Bitcoin fell beneath $100,000 on Sunday following U.S. affirmation of involvement within the Israel-Iran battle, as derivatives information reveals merchants are closely positioned for additional volatility.

Bitcoin Choices Open Curiosity Hits $51B Amid Geopolitical Jitters

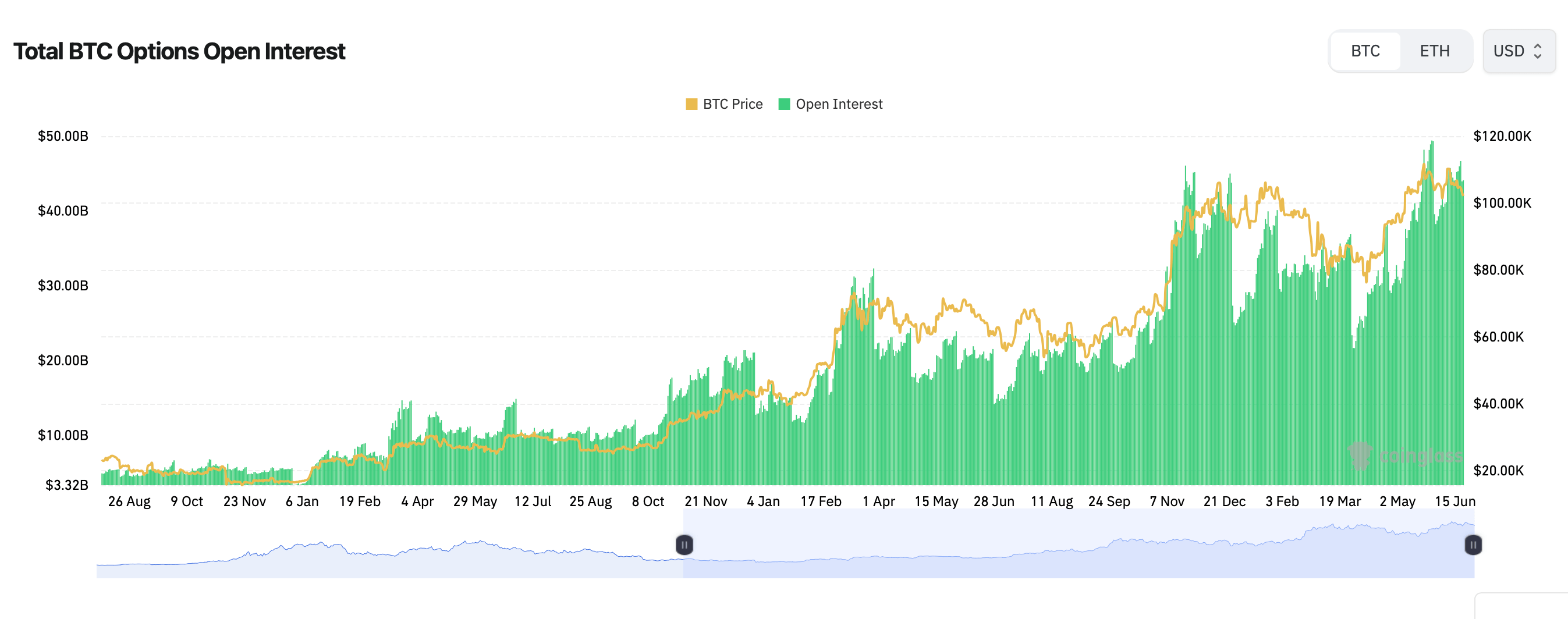

Open curiosity in bitcoin (BTC) choices is now hovering round $51 billion, in keeping with Coinglass information, whereas ethereum ( ETH) open curiosity trails behind at roughly $17 billion. This important divergence highlights the intensified concentrate on bitcoin amid heightened geopolitical tensions.

Primarily, open curiosity displays the overall worth of excellent choices contracts and is usually used to gauge market participation and sentiment. On Deribit, name choices stay dominant within the open curiosity for each bitcoin and ethereum. Roughly 59.73% of bitcoin choice contracts are calls, in comparison with 40.27% places.

For ether, calls make up a fair bigger share, at 67.39% versus 32.61% places. Bears at present reign in ETH derivatives markets. Nevertheless, the 24-hour buying and selling quantity paints a extra balanced image. For bitcoin, name quantity stands at 24,168 BTC whereas put quantity is barely increased at 24,780 BTC.

Ethereum buying and selling exercise reveals a slight desire for bets that its value will rise, with 53.06% of quantity going to these contracts. Probably the most actively traded bitcoin contract is a wager that BTC will drop by June 27, with over 2,000 BTC tied to that place. The amount is tied to the expectation that BTC will fall to $95,000 or decrease by that day.

One other common commerce is a wager that bitcoin will climb to $105,000 by July 11. For ethereum, the busiest choices are these speculating it might fall to $2,100, $2,200, and even $2,000 by June 27—signaling that some merchants are getting ready for short-term draw back.

Regardless of heavy curiosity in draw back safety, particularly for near-dated expiries, the heavier tilt towards calls in open curiosity implies longer-term optimism stays intact. Crypto merchants look like bracing for extra short-term turbulence whereas nonetheless eyeing upside potential later this yr.