetary merchandise.

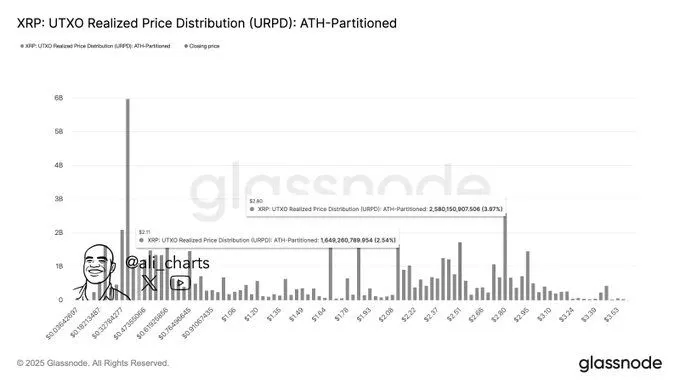

XRP Eyes $2.10 Assist and $2.80 Resistance Amid Market Pullback

Famend analyst Ali Martinez spots XRP’s subsequent help at $2.10 and resistance at $2.80, because the token dips to $2.27 amid a broader crypto correction after weeks of bullish momentum pushed by asset tokenization and the rising RWA sector.

XRP’s latest pullback follows a technical cooling interval after climbing above $2.50, pushed by profit-taking and short-term momentum loss. Regardless of this, investor sentiment stays bullish, fueled by rising institutional curiosity in tokenized belongings.

Technically, a sustained shut above $2.80 may set off a breakout towards $3.30, revisiting 2017–2018 highs. Conversely, failing to carry $2.10 might open the trail to the important thing $2.00 help.

Subsequently, XRP’s near-term value will probably be formed by market sentiment, regulatory readability, and tokenization momentum. The $2.10–$2.80 vary now marks the important thing battleground for its subsequent main breakout or consolidation.

Conclusion

mXRP’s record-breaking launch indicators hovering investor demand for yield-driven, XRP-backed merchandise.

By merging Axelar’s safe cross-chain infrastructure with Midas’ RWA platform, it showcases the rising attraction of tokenized real-world belongings and a broader shift towards clear, high-yield DeFi options.

In the meantime, XRP’s $2.10–$2.80 vary marks a vital section: staying above $2.10 may spark a rally, whereas a break under dangers testing investor confidence and driving costs decrease.