Nobel Prize-winning economist, Jean Tirole, warns retail buyers of the hidden dangers behind viewing stablecoins as “protected belongings” contemplating it nonetheless has inadequate supervision.

Abstract

- Nobel Prize winner Jean Tirole warns that buyers could gravitate in direction of riskier belongings if U.S. authorities bonds fail to carry out effectively.

- Stablecoin market cap rose by $16 billion previously month to $280 billion, based on information from McKinsey.

In an interview with Monetary Instances, 2014 Nobel laureate Jean Tirole warned retail buyers that stablecoins might push governments into multibillion-dollar bailouts if the tokens pegged to fiat currencies find yourself unraveling sooner or later.

“Whether it is held by retail or institutional depositors who thought it was a wonderfully protected deposit, then the federal government shall be underneath loads of stress to rescue the depositors in order that they don’t lose their cash,” he mentioned.

Tirole, a professor on the Toulouse Faculty of Economics, warned that as stablecoins are backed by fiat-based belongings similar to US authorities bonds, they might find yourself changing into unpopular as a result of the underlying belongings’ provides comparatively low yields. The Nobel-prize winner introduced up earlier situations the place the returns have been “unfavourable for a lot of years” and payouts after inflation have been even decrease.

Learn extra: Japan’s 40Y Bond Yield nears all-time excessive, right here’s the way it impacts the crypto market

Stablecoins are at present dominating the monetary programs as extra governments gravitate in direction of stablecoin laws, particularly international locations like america with the Genius Act and Hong Kong with its Stablecoin Ordinance issuers’ license. They’re anticipated to realize additional recognition as extra governments and establishments are leaping on the bandwagon.

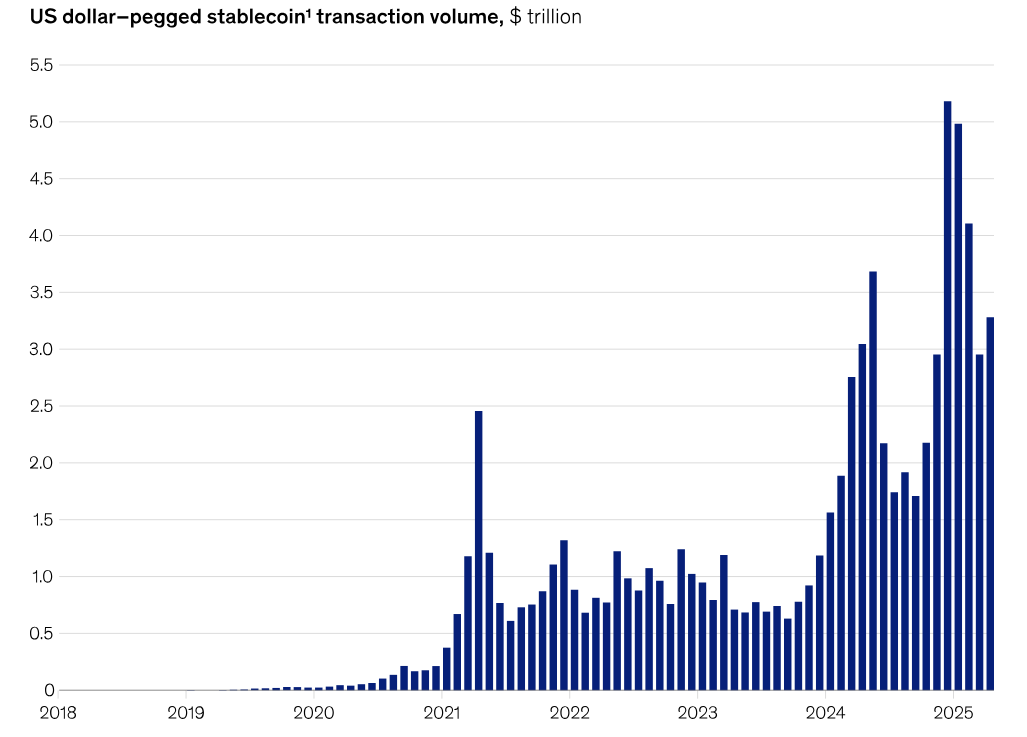

Stablecoin transaction quantity for U.S.-pegged tokens | Supply: McKinsey

In accordance with a McKinsey report, the stablecoin market cap not too long ago hit an all-time excessive of $280 billion. The worth elevated by $16 billion previously month alone, with Tether (USDT) main the cost with 60% of the market cap share.

The stablecoin market is predicted to surpass $400 billion by the tip of 2025 and increase as excessive as $2 trillion by the point 2028 rolls round.

Nobel Prize winner worries about reserve asset supervision

Nobel laureate Jean Tirole mentioned that he was “very, very apprehensive” in regards to the supervision relating to stablecoins and the dangers of depositors occurring a run if buyers start to doubt the underlying belongings that stablecoins are pegged to.

Though they’re now regarded by customers as “completely protected deposits,” Tirole believes that stablecoins might set off losses and a potential government-led bailouts. He warned that stablecoin issuers might be drawn to investing in different belongings which might be riskier and provide larger return.

He acknowledged that larger dangers might improve the probabilities of stablecoin’s reserve asset shedding worth and triggering a run on the asset. On this case, he predicted that “the worth of the stablecoins may [also] go down,” as they misplaced their peg to a sovereign foreign money.

Nevertheless, such dangers might be mitigated if international supervisors are in a position to correctly regulate digital tokens to ensure the collapse doesn’t occur. Although, Tirole mentioned that to ensure that america to deal with this downside, they need to put aside private monetary stakes in cryptocurrency.

“Some key members of the [U.S.] administration . . . have a private monetary curiosity in [cryptocurrency]. And past the non-public curiosity, there’s ideology,” mentioned Tirole, presumably referring to the Trump household’s numerous crypto-related initiatives, together with Trump Media’s crypto-backed ETFs and World Liberty Financials’ USD1.

You may additionally like: Trump’s World Liberty Monetary desires to construct a ‘strategic’ token reserve: report