The blockchain business continues to grapple with basic scalability and interoperability challenges which have persevered since Ethereum’s early days. Excessive transaction charges, sluggish affirmation occasions, and remoted ecosystems create obstacles stopping mainstream adoption of decentralized functions. Mango Community, a brand new Layer 1 blockchain constructed by MangoNet Labs, claims to resolve these issues via an formidable technical structure that mixes a number of digital machines, cross-chain performance, and throughput capabilities that dwarf current options.

With $13.5 million in funding, Mango Community guarantees to course of 297,450 transactions per second with 380-millisecond finality whereas supporting each Ethereum Digital Machine (EVM) and Transfer Digital Machine (MoveVM) in a unified ecosystem. These daring claims arrive alongside the undertaking’s Token Era Occasion on June 24, 2025, when $MGO tokens start buying and selling on Bitget, MEXC, and KuCoin at 09:00 AM UTC.

However technical specs alone do not assure success within the aggressive Layer 1 panorama. This evaluation examines Mango Community’s structure, tokenomics, and real-world potential to find out whether or not it represents real innovation or one other case of blockchain hype exceeding actuality.

Technical Structure: Multi-VM Innovation

The Transfer Programming Language Benefit

Mango Community implements “Mango Transfer,” an enhanced model of the Transfer programming language initially developed by Fb for the Diem undertaking. Transfer was designed particularly for digital belongings, treating tokens and NFTs as “first-class residents” within the programming mannequin.

This resource-oriented method gives a number of crucial benefits:

- Possession Security: Digital belongings are represented as assets that can not be copied or implicitly discarded, stopping double-spending assaults

- Static Typing: Each variable’s sort is thought at compile time, eliminating complete classes of runtime bugs which have plagued different good contract platforms

- Formal Verification: The Transfer Prover device mathematically verifies good contract habits earlier than deployment, permitting builders to specify contract logic in formal phrases

- Modular Design: Sensible contracts may be safely upgraded and composed with out breaking current performance

Twin Digital Machine Implementation

Whereas Transfer gives superior safety for monetary functions, Mango Community acknowledges that almost all current DeFi protocols and instruments are constructed for the Ethereum Digital Machine. Moderately than forcing builders to decide on between safety and compatibility, Mango implements each EVM and MoveVM throughout the similar blockchain.

This dual-VM method works via parallel execution, permitting EVM-based functions to function alongside Transfer-based contracts with out interference. Every VM maintains its personal state house whereas sharing the underlying blockchain infrastructure. Mango’s OP-Mango Layer 2 answer facilitates communication between EVM and MoveVM environments via standardized occasion seize and knowledge serialization protocols.

The platform implements subtle useful resource allocation to stop one VM from monopolizing community capability. Transaction charges and execution limits are balanced throughout each environments to take care of truthful entry, whereas each digital machines entry a shared knowledge availability layer to make sure state modifications in a single setting are seen to the opposite when wanted.

Modular Structure

Conventional blockchains bundle a number of features into single methods that turn out to be troublesome to optimize. Mango separates 4 core features: execution handles good contract computation, consensus manages validator coordination via DPoS, settlement gives last transaction affirmation, and knowledge availability shops transaction info throughout the community.

This separation permits every part to optimize independently whereas sustaining system integrity. The claimed 297,450 TPS throughput relies on this modular design, although real-world efficiency typically differs from theoretical maximums.

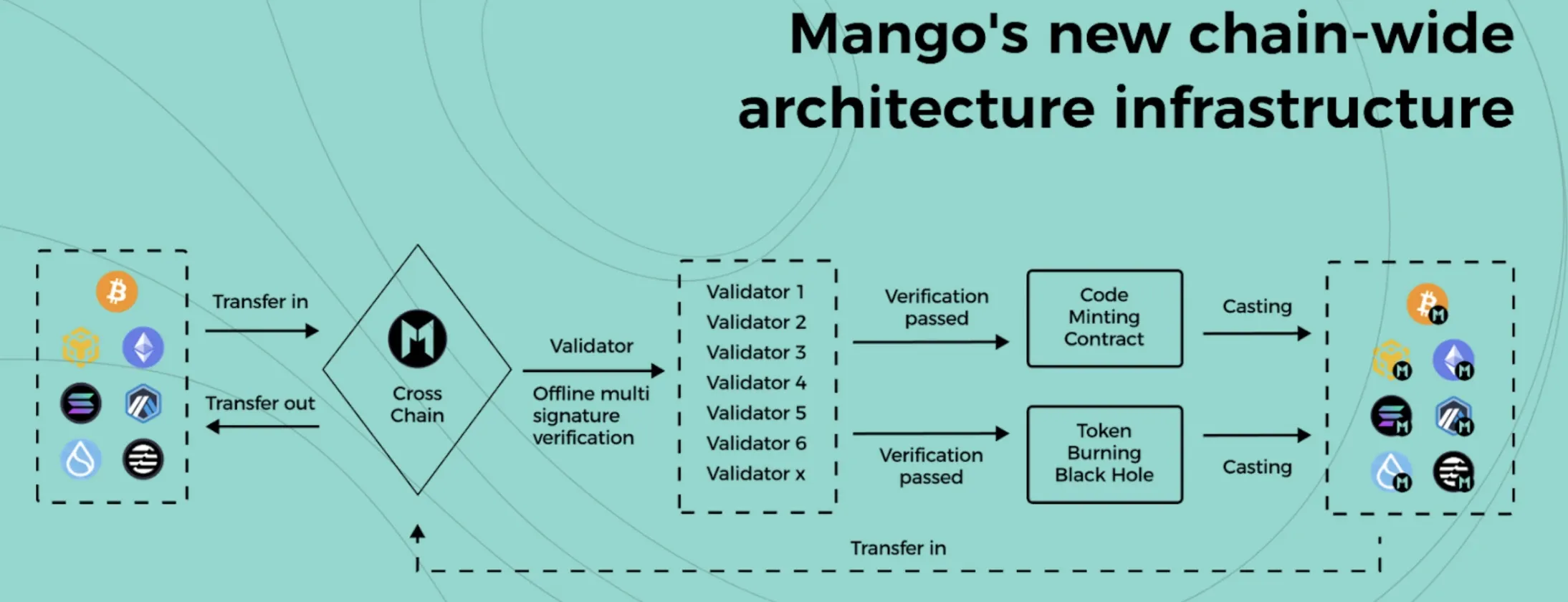

Mango’s chain infrastructure (official web site)

Cross-Chain Infrastructure and Zero-Data Integration

Cross-Chain Infrastructure and Privateness Options

OP-Mango powers cross-chain performance by processing transactions off-chain in batches earlier than submitting outcomes to networks like Ethereum. The system makes use of $MGO tokens as gasoline for cross-chain operations, contains fraud proof mechanisms, and permits asset transfers between totally different blockchains whereas sustaining safety via cryptographic verification.

Privateness and Storage Options

The platform incorporates ZK-SNARK and ZK-STARK applied sciences for privacy-preserving transactions and cross-chain transfers. Customers can commerce anonymously or transfer belongings between chains with out revealing transaction particulars. The platform additionally makes use of decentralized storage with knowledge backups and financial incentives for storage suppliers who earn $MGO tokens for sustaining knowledge availability.

MgoDNS represents the platform’s decentralized area identify system that bridges conventional web and blockchain environments. The system can resolve normal web domains whereas including blockchain-specific options. For instance, a single area identify like “alice.mgo” might resolve to pockets addresses on a number of totally different blockchains. Sensible contracts also can mechanically replace these area resolutions primarily based on programmed situations.

Tokenomics Deep Dive

Distribution Technique and Financial Mannequin

The $MGO token’s 10 billion whole provide with fast full unlock represents a big departure from typical token launch schedules. This technique displays particular theories about token velocity and community adoption however creates substantial financial dangers.

The great distribution allocates tokens throughout eight classes. The Basis receives 20% (2 billion tokens) for long-term improvement and operations, whereas the POS Stake Pool will get an equal 20% for community safety and validator rewards. The Ecosystem Innovation Fund holds 17% (1.7 billion tokens) for dApp improvement and partnerships, indicating severe dedication to ecosystem development.

Non-public buyers obtain 15% (1.5 billion tokens) from the $13.5 million funding spherical, which implies these tokens face fast unlock and potential promoting stress. The workforce and early contributors additionally get 15%, which raises questions on long-term alignment incentives given the shortage of vesting schedules.

Group airdrops characterize 10% of the whole provide, cut up equally between testnet (500 million tokens) and mainnet (500 million tokens) individuals. Claims open at 17:50 UTC on June 24, 2025, on a first-come, first-served foundation.

Advisors obtain the smallest allocation at 3% (300 million tokens), suggesting they supply primarily strategic somewhat than operational worth.

Token Utility and Worth Drivers

The $MGO token serves a number of features that ought to create varied sources of demand:

- Transaction Charges: All community operations require $MGO for gasoline, creating baseline demand that scales with community utilization

- Cross-Chain Operations: OP-Mango makes use of $MGO as common gasoline for cross-chain transactions, probably driving vital demand as interoperability grows

- Community Safety: Validators should stake $MGO to take part in consensus, eradicating tokens from circulation whereas incomes staking rewards

- Governance Rights: Token holders vote on protocol modifications and parameter updates, giving $MGO worth past pure utility

- Ecosystem Integration: Numerous protocols inside Mango could incorporate $MGO into their very own tokenomics, creating further demand sources

Nonetheless, the fast unlock technique creates a number of financial dangers. Ten billion tokens coming into circulation concurrently might overwhelm demand, notably if early individuals rush to understand income. The massive ecosystem fund allocation assumes speedy adoption and improvement exercise, but when ecosystem development lags expectations, these tokens might turn out to be a chronic supply of promoting stress.

Aggressive Evaluation and Market Positioning

Layer 1 Competitors Panorama

Mango Community enters a crowded Layer 1 market the place established gamers keep vital benefits via developer adoption, whole worth locked, and ecosystem maturity. Ethereum retains the biggest developer ecosystem regardless of excessive charges and scaling challenges, whereas Solana gives excessive throughput with a confirmed observe report, although it has confronted community stability points.

Transfer-based opponents Aptos and Sui each use variations of the Transfer programming language with totally different approaches. Mango’s dual-VM method differentiates it from these opponents but in addition provides complexity.

The platform’s claimed 297,450 TPS represents a big enchancment over most current networks, however these theoretical maximums require validation underneath real-world situations. Mango’s omni-chain imaginative and prescient competes with established interoperability options like Cosmos and Polkadot, which supply cross-chain performance via totally different technical approaches. Success will depend upon whether or not Mango’s built-in method gives significant benefits over current options and whether or not builders discover the multi-VM structure compelling sufficient to beat the momentum of established platforms.

Safety Audit and Improvement Group

Skilled Safety Evaluation

Mango Community underwent complete safety audits by MoveBit, a acknowledged blockchain safety agency. The undertaking accomplished two separate audits: a core community audit (April 7-19, 2024) and a devoted bridge audit (December 9, 2024 – January 6, 2025), demonstrating thorough safety protection throughout all crucial parts.

The core community audit employed a number of testing methodologies together with dependency checks, static code evaluation, fuzz testing, and handbook code evaluation. Outcomes had been notably constructive, with solely two points recognized – zero crucial vulnerabilities, one main challenge, and one informational discovering. Each points had been resolved earlier than mainnet launch.

The bridge audit was extra complete, figuring out seven points throughout totally different severity ranges, together with one crucial vulnerability associated to signature replay assaults. Nonetheless, all seven points had been efficiently fastened earlier than deployment. The bridge audit lined cross-chain performance between Sui, Ethereum, and Mango chains, making certain safe asset transfers throughout the platform’s multi-chain structure.

MoveBit’s evaluations lined execution layers, consensus mechanisms, cross-chain infrastructure, and exterior dependencies, offering confidence within the platform’s safety basis throughout each core performance and significant bridge operations.

Improvement Group and Management

The undertaking maintains transparency via seen management, together with CEO Benjamin Kittle and CTO David Brouwer. Brouwer brings related technical experience in Transfer programming and high-performance methods improvement. The workforce’s dedication to open-source improvement is obvious via their lively GitHub repository with a number of branches and model tags, indicating ongoing improvement exercise.

The event course of emphasizes educational analysis and formal verification instruments, with Transfer Prover being actively maintained as an open-source part. This method aligns with the technical rigor required for the platform’s formidable multi-VM structure.

Ecosystem Functions and Adoption Technique

DeFi and Cross-Chain Use Instances

Conventional DeFi operates in a multi-chain setting the place protocols deploy separate cases on totally different blockchains, creating liquidity silos and forcing customers to handle belongings throughout a number of environments. Mango Community’s omni-chain method guarantees unified liquidity swimming pools that may entry belongings from a number of blockchains concurrently.

For instance, a lending protocol on Mango might theoretically settle for Bitcoin collateral, Ethereum-based tokens, and Solana belongings throughout the similar pool, dramatically increasing out there liquidity. Nonetheless, this imaginative and prescient requires fixing challenges round asset value synchronization, bridge safety, and regulatory complexity throughout a number of jurisdictions.

The platform’s excessive throughput and low charges additionally make it appropriate for gaming functions that require frequent microtransactions. Dynamic NFTs that change properties primarily based on participant actions or cross-game interactions turn out to be possible, probably creating shared gaming economies the place belongings transfer between totally different video games.

Enterprise Integration Potential

MgoDNS represents the platform’s decentralized area identify system that bridges conventional web and blockchain environments. The system can resolve normal web domains whereas including blockchain-specific options. For instance, a single area identify like “alice.mgo” might resolve to pockets addresses on a number of totally different blockchains. Sensible contracts also can mechanically replace these area resolutions primarily based on programmed situations.

Corporations might probably handle tokenized belongings via acquainted net interfaces backed by blockchain safety, or combine blockchain monitoring into current provide chain methods with out full infrastructure overhauls. Nonetheless, enterprise adoption sometimes requires confirmed safety observe information and regulatory readability that new platforms lack.

The success of those functions relies on greater than technical functionality. Consumer expertise components, regulatory compliance, and integration with current enterprise processes typically decide adoption charges greater than underlying technical efficiency.

Funding Evaluation and Danger Evaluation

Bull Case for Mango Community

The platform addresses actual issues in present blockchain infrastructure via technical innovation that, if executed efficiently, might present sustainable aggressive benefits. Rising demand for cross-chain performance creates market alternatives for platforms that ship seamless omni-chain experiences.

Constructive Improvement Indicators

The platform demonstrates a number of encouraging alerts for potential success. The MoveBit safety audits, with minimal findings, counsel stable code high quality and improvement practices. The $13.5 million funding gives ample assets for ecosystem improvement, whereas the substantial ecosystem fund allocation signifies a severe dedication to attracting builders and functions.

Energetic GitHub improvement with a number of branches and common commits reveals ongoing technical progress. The workforce’s emphasis on formal verification via Transfer Prover and educational analysis references suggests a rigorous method to blockchain improvement that might enchantment to institutional customers and severe DeFi protocols.

The blockchain infrastructure market continues to develop quickly, with room for a number of profitable Layer 1 platforms serving totally different use instances and consumer segments. If Mango can show its technical claims and entice high quality builders, it might seize vital market share within the cross-chain and high-performance blockchain segments.

Danger Elements and Issues

The technical complexity of supporting a number of VMs and seamless cross-chain performance creates vital execution threat. Many blockchain tasks fail to ship on formidable technical guarantees, and Mango’s scope will increase each potential affect and failure threat.

Established Layer 1 platforms have community results, developer mindshare, and institutional relationships that might be troublesome to beat no matter technical superiority. The fast unlock of all tokens creates vital draw back threat and suggests both overconfidence in fast adoption or inexperience with token financial greatest practices.

Cross-chain performance and privateness options could face regulatory challenges that might restrict adoption or require expensive compliance modifications. The Layer 1 blockchain market may be approaching saturation, with restricted room for brand spanking new entrants to attain significant market share and developer adoption.

Conclusion

Mango Community presents a technically subtle method to Layer 1 blockchain infrastructure via its multi-VM structure, complete cross-chain performance, and powerful safety basis. The platform’s clear audit outcomes from MoveBit, clear improvement practices, and substantial funding present a stable basis for ecosystem development.

Whereas the fast token unlock technique and aggressive market dynamics current challenges, the undertaking’s technical improvements deal with actual issues in present blockchain infrastructure. The mix of Transfer programming language safety, EVM compatibility, and omni-chain capabilities might present significant benefits if correctly executed and adopted.

The June 24, 2025 token launch will present essential market suggestions on investor and consumer curiosity. Early efficiency metrics, developer adoption charges, and the platform’s means to ship on its high-throughput guarantees might be key indicators of long-term viability and success within the aggressive Layer 1 panorama.

For extra details about Mango Community and airdrop eligibility, go tomangonet.io, or for updates, comply with @MangoOS_Network on X.