The non-fungible token (NFT) market confirmed early indicators of restoration after a steep sell-off worn out about $1.2 billion in market capitalization in the course of the crypto market crash on Friday.

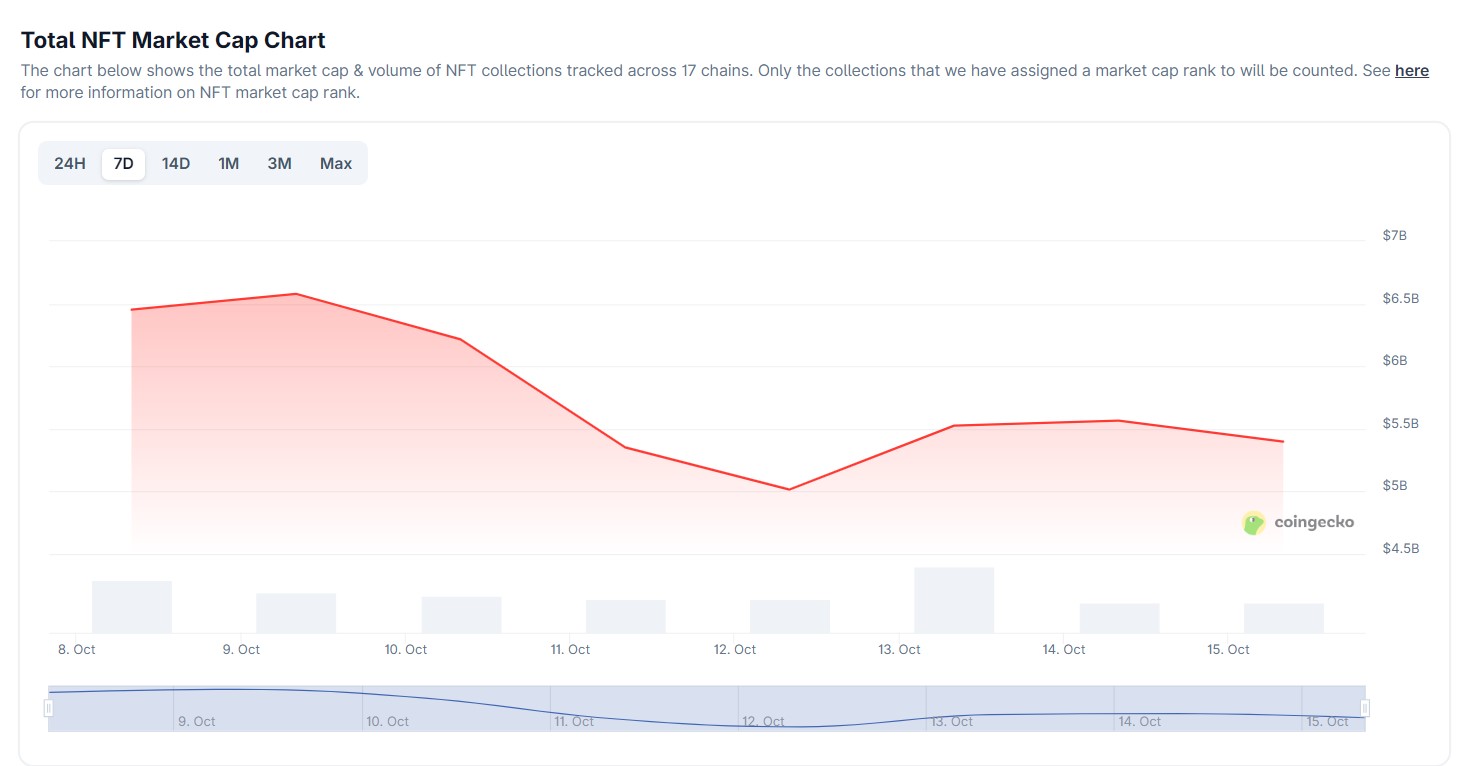

In response to CoinGecko knowledge, the sector’s general valuation fell from $6.2 billion on Friday to $5 billion on Saturday. This erased virtually 20%, or about $1.2 billion, in market capitalization for digital collectibles throughout all blockchain networks.

The sector skilled a speedy restoration as crypto markets rebounded. On Sunday, NFTs reached $5.5 billion, marking a ten% achieve following the crash. On the time of writing, the general market cap was virtually $5.4 billion.

The sell-off highlights the NFT sector’s sensitivity to wider crypto volatility. With the market dropping sharply on Friday, NFT flooring costs adopted go well with as liquidity dried up and speculative demand went down.

Complete NFT market capitalization chart. Supply: CoinGecko

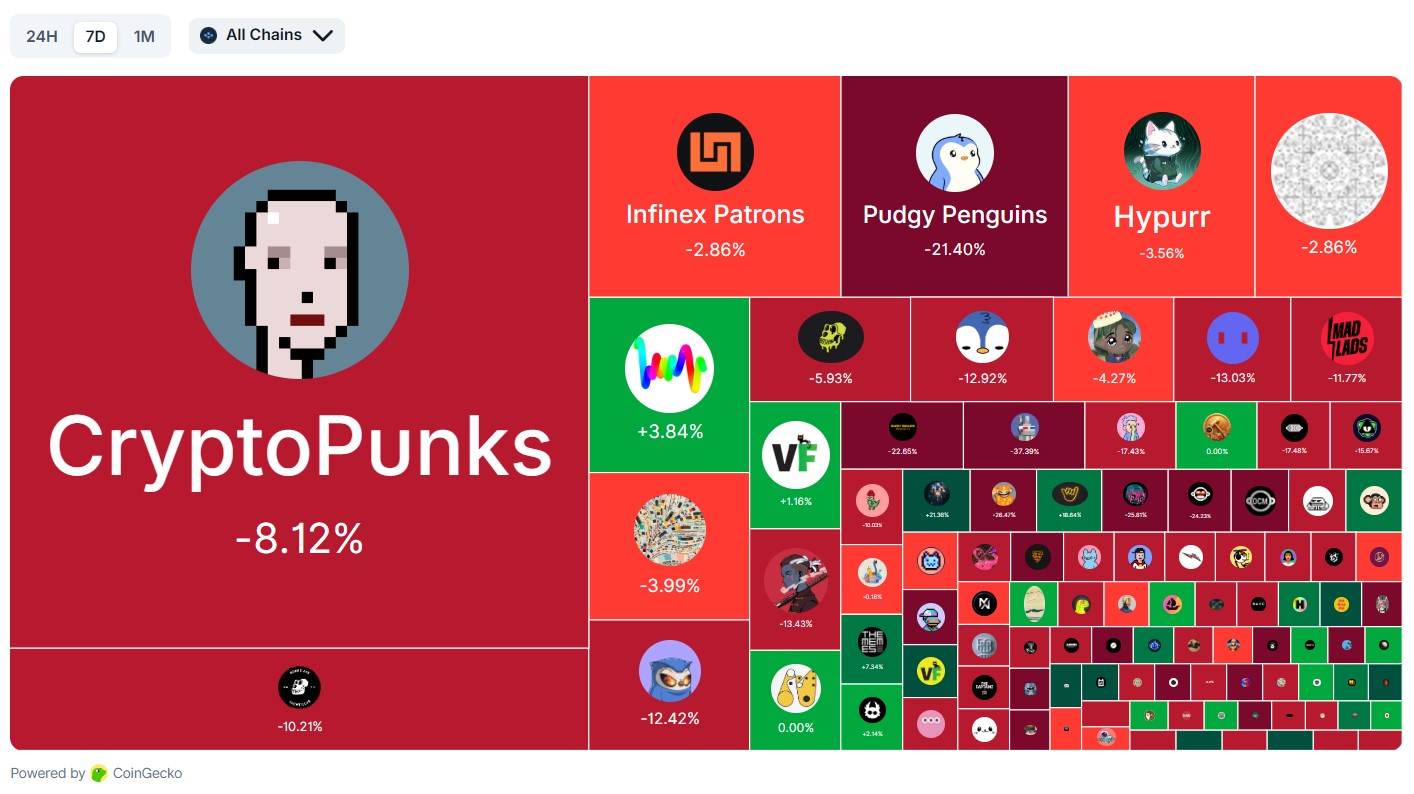

Prime NFT collections stay within the crimson

Regardless of the partial restoration, many high NFT collections are down over seven- and 30-day intervals.

Prime Ethereum-based initiatives, such because the Bored Ape Yacht Membership (BAYC) and Pudgy Penguins, are nonetheless down 10.2% and 21.4%, respectively, over the previous week. Collections like Infinex Patrons and Fidenza by Tyler Hobbs recorded double-digit losses on the month-to-month charts.

CryptoPunks, the highest NFT assortment by market capitalization, is down by 8% on the weekly charts and almost 5% on the 30-day NFT efficiency chart.

Whereas a lot of the high 10 NFTs are down, some collections confirmed a slight restoration on the 24-hour charts. This contains Hyperliquid’s Hypurr NFTs, which posted a 2.8% achieve within the final 24 hours, and the Mutant Ape Yacht Membership (MAYC) assortment, which posted a 1.5% achieve.

The slight restoration hints that, regardless of the crash, patrons could also be selectively returning to the market.

Seven-day NFT assortment heatmap. Supply: CoinGecko

Associated: Decide tosses lawsuit in opposition to Yuga Labs over failure to fulfill Howey take a look at

Crypto merchandise recuperate after Friday market crash

On Friday, Bitcoin plunged to $102,000 within the Binance perpetual futures pair as US President Donald Trump introduced a 100% tariff on China because the nation tried to put export restrictions on uncommon earth minerals.

Because the markets crashed, the sector noticed liquidations of as much as $20 billion, outpacing earlier crypto market crashes, together with the FTX collapse.

CoinGecko knowledge confirmed that the general crypto market capitalization dropped from $4.24 trillion on Friday to $3.78 trillion on Sunday, a virtually $460 billion wipeout in two days.

The market recovered to a valuation of $4 trillion on Monday. On the time of writing, crypto markets are valued at $3.94 trillion.

Regardless of the market crash, crypto funding merchandise attracted billions in inflows.

On Monday, CoinShares reported that crypto exchange-traded merchandise (ETPs) noticed $3.17 billion in inflows final week regardless of the flash crash on Friday. This highlights the funds’ resilience to market panic attributable to the liquidations and the sell-off.

Journal: Digital artwork will ‘age like tremendous wine’: Inside Flamingo DAO’s 9-figure NFT assortment