For the second time this month, Binance has recorded an inflow of stablecoins surpassing $1.5B in addition to giant outflows of Ethereum. Each outcomes replicate investor confidence that coincides with bullish BTC worth motion.

The big influx of stablecoins on Binance coincides with aggressive ETH withdrawals, hinting at an thrilling future for crypto.

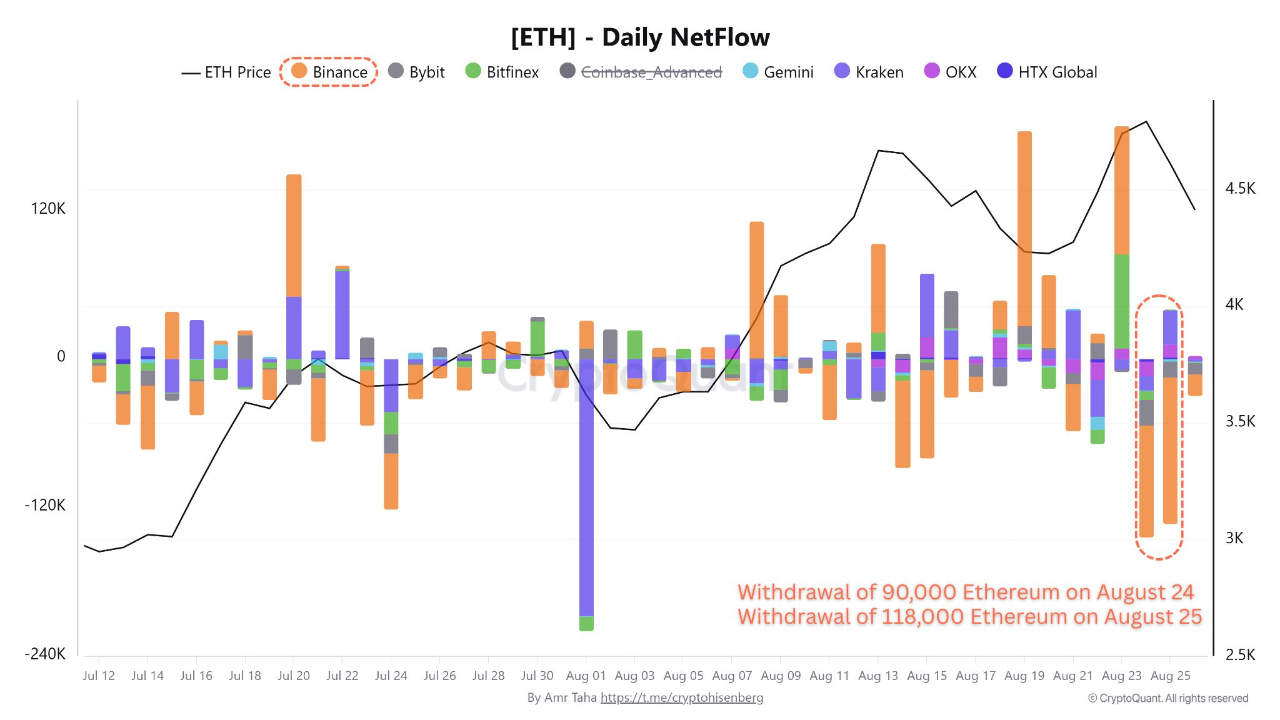

ETH every day influx chart. Supply: CryptoQuant

Nevertheless, analysts have additionally famous that Bitcoin’s Taker Purchase Promote Ratio indicator, adjusted with a 30-day transferring common, only recently reached its lowest stage since November 2021, a time marked by the historic peak of the earlier cycle.

Binance sees motion forward of recent market push

In keeping with latest on-chain information, Binance has seen a $1.65B stablecoin surge simply as Ethereum withdrawals from the alternate close to $1B.

It’s the second time in August that stablecoin deposits on the alternate have surpassed the $1.5B threshold, and it’s proof that new capital is getting into the spot market.

In parallel, Binance additionally witnessed two consecutive days of large Ethereum outflows, with the primary, which was on August 24, seeing as much as 90,000 ETH withdrawn, whereas the second, from August 25, noticed 118,000 ETH withdrawn.

Traditionally, giant withdrawals of ETH had been noticed when traders had been transferring property to chilly wallets for long-term holding, decreasing accessible alternate provide. Prior to now, such strikes proved that Ethereum traders have change into extra bullish and could also be shifting their property to long-term storage, akin to chilly wallets, to cut back publicity to short-term market volatility

Within the coming days, this might translate into diminished alternate reserves as much less ETH will likely be accessible in circulation for rapid promoting.

Giant inflows of stablecoins to identify exchanges like Binance additionally replicate bullish investor motion, because it alerts their readiness to deploy liquidity into crypto markets.

Binance Taker Purchase Promote Ratio reaches its lowest since November 2021

Binance’s Taker Purchase Promote Ratio chart. Supply: CryptoQuant

The Taker Purchase Promote Ratio measures the connection between purchase and promote orders on the market worth (takers). If the index stays above 1, it signifies larger shopping for stress, however whether it is beneath 1, promoting stress prevails.

At the moment, the indicator’s worth is beneath its historic common, which means gross sales have constantly outpaced shopping for. Which means that the market is responding to Bitcoin’s latest appreciation with pessimism and warning.

The information is taken into account very related as a result of the final related stage was noticed on the peak of November 2021, when Bitcoin reached the $69,000 vary earlier than getting trapped in a protracted interval of correction. The present promoting stress, due to this fact, may be in comparison with the one recorded at that essential second within the cycle.

This conduct means that traders will not be joking with taking earnings or decreasing market publicity danger, reflecting a notion that the market could also be overextended. It displays a mismatch between worth and sentiment, a warning signal which will precede phases of larger volatility.

Briefly, what the Taker Purchase Promote Ratio is saying is that the market is in a zone of consideration and that rising promoting stress is proof there are weaknesses within the bullish worth construction that shouldn’t be ignored.

Need your venture in entrance of crypto’s high minds? Characteristic it in our subsequent business report, the place information meets influence.