In a shocking improvement, 80,000 Bitcoin (BTC), valued at over $8.6 billion, have been moved into new wallets setting a wave of speculations throughout the crypto market. Contributing to this discourse, Conor Grogan, Head of Product at Coinbase has said there’s important chance that this sequence of latest whale transactions could possibly be an precise crypto heist.

Did The Largest Bitcoin Theft Simply Unfold In Silence?

In an X put up on July 4, distinguished analytics agency Arkham Intelligence agency stories {that a} single entity has now transferred 80,000 BTC in equal parts into eight new wallets. On-chain information reveals that these Bitcoin holdings had been initially deposited into their earlier wallets on April 2 and Might 4, 2011, suggesting over 14 years of full dormancy.

As with different main whale transactions, the latest activation of those long-held BTC have alerted market merchants and traders alike particularly amidst the current BTC value struggles. Though, the truth that these transfers didn’t contain exchange-affiliated wallets has helped ease issues of an imminent market sell-off.

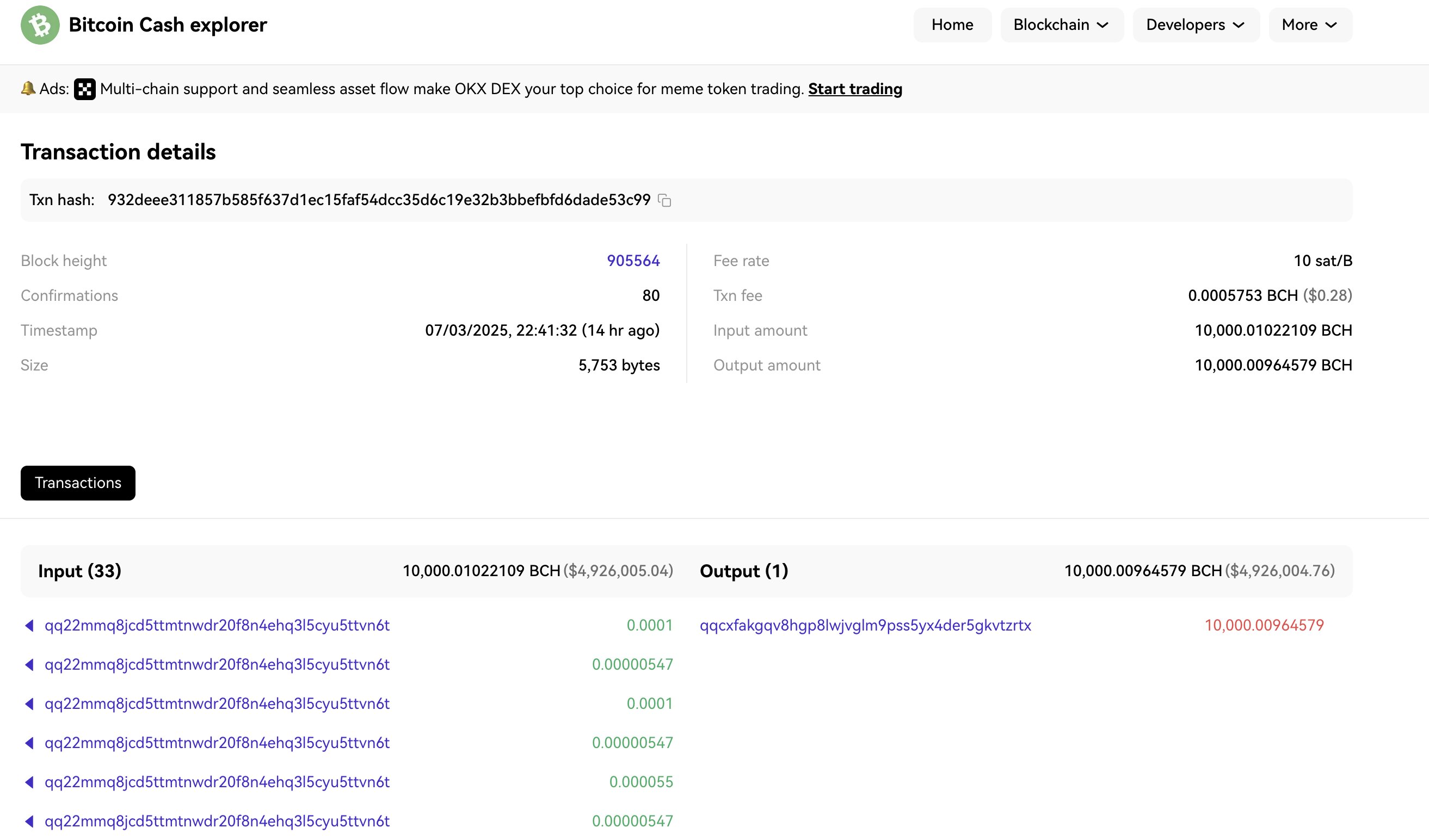

Nevertheless, Conor Grogan has warned these sudden Bitcoin transfers might need been the most important crypto heist in historical past. In explaining this idea, the Coinbase government attracts consideration to a small Bitcoin Money (BCH) transaction from one of many corresponding pockets clusters roughly 14 hours previous to the large Bitcoin actions.

The transaction which is a test-like output of 10,000 BCH valued at roughly $4.9 million was traced on the Bitcoin Money blockchain. Grogan explains the truth that different BCH wallets remained dormant counsel that this explicit BCH switch might need been hackers testing the personal key as BCH transactions at the moment are often tracked by whale monitoring providers.

One other concern highlighted by the Coinbase government is the transfers weren’t automated or exchange-related, however reasonably seemed to be guide transactions, thereby growing suspicions of compromised personal keys. Nonetheless, Grogan retains the place that this idea represents “excessive hypothesis” suggesting the transactions could have certainly been initiated by the pockets’s rightful proprietor.

Notably, a number of crypto analysts and fanatics have pushed again in opposition to Grogan’s narrative, describing the latest 8,000 BTC switch as a “handshake transaction” reasonably than a hack. Specifically an analyst with X username binji identified that the sluggish and deliberate tempo of the transactions appeared inconsistent with the conduct sometimes noticed in hacks, particularly in the event that they had been executed by a single entity.

Bitcoin Worth Overview

On the time of writing, Bitcoin exchanges arms at $108,150 following a 1.06% decline prior to now day. Nevertheless, the main cryptocurrency maintains a optimistic efficiency on bigger time frames as evidenced by features of 0.98% and a pair of.78% on the weekly and month-to-month chart respectively.

Featured picture from Pexels, chart from Tradingview

Editorial Course of for is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our crew of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.