Based on a brand new report from Constancy, 17% of all BTC formally counts as “historical Bitcoin,” which means it has not moved in at the least ten years. These property are price round $360 billion.

Worryingly, Constancy claims that extra BTC is turning into historical per day than new miners can change it. Between this pattern and company acquisitions, Bitcoin’s perform as a circulating foreign money could also be at risk.

Is Historical Bitcoin Taking Over

Due to the pattern of HODLing, Bitcoin has no scarcity of whales that maintain onto their property for years at a time.

Nevertheless, the crypto trade is greater than 15 years outdated now, and the variety of “historical” tokens can solely be rising. Constancy performed a research on historical Bitcoin, figuring out a collection of essential conclusions:

Constancy is a number one Bitcoin ETF issuer, so it naturally has a powerful curiosity in conducting this analysis. On the floor, the declare that 17% of all Bitcoins are historical appears extraordinarily noteworthy.

The agency estimates that 3.4 million BTC fall into this class, representing greater than $360 billion in worth. Nevertheless, Constancy’s findings on mining could be much more consequential:

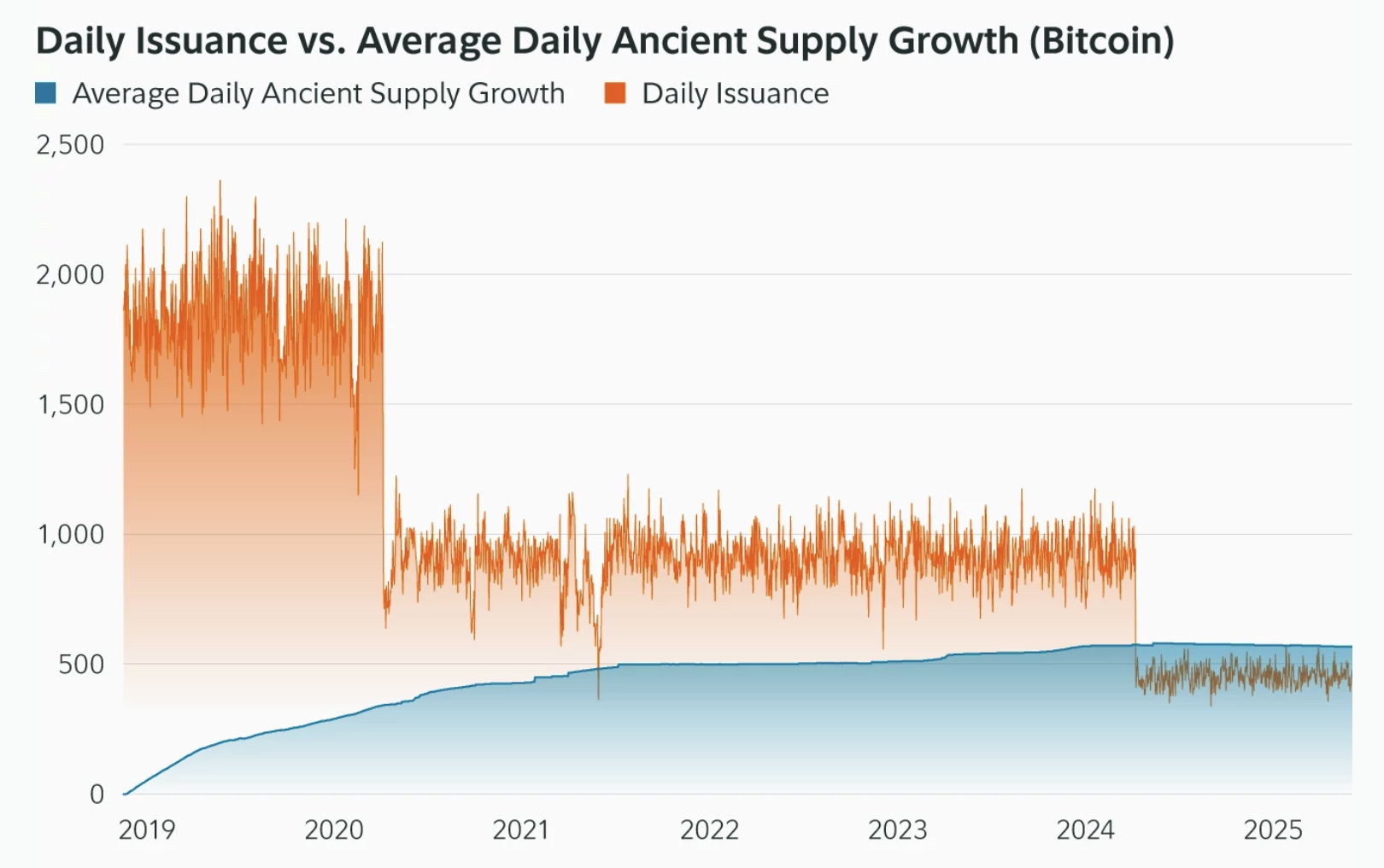

Historical Bitcoin vs Mined. Supply: Constancy

Particularly, the agency claimed that extra Bitcoin is turning into historical per day than new tokens are being mined. The mining trade is turning into much less worthwhile, and ETF issuers buy much more BTC than miners can produce.

Constancy discovered that 566 tokens develop into historical per day, whereas solely 450 new ones change them.

Why Historical ‘Misplaced’ Provide is a Main Concern

A major concern is {that a} portion of the traditional provide is successfully misplaced, for causes corresponding to discarded non-public keys or inaccessible wallets. On-chain information means that round 20% of all mined Bitcoin has already been misplaced completely.

Individually, over 1.8 million Bitcoins linked to Satoshi Nakamoto have remained dormant for greater than ten years. When cash are actually misplaced, the efficient circulating provide shrinks, which alters supply-demand dynamics.

Decreased energetic provide can amplify worth volatility. As Bitcoin’s provide cap approaches, every incremental elimination from energetic circulation causes a tighter out there float.

Additionally, focus danger rises when fewer cash stay energetic. Whales can transfer the market extra simply if energetic provide dwindles.