Asset supervisor Franklin Templeton has secured approval from the Financial Authority of Singapore to launch its tokenized Franklin OnChain US Greenback Brief-Time period Cash Market Fund. With the transfer, it grew to become the primary tokenized fund open to all traders in Singapore.

In accordance with studies, the fund is just like the Luxembourg-registered Franklin Templeton cash market fund, which exposes traders to short-term securities and authorities cash market devices. That fund presently has $1.76 billion in whole internet property, with the online asset worth (NAV) being $9.81.

A breakdown of its portfolio additionally exhibits that the majority of its investments (52%) are allotted to property with greater than 30 days of maturity. The remainder have maturity dates various between someday and 30 days.

Apparently, 92.38% of the Luxembourg fund allocation is in money or money equivalents. The remaining is split amongst securities of a number of industrial banks and different firms. Thus, the Singapore fund can also be anticipated to have an analogous technique and construction.

In the meantime, media studies declare that the Singapore fund is structured beneath Franklin Templeton Investments Variable Capital Firm (VCC), and a blockchain-integrated switch company platform from the agency will deal with the issuance of shares.

Talking on the event, Franklin Templeton’s head of APAC, Tariq Ahmed, described it as a milestone second that exhibits how the corporate is leveraging blockchain expertise to make funding alternatives obtainable.

Ahmed stated:

“The brand new fund marks a major milestone in our dedication to harnessing the facility of blockchain expertise to decrease the boundaries to investing and ship transformative merchandise for traders in Asia-Pacific.”

That is evident within the minimal funding quantity for traders being $20, a really low barrier of entry in comparison with different cash market funds. The low funding threshold signifies the agency launching the product for retail traders.

Tokenization market continues to develop with new merchandise and gamers

Whereas there isn’t a date but for when the fund will launch in Singapore, the transfer by Franklin Templeton highlights the expansion of real-world property (RWA) tokenization. The agency is already one of many largest gamers within the rising market, with its tokenized US treasury product BENJI having nearly $750 million in market cap.

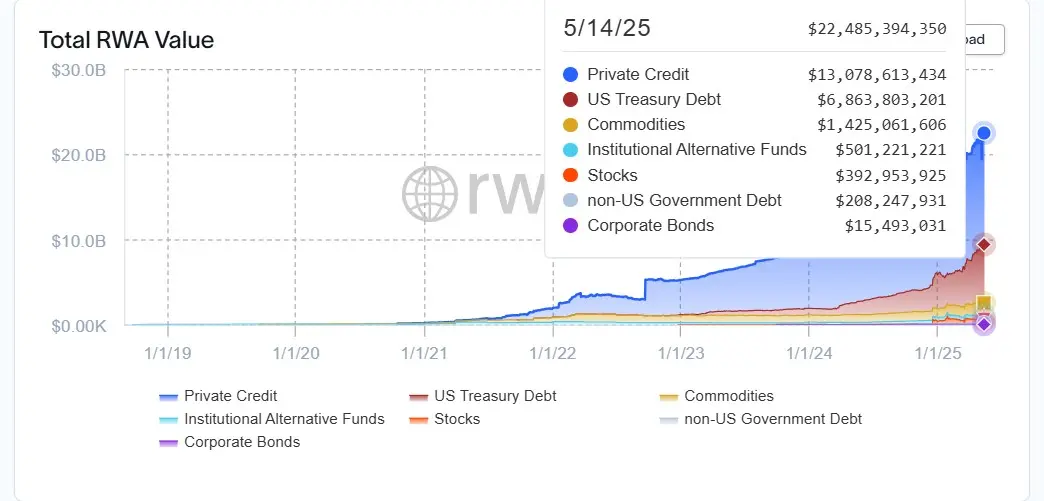

Apparently, VanEck not too long ago ventured into tokenization with its personal tokenized US Treasury fund, VBILL. Different corporations corresponding to BlackRock, WisdomTree, and Apollo even have tokenized funds. General, the overall worth of on-chain RWA now stands at $22.57 billion, with an 8.33% progress within the final 30 days.

Complete Worth of Belongings in RWA (Supply: RWA.xyz)

In the meantime, the sector’s potential has change into more and more evident to policymakers, doubtless influencing the MAS determination to approve the Franklin Templeton fund. Singapore is likely one of the main nations by way of regulatory readability on monetary improvements, which has allowed it to change into a significant hub for crypto exercise.

Apparently, even US regulators are recognizing the potential influence of tokenization. The brand new chair of the Securities and Alternate Fee (SEC), Paul Atkins, in contrast the tokenization of securities within the monetary sector to the transition from analog to digital audio within the music business.

In a current report, the Federal Reserve of New York additionally recognized tokenization as the way forward for finance. The Venture Pine report, which was carried out in collaboration with the Financial institution of Worldwide Settlements (BIS), discovered that central banks can implement financial insurance policies in a tokenized world.

Ethereum is pushing to take care of dominance within the RWA sector

In the meantime, Ethereum is on the middle of the on-chain RWA ecosystem, with the community holding 58.37% of the market share for RWA worth. Its layer-2 networks, corresponding to ZkSync period, Arbitrum, and Polygon, account for an additional 25% of the worth.

The community is now pushing to take care of that dominance by unveiling a “One Trillion Safety” initiative that may additional strengthen its resilience as extra RWA worth flows to the community. Safety is essential to why many main asset issuers select Ethereum over some other blockchain to launch their tokenized merchandise.

Nevertheless, the competitors for blockchain networks dominating the RWA market will doubtless enhance within the coming years as different networks proceed to scale in the direction of assembly institutional requirements.