A brand new slew of crypto ETFs might be simply across the nook.

“I might be mistaken, however my guess is you may speak to your loved ones about a number of crypto ETPs at Thanksgiving. Possibly at Halloween. I don’t suppose you’re gonna have to attend until Christmas,” Bitwise Chief Funding Officer Matt Hougan instructed Blockworks.

Bloomberg Intelligence analysis analyst James Seyffart stated he expects that “dozens of merchandise” might be launched “most likely inside the subsequent month or two,” and positively by the top of the 12 months.

Nonetheless, the approval course of may take longer if there’s a authorities shutdown, as Hougan famous that “issues gained’t be permitted if the federal government shuts down.”

In September, when the Securities and Trade Fee permitted the generic itemizing requirements, it turned clear that it was merely a matter of time earlier than extra crypto ETPs hit the market, and, at this level, “all the pieces is shifting extraordinarily quick,” Seyffart stated.

Learn extra: Crypto ETF swell approaching after Grayscale’s newest launch

The transfer, whereas anticipated, confirmed that the SEC had absolutely entered a brand new period of crypto regulation. One the place it might return to its roots — as Seyffart put it — as a disclosure regulator. Whereas each the ETH and bitcoin ETFs have been launched underneath earlier SEC Commissioner Gary Gensler’s tenure, each approvals took years of shut scrutiny to get throughout the end line.

That gained’t be the case for potential ETPs reminiscent of Solana, which noticed its first submitting simply final 12 months.

The proposed crypto merchandise will give each crypto natives and people who’re thinking about crypto publicity to new belongings.

“I believe we’re going to get Litecoin launched, get Solana launched. We’re gonna get a few of these different cash launched, together with XRP down the road,” Seyffart added.

Learn extra: Listed here are the 8 companies vying to record Solana ETFs

“ETF issuers will launch all the pieces they’ll,” Hougan instructed Blockworks, noting that he wasn’t speaking about Bitwise particularly.

And whereas there could also be an abundance of crypto ETPs doubtlessly launching within the US, Seyffart doesn’t appear too fearful.

“Truthfully, the market will determine what has worth. If there’s buying and selling quantity…AUM which are attracting these merchandise, they’re going to stay round for the foreseeable future. It’s as much as no person else, however the place the cash goes actually.”

The idea, although, is that the brand new itemizing requirements from the SEC cowl 12 belongings, together with SOL and XRP.

Assessing urge for food

Whereas issuers will proceed to launch single-asset ETPs, Hougan stated he’ll be fastidiously anticipating a “giant variety of index and theme ETPs.”

He expects that there’ll be extra urge for food for the exchange-traded merchandise that provide a broader publicity to crypto as a substitute of simply, say, a bitcoin ETF.

“As the common purchaser of a crypto ETP strikes from somebody who’s extra crypto native to the final inhabitants, which I believe is sort of a multi-year transition, nevertheless it’s occurring, proper? It’s shifting from crypto Twitter to my uncle. The tendency goes to be to need to get thematic publicity and never particular person asset publicity,” Hougan added, likening it to Invesco’s QQQ ETF.

He thinks that single-asset versus index-based ETFs is a bit like a horse race the place the single-asset ETPs will look sturdy out of the gate, however index-based ETPs will end in first in the long run.

Seyffart echoed Hougan, noting that he’s “most bullish on these index-type merchandise. I believe they’re going to get probably the most curiosity, however you’re going to see a number of curiosity in, particularly, Solana and XRP ETFs, primarily based on what we’ve seen within the ETF market elsewhere.”

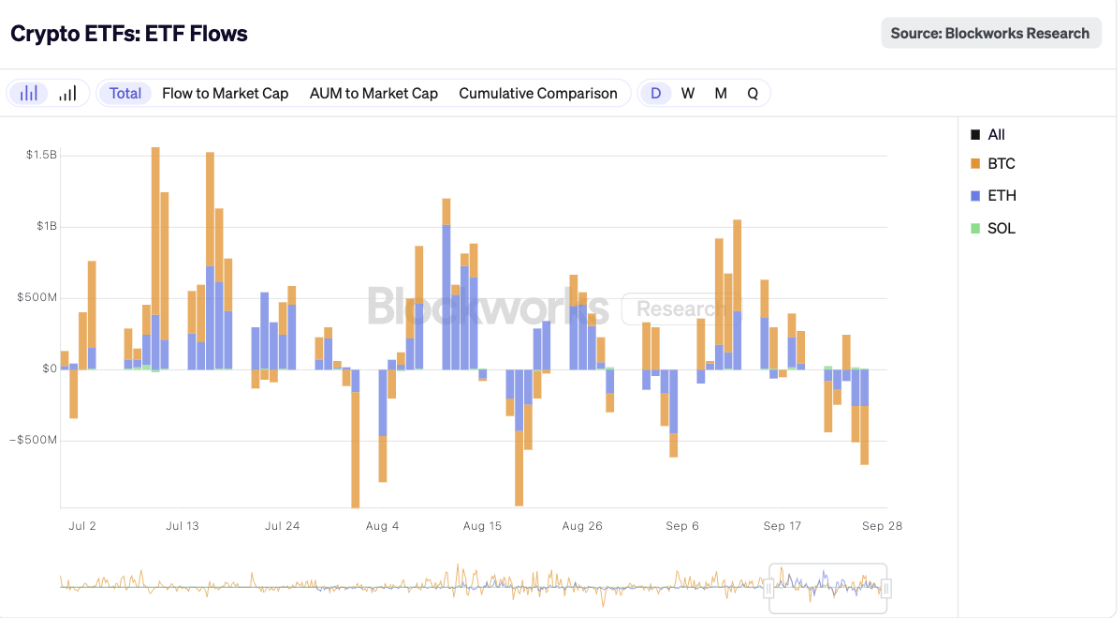

Supply: Blockworks Analysis

Supply: Blockworks Analysis

Rather a lot at stake

The SOL ETFs are “most probably” going to launch with staking, Seyffart stated, although nothing’s assured till the merchandise are formally permitted for launch.

“It’s been a very long time coming,” Hougan famous. “Most individuals will need staked publicity the identical approach most individuals need dividends.”