Sol Methods, a Canadian inventory exchange-listed firm, has filed with the US SEC to be listed on Nasdaq. The agency goals to commerce beneath the ticker title STKE. Sol Methods has been accumulating Solana (SOL) as a treasury asset. The corporate at the moment holds 420,355 SOL, value round $61.13 million.

Will We See Elevated Solana Buys?

Sol Methods has beforehand ditched its Bitcoin holdings to focus extra on SOL. The newest 40-F submitting with the SEC marks one other milestone for the corporate. The transfer highlights the agency’s rising confidence within the SOL community.

If the SEC approves the 40-F submitting, we might even see a rise in Solana (SOL) publicity for the corporate. The underlying asset will seemingly see a worth bump if issues go in accordance with plan.

Solana (SOL) additionally has a number of spot ETF purposes at the moment awaiting approval with the SEC. In accordance with Bloomberg ETF analyst James Seyffart, there’s a 90% probability that the SEC will approve a spot SOL ETF this yr.

The Asset Continues To Glow Crimson Regardless of Bullish Developments

Solana (SOL) has seen fairly a couple of bullish developments over the previous few days. VanEck lately registered its SOL ETF with the Depository Belief & Clearing Company (DTCC). SOL’s worth doesn’t appear to maneuver regardless of the bullish setting across the asset.

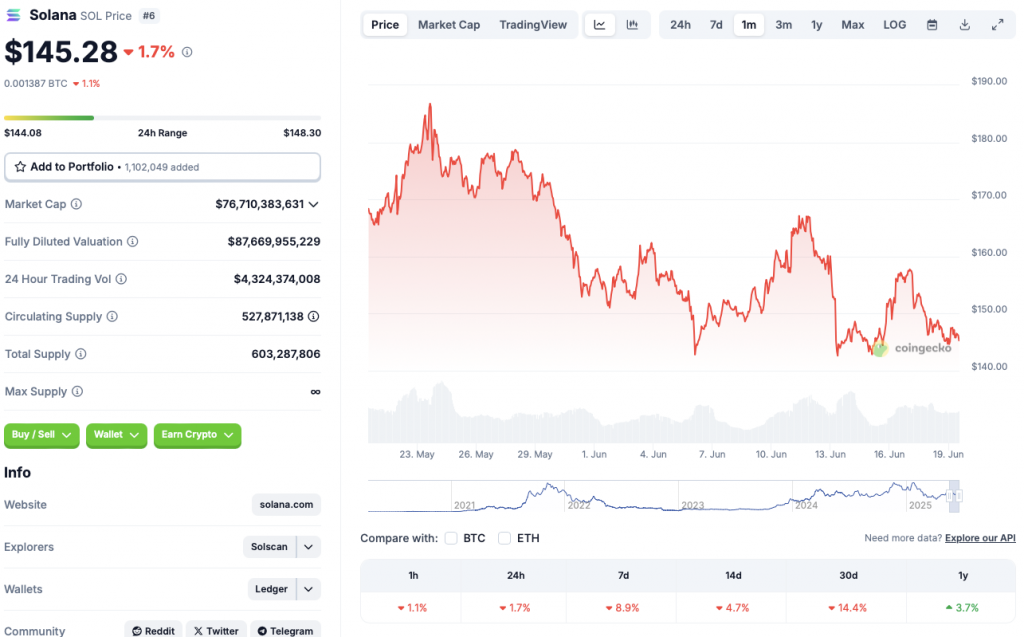

SOL is at the moment struggling to breach the $150 mark. The asset is down 1.7% within the day by day charts, 8.9% within the weekly charts, 4.7% within the 14-day charts, and 14.4% over the earlier month.

Whereas the present dip is regarding, Solana (SOL) has confirmed to be fairly a resilient cryptocurrency over the previous few years. The asset’s worth had fallen to beneath $9 after the collapse of FTX in 2022. Since its 2022 lows, SOL has hit a number of all-time highs. The asset might get better from its present predicament if market sentiment rebounds.