Crypto funding agency Pantera Capital says the utility token of 1 layer-1 blockchain possesses large upside potential amid low adoption by institutional buyers relative to Bitcoin (BTC) and Ethereum (ETH).

Pantera Capital says Solana (SOL) is “subsequent in line” for its “institutional second” forward of the potential approval of a spot Solana exchange-traded fund (ETF) within the fourth quarter of this 12 months.

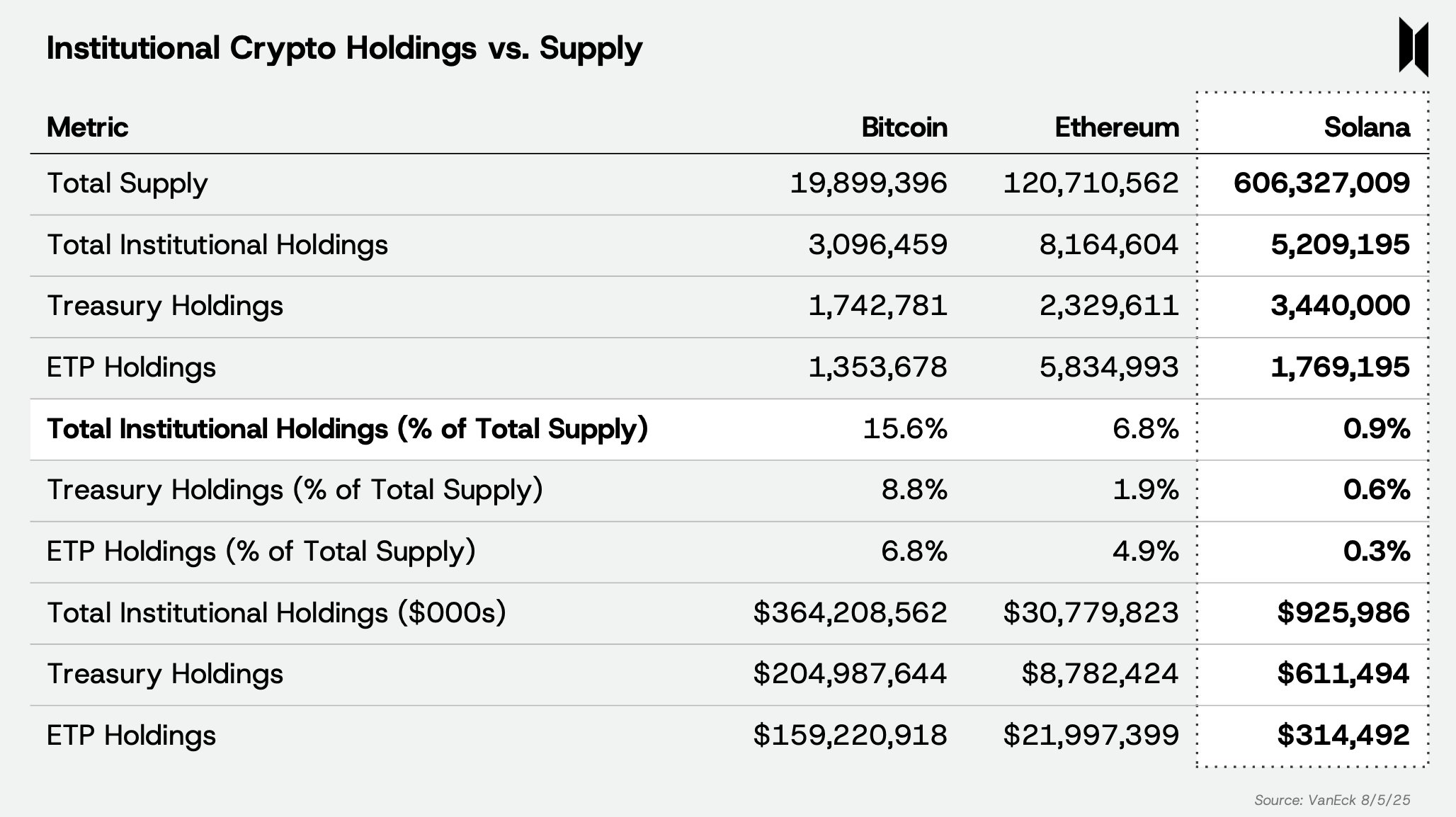

“Establishments are at present under-allocated to SOL relative to BTC and ETH, holding lower than 1% of the overall provide – in comparison with 16% of BTC and seven% of ETH.

With a Solana ETF approval anticipated as early as This autumn 2025, we imagine Solana is subsequent in line for its ‘institutional second.’”

Supply: Pantera Capital/X

Pantera Capital additional says,

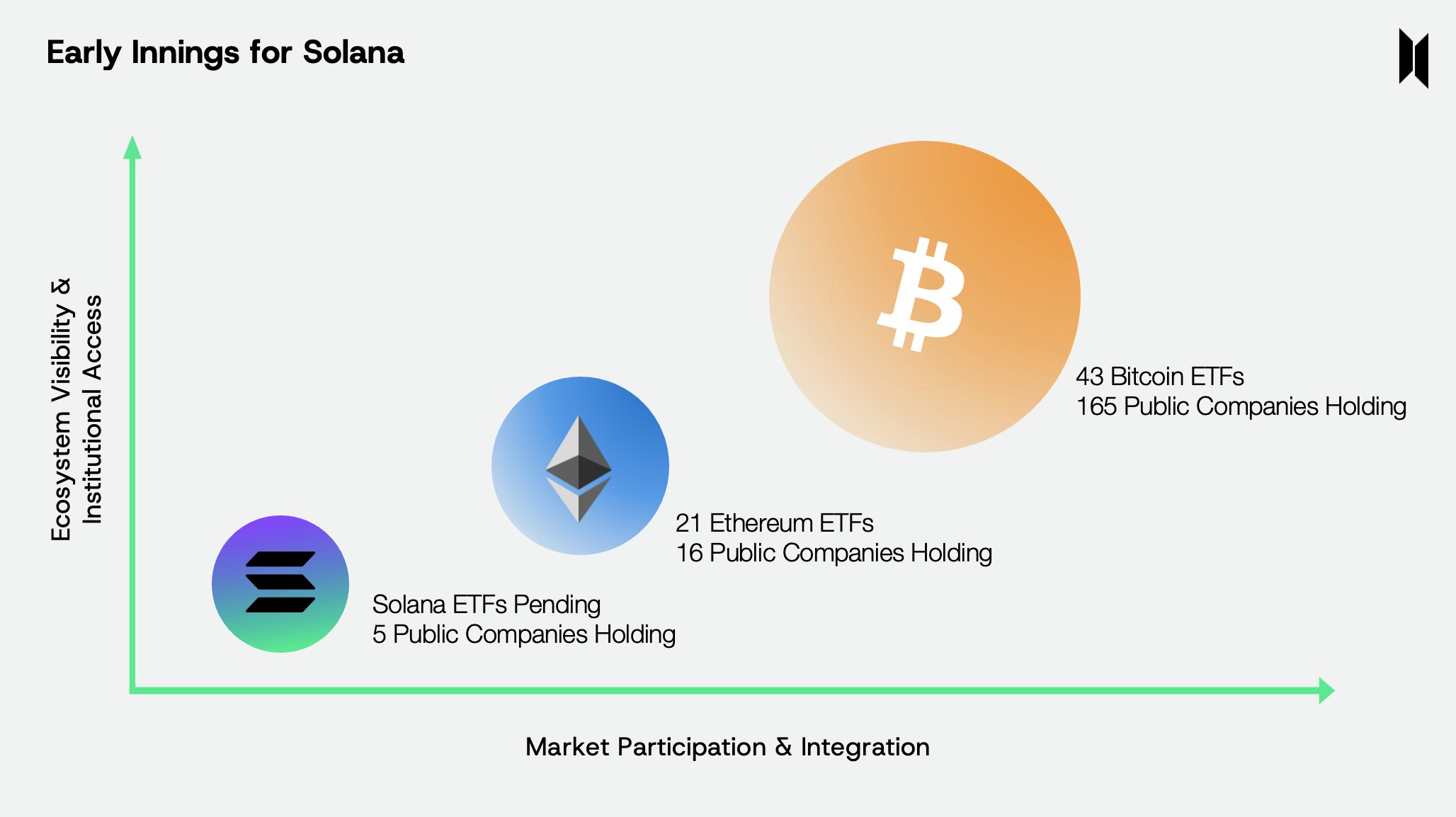

“The ETF launches accelerated institutional adoption of BTC and ETH.

43 Bitcoin ETFs. 165 public corporations maintain BTC.

21 Ethereum ETFs. 16 public corporations maintain ETH.

Solana continues to be in its early days:

0 Solana ETFs. 5 public corporations maintain SOL.”

Supply: Pantera Capital/X

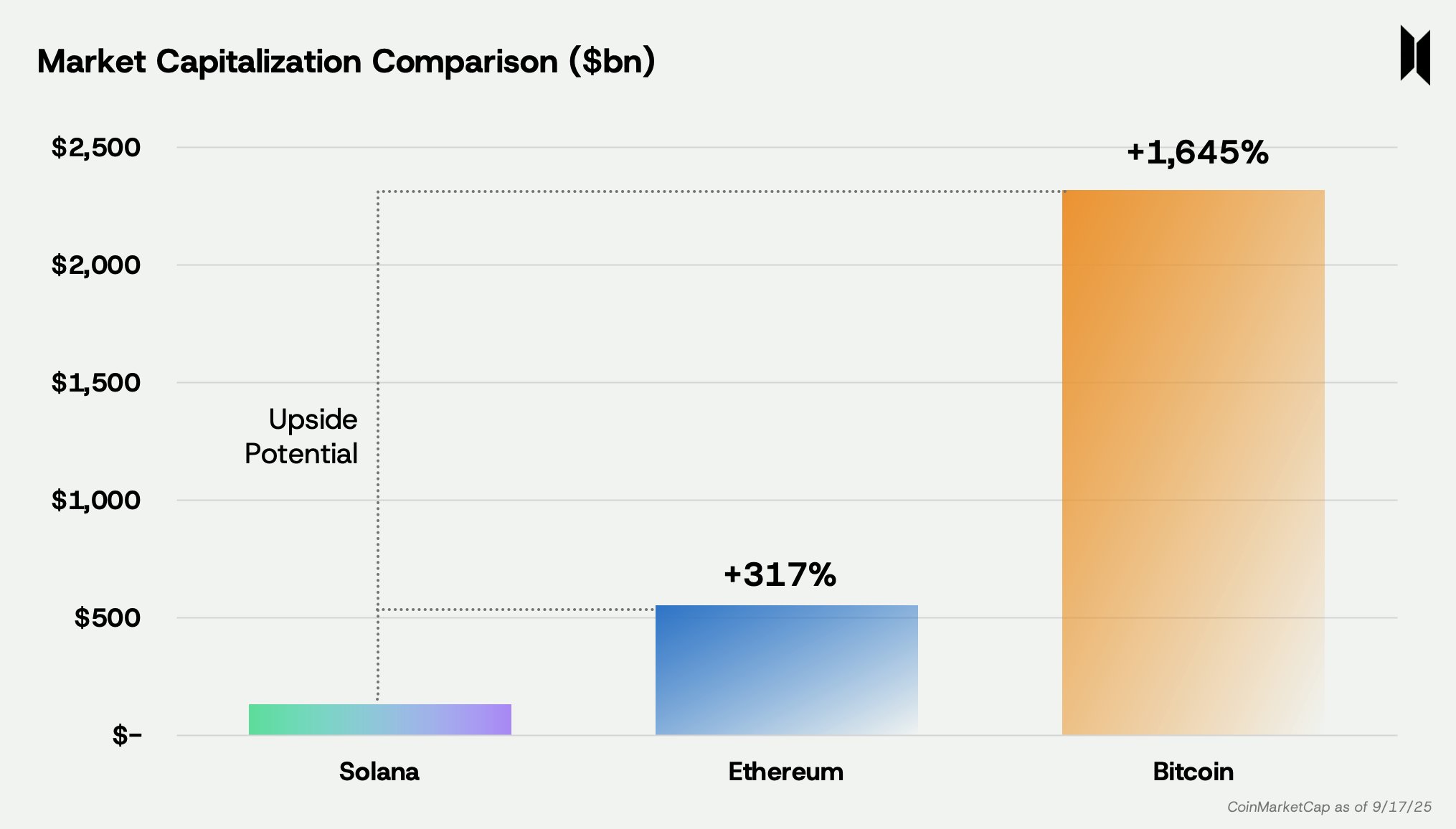

Pantera Capital additionally says that blue-chip corporations corresponding to PayPal and Stripe are starting to construct on Solana. And regardless of having fun with larger utilization metrics in comparison with the 2 largest crypto property by market cap, the market cap of Solana is 1 / 4 of Ethereum’s and 1/twentieth of Bitcoin’s, in keeping with Pantera Capital.

Earlier this week, Helius Medical Applied sciences, a Pantera Capital-backed digital asset treasury agency, raised greater than $500 million with the intention of utilizing the proceeds to amass Solana. Helius Medical Applied sciences intends to have Solana as its main treasury reserve asset.

At time of writing, Solana is price $238.

Generated Picture: Midjourney