Ethereum is buying and selling close to $4.3K, testing important helps inside its long-term ascending channel. The market now sits at a pivotal juncture, with upcoming classes prone to decide whether or not ETH stabilises for an additional push greater or slips right into a deeper retracement.

Technical Evaluation

By Shayan

The Day by day Chart

On the every day chart, Ethereum stays inside its ascending channel, but momentum has begun to weaken. The RSI has shaped a bearish divergence in opposition to the value: whereas ETH posted greater highs, the RSI recorded decrease highs, signalling fading bullish energy.

The value motion is at present urgent in opposition to the channel’s mid-support round $4,200, a stage that has repeatedly acted as a decisive demand zone. If the bulls maintain this space, Ethereum retains the technical setup to problem the $5K area within the medium time period. A breakdown, nonetheless, would expose the $3.8K channel backside, opening the best way for a deeper correction.

The 4-Hour Chart

On the 4-hour timeframe, short-term weak point is extra obvious. The ascending yellow trendline that guided ETH’s rally has been damaged, confirming that consumers have misplaced grip on momentum. Since then, the asset has consolidated in a good vary, with the damaged trendline capping strikes to the upside and the channel’s midline offering assist beneath.

This compression part usually precedes a decisive transfer. Until ETH can reclaim $4.5K with conviction, the bias leans to the draw back, with the $4.2K assist remaining the important thing stage to defend.

Sentiment Evaluation

By Shayan

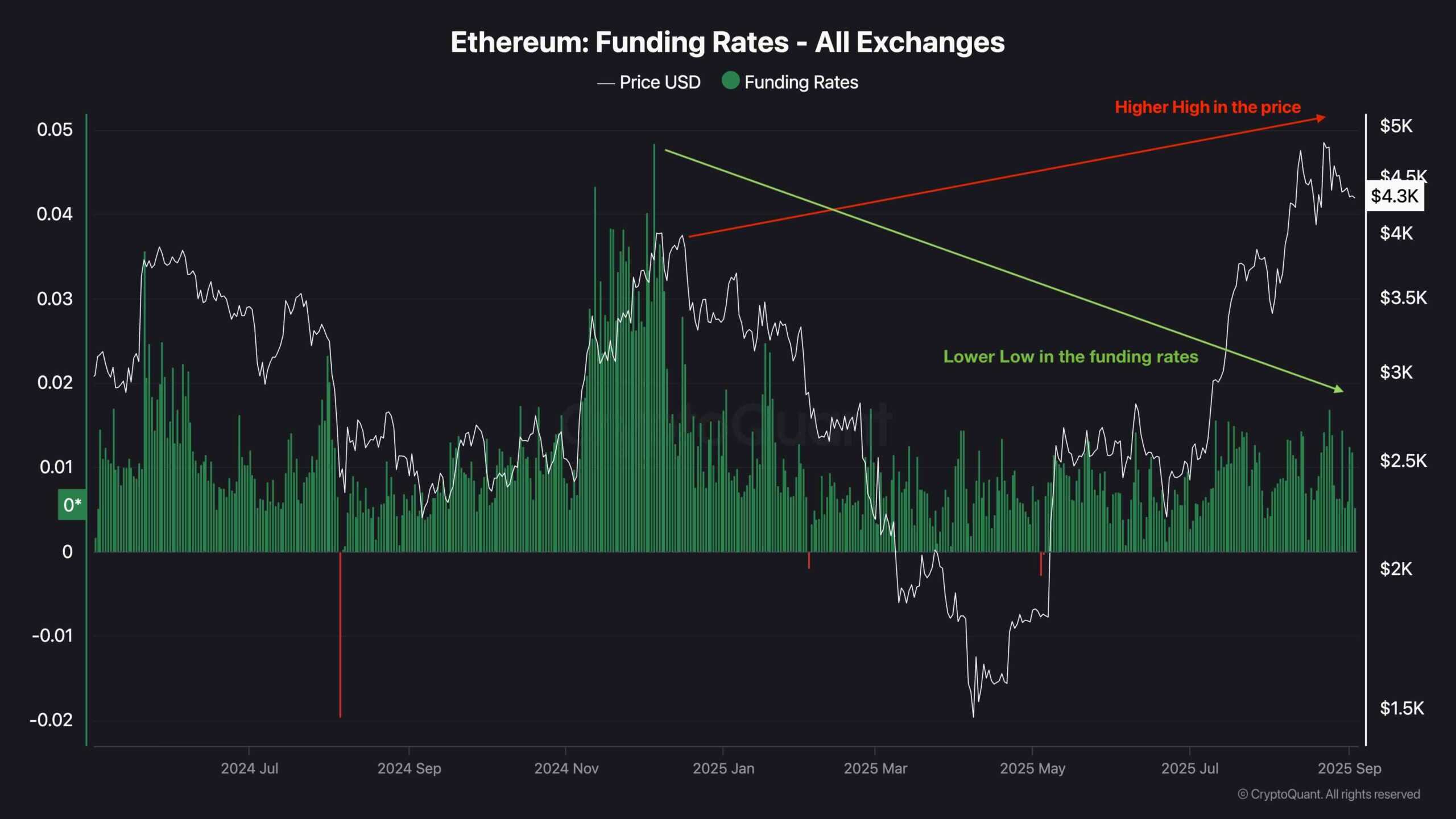

Funding charges throughout exchanges are exhibiting a transparent divergence from Ethereum’s value motion. Whereas ETH pushed to the next excessive close to $4.9K, funding charges peaked a lot decrease than they did within the earlier cycle, when Ether was buying and selling nearer to $4K.

This sample, a decrease excessive in funding charges in opposition to the next excessive in value, signifies that merchants are much less prepared to open aggressive leveraged lengthy positions whilst Ethereum units new highs. Such behaviour suggests waning speculative enthusiasm within the derivatives market, regardless of spot value energy.

Traditionally, these divergences have usually preceded exhaustion in bullish momentum, adopted by durations of sideways consolidation or corrective pullbacks. Until speculative demand revives, this sign reinforces warning within the quick time period, even because the broader bullish construction stays intact.