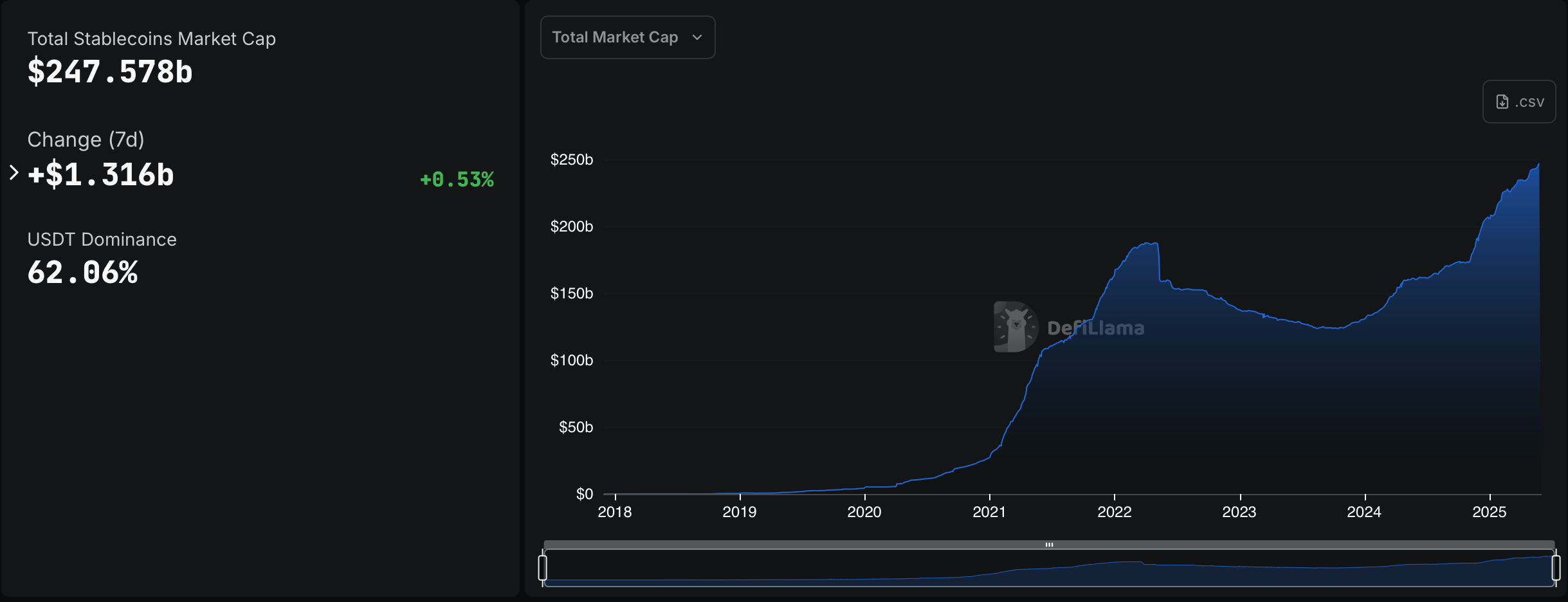

In accordance with present knowledge, the stablecoin market expanded by roughly $1.31 billion over the previous week, lifting the overall market capitalization of fiat-linked digital property to $247.578 billion. This locations the stablecoin sector simply $2.422 billion shy of the $250 billion threshold.

Stablecoin Market Closes in on $250B With Simply $2.42B to Go

The fiat-pegged token economic system continues its upward trajectory and, as of this weekend, stays at its all-time excessive of $247.578 billion, per metrics from defillama.com. Within the span of seven days, it gained $1.31 billion, and since Might 1—a 30-day stretch—it has grown by $5.513 billion. Tether’s USDT leads the pack with a market capitalization of $153.659 billion, representing 62.06% of the stablecoin market’s complete worth.

Stablecoin economic system in line with knowledge collected by defillama.com.

Tether’s market capitalization expanded by 2.9% over the previous 30 days, climbing roughly $4.32 billion. In distinction, Circle’s USDC skilled a modest decline of 1.48%, shedding simply over $909 million throughout the identical interval. As of this weekend, USDC holds a market cap of roughly $60.606 billion. Among the many prime ten stablecoins, the standout performer was First Digital’s FDUSD, which superior 15.94%, including $192 million in worth.

Sky’s DAI and Ethena’s USDe adopted carefully, with month-to-month beneficial properties of 14.44% and 14.78%, respectively—securing the second and third spots among the many prime stablecoin gainers. USDe now instructions a $5.357 billion valuation, whereas DAI trails barely at round $4.712 billion. The main ten stablecoins at current are USDT, USDC, USDe, DAI, USDS, BUIDL, USD1, USDTB, FDUSD, and PYUSD. Exterior of USDC’s modest dip, the one different decline within the group was Sky’s USDS, which fell 15.77% over the previous month.

The shifting steadiness amongst main stablecoins indicators a broader recalibration inside the sector, hinting at evolving market preferences and liquidity methods. As capital allocation continues to fluctuate, these actions might foreshadow deeper modifications in consumer confidence, issuer resilience, and protocol utility. Market individuals will probably watch upcoming traits carefully, looking for indicators amid the quiet recalibrations inside the fiat-pegged token economic system.