A intently adopted crypto analyst says Bitcoin (BTC) might be on the cusp of its subsequent explosive rally, as two key macroeconomic indicators with a observe file of precisely predicting bull runs flash inexperienced.

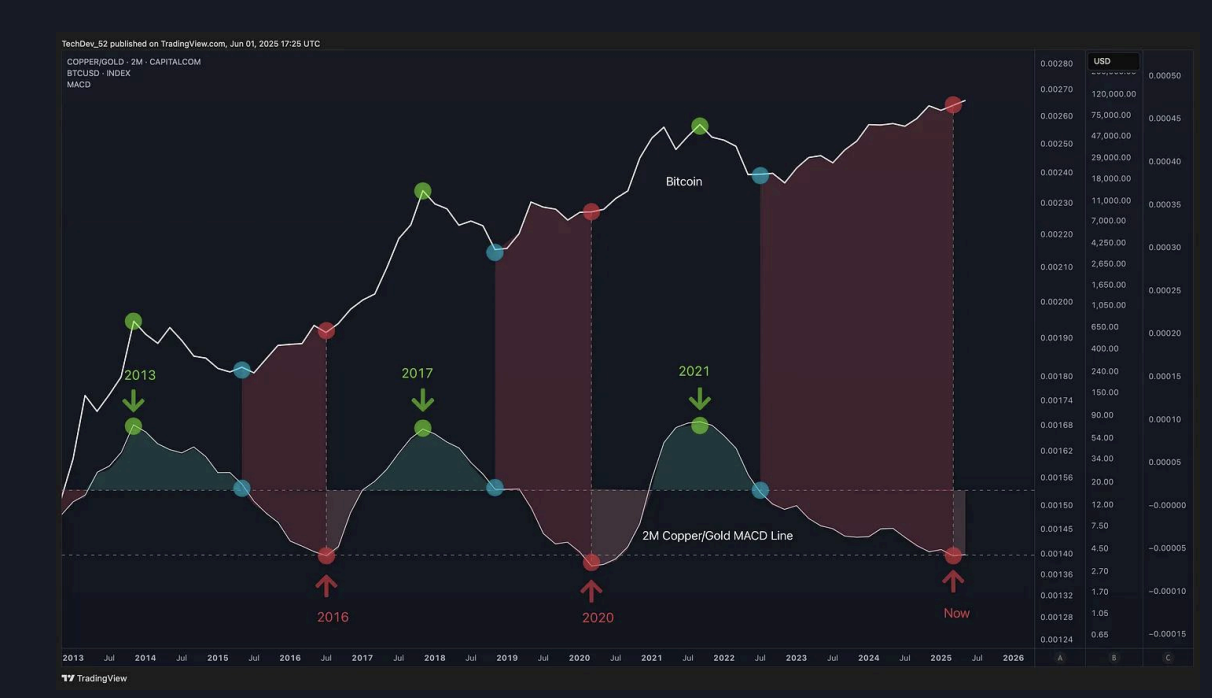

In a newly launched macro report, pseudonymous analyst TechDev highlights the copper-to-gold ratio and M2 cash’s provide year-over-year change as important indicators pointing to a brewing Bitcoin surge.

The copper/gold ratio, usually seen as a proxy for financial threat urge for food, has begun to pattern upward – a transfer TechDev notes has traditionally preceded BTC bull markets by a number of months.

“As of mid-2025, the ratio has stopped declining and is stabilizing, even exhibiting indicators of turning increased. This means that traders are starting to anticipate restoration. If copper begins to outperform gold within the coming quarters, it will sign a bottoming of the enterprise cycle – exactly the sort of macro regime change that helps a bitcoin bull run.”

Supply: TechDev

And the analyst says international M2 cash provide – a broad measure of liquidity on this planet monetary system – has flipped from unfavourable to optimistic annual progress, additionally a sign that he says has preceded every of Bitcoin’s parabolic phases by 6–10 months, suggesting a powerful chance that one other upward cycle is imminent.

“When international M2 is rising, Bitcoin usually follows go well with. This dynamic is seen throughout a number of cycles. Within the aftermath of the 2020 COVID disaster, for example, international M2 surged on the quickest charge in fashionable historical past. Bitcoin responded by rallying from beneath $10,000 to over $60,000 in simply over a 12 months.

Conversely, when central banks tighten coverage as they did in 2022 and 2023 to fight inflation, international M2 flattens or contracts. Throughout this time, Bitcoin struggled. Its worth declined sharply in tandem with falling liquidity, reinforcing that it’s not sentiment however capital circulate that drives crypto worth motion. As liquidity dried up, so did Bitcoin’s momentum.”

Generated Picture: DALLE3