Main public mining firms are aggressively elevating billions of {dollars} by means of convertible bonds, the most important capital push since 2021.

This might mark a turning level towards AI growth, but in addition carries the danger of fairness dilution and mounting debt stress if income fail to speed up.

A New Wave of Massive-Scale Debt Issuance

The yr 2025 marks a transparent shift in how Bitcoin miners elevate capital. Bitfarms lately introduced a $500 million providing of convertible senior notes due 2031. TeraWulf proposed a $3.2 billion senior secured observe issuance to broaden its knowledge heart operations.

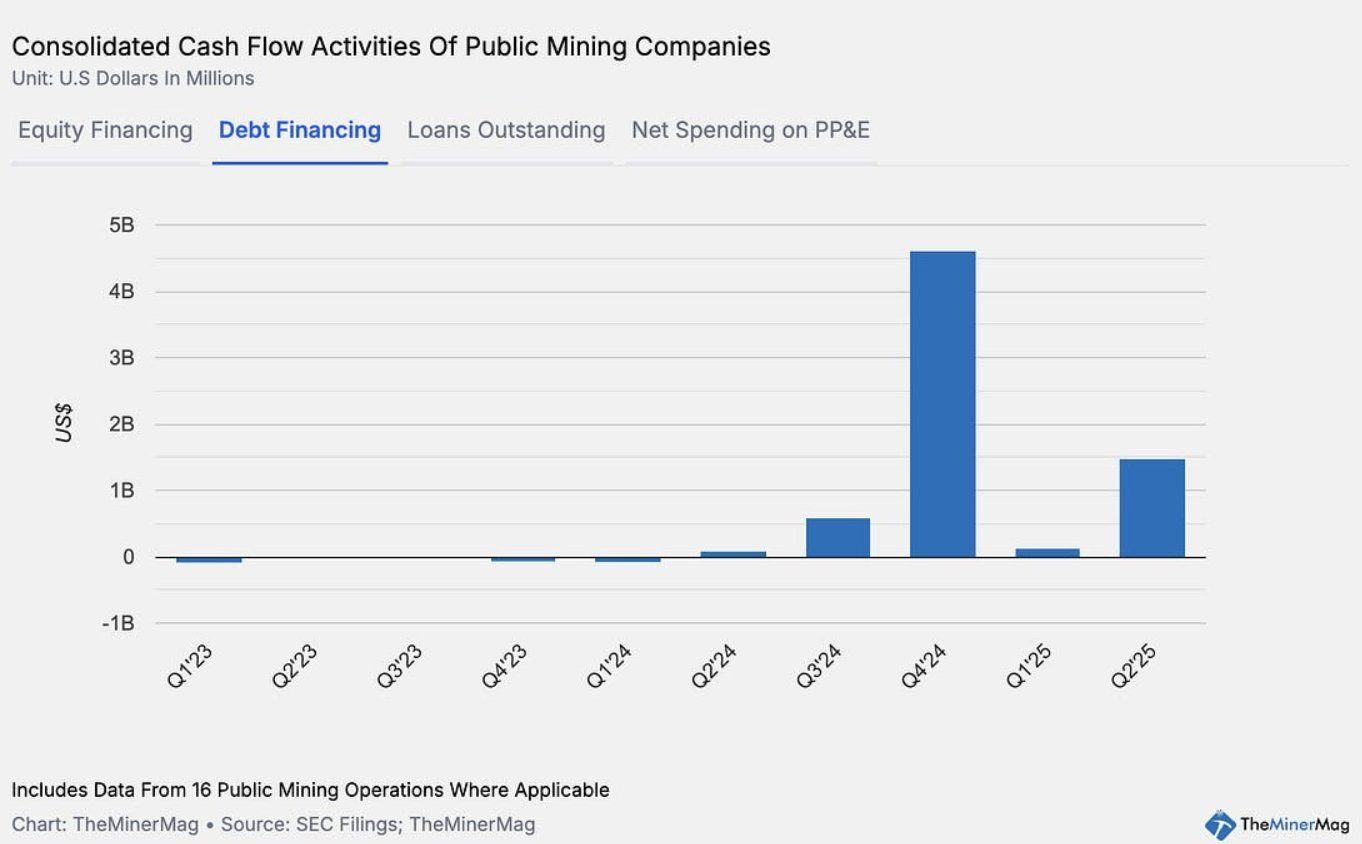

In keeping with TheMinerMag, the entire worth of convertible and debt observe issuances from 15 public mining firms reached a report $4.6 billion in This autumn 2024. That determine fell under $200 million in early 2025 earlier than surging once more to $1.5 billion in Q2.

Consolidated money stream actions of public mining firms. Supply: TheMinerMag

This capital technique mirrors what MicroStrategy has accomplished efficiently lately. Nevertheless, at present’s debt mannequin essentially differs from the 2021 cycle within the mining business. Again then, ASIC mining rigs had been typically used as collateral for loans.

Public mining firms more and more flip to convertible notes as a extra versatile strategy to financing. This technique shifts monetary danger from gear repossession to potential fairness dilution.

Whereas this provides firms extra respiration room to function and broaden, it additionally calls for stronger efficiency and income progress to keep away from weakening shareholder worth.

Alternatives and Dangers

If miners pivot towards new enterprise fashions, akin to constructing HPC/AI infrastructure, providing cloud computing companies, or leasing hash energy, these capital inflows might develop into a robust progress lever.

Diversifying into knowledge companies guarantees longer-term stability than pure Bitcoin mining.

As an illustration, Bitfarms has secured a $300 million mortgage from Macquarie to fund HPC infrastructure at its Panther Creek undertaking. Ought to AI/HPC revenues show sustainable, this financing mannequin may very well be much more resilient than the ASIC-lien construction utilized in 2021.

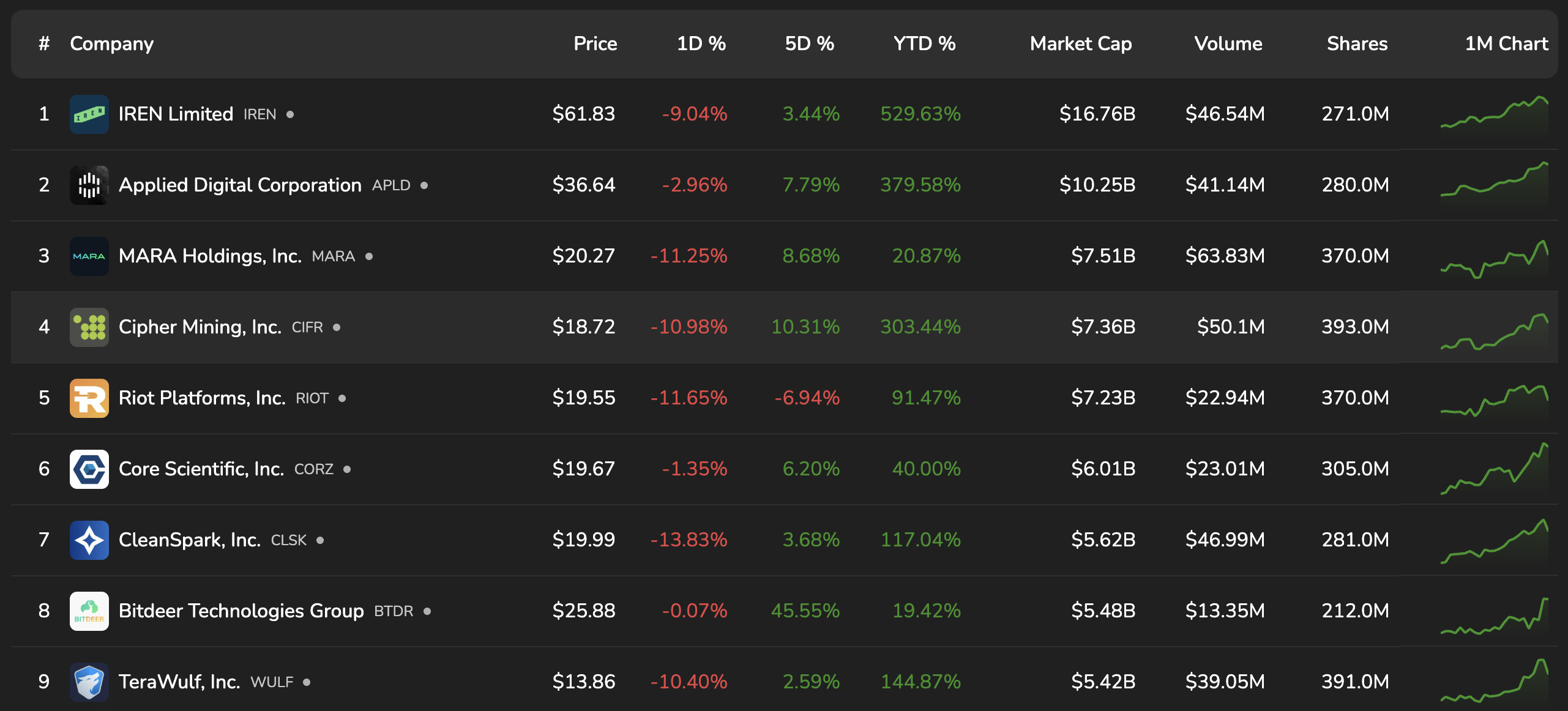

The market has seen a optimistic response from mining shares when firms announce debt issuances, with inventory costs rallying because the growth and progress narrative is emphasised. Nevertheless, there are dangers if expectations aren’t met.

Shares of mining firms. Supply: bitcoinminingstock

Suppose the sector fails to generate further revenue to offset financing and growth prices. In that case, fairness buyers will bear the brunt by means of heavy dilution — as an alternative of apparatus repossession as in earlier cycles.

This comes when Bitcoin’s mining problem has reached an all-time excessive, reducing into miners’ margins, whereas mining efficiency throughout main firms has been trending downward in latest months.

Briefly, the mining business is as soon as once more testing the boundaries of economic engineering — balancing between innovation and danger — because it seeks to rework from energy-intensive mining to>Public Mining Firms Increase Billions in Debt to Fund AI Pivot appeared first on BeInCrypto.