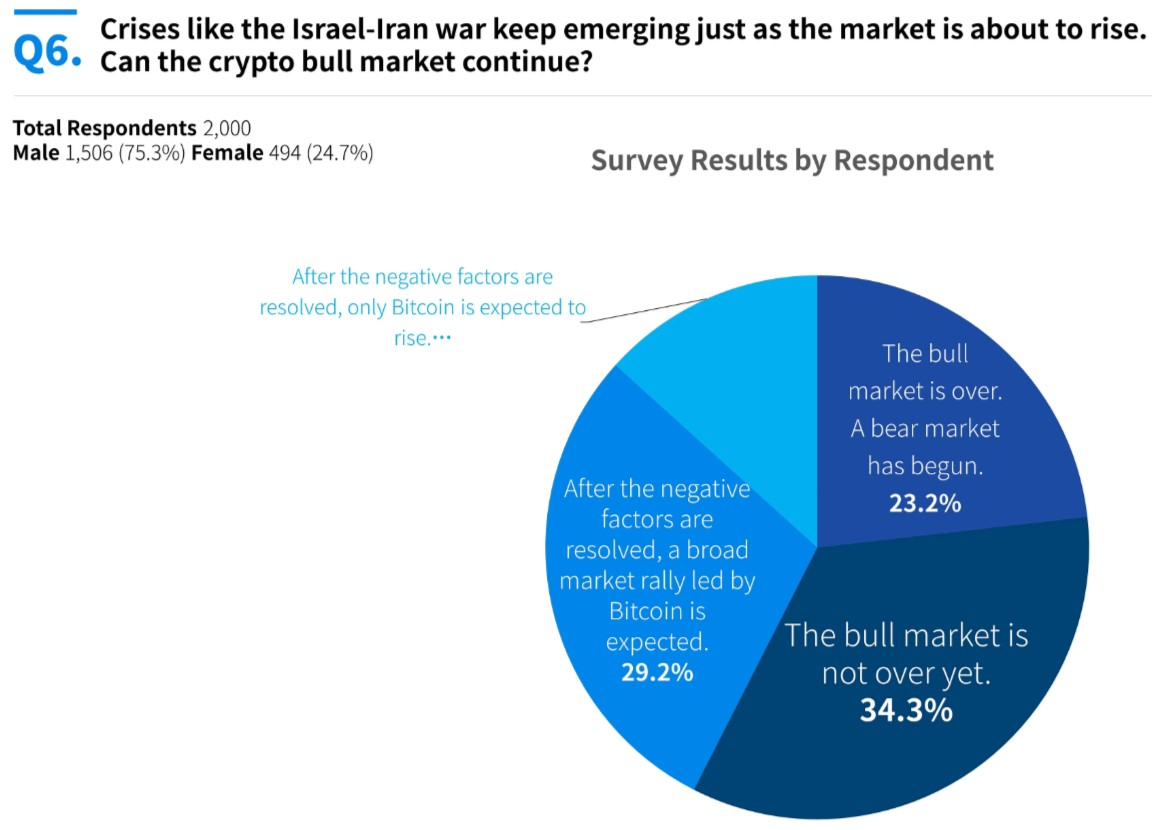

A brand new survey of South Korean crypto buyers reveals a divided however cautiously optimistic outlook in the marketplace, even after a latest worth pullback triggered by the escalating conflict between Israel and Iran. The survey reveals that 34.3% of respondents consider the present crypto bull run will proceed regardless of the geopolitical turmoil.

Supply: Coinness

They consider the most recent pullback in crypto costs is momentary and doesn’t outline the general market development. The survey concerned 2,000 respondents, together with 1,506 males and 494 females.

Associated: Prime Cryptos Decline Massively as Israel-Iran Battle Escalates With the US Involvement

Survey Reveals Divided Outlook on Market Restoration

Though 34.3% of the respondents consider that the bull run shouldn’t be over and the market will resume upwards after the preliminary phases of the conflict, solely 29.2% anticipate a broad market rally to occur.

This class of respondents believes that Bitcoin will lead the rally and different cryptocurrencies will observe.

A Cut up Between Bitcoin and Altcoin Sentiment

In the meantime, 13.3% of Korean crypto buyers who participated within the survey don’t see altcoins recovering from the pullback earlier than sliding right into a bear market. They suppose that solely Bitcoin can provoke a comeback after the most recent pullback.

Associated: Bitcoin Value Prediction: Can BTC Reclaim the $103K Degree After Sharp Rebound?

The remaining 23.2% of survey respondents have given up on the bull run. They consider the consequences of the conflict have plunged cryptocurrencies right into a bear market, and the costs will drop additional sooner or later.

Market Context: Pullback From Current Highs

Bitcoin slid beneath the $100,000 assist stage final Sunday for the primary time for the reason that starting of Might. That marked the pullback’s lowest level for the reason that turnaround that adopted the assaults and counterattacks between Israel and Iran.

The conflict began shortly after a crypto market surge that advised the start of one other rally section. Nevertheless, the present state of affairs leaves buyers questioning whether or not the surge will resume quickly or if the market will succumb to the conflict’s results.

Disclaimer: The data offered on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version shouldn’t be chargeable for any losses incurred because of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.