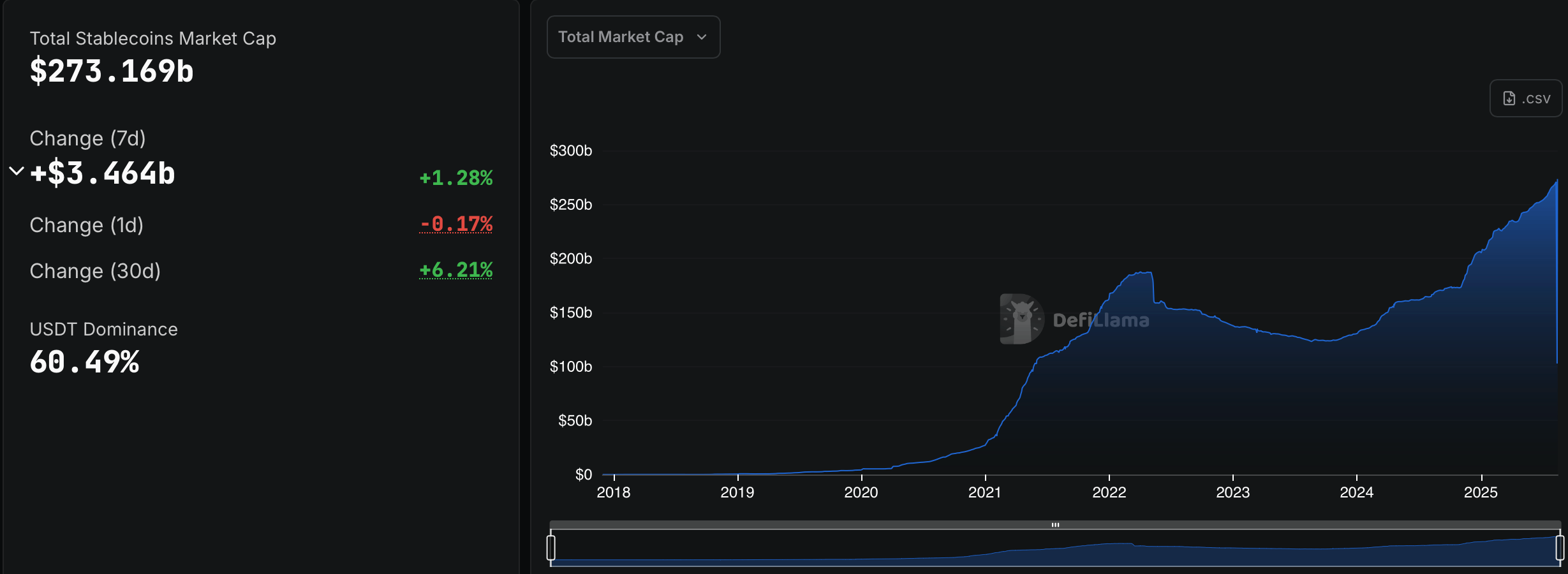

Over the previous week, the stablecoin market expanded by 1.28%, including $3.464 billion to succeed in a complete of $273.169 billion. Tether ( USDT) stays the heavyweight, commanding 60.49% of the complete market, with its provide climbing by roughly 730 million cash in the course of the seven-day interval.

Tether and USDC Add to Market Dominance as Stablecoin Financial system Pushes Greater

Tether (USDT) holds a commanding lead on the stablecoin leaderboard with a hefty $165.25 billion market cap, climbing 0.44% this week and a pair of.93% over the previous month. In greenback phrases, that’s a $4.7 billion enhance to USDT’s market cap in simply 30 days. USDC holds second at $66.80 billion, climbing 3.56% in seven days and seven.56% in a month.

USDC added roughly $2.29 billion to its market cap this week, bringing its 30-day development to $4.69 billion. In third place, Ethena’s USDe shines with $10.99 billion, hovering 12.31% over the week and an eye-popping 106% for the month. Sky’s DAI holds $4.51 billion, climbing 4.38% in every week and 4.39% in a month, whereas its counterpart, sky greenback (USDS), sits simply behind at $4.48 billion, dipping 11.22% weekly however advancing 11.24% over 30 days.

Blackrock’s BUIDL holds $2.37 billion, marking a light 4.48% acquire for the week however a steep 15.61% drop over the month. The month-to-month decline traces again to final month’s pullback within the tokenized treasury sector, although the market has bounced 6.46% previously week, in line with rwa.xyz stats. World Liberty Monetary’s USD1 trails intently with a $2.21 billion market cap, edging up 0.51% this week and 0.12% over the previous month.

Ethena’s USDtb sits at $1.46 billion, posting modest positive aspects of 0.34% for the week and 0.76% over the month. Falcon’s USDf jumped 6.50% this week and an attention grabbing 86.35% in 30 days, reaching $1.23 billion. Paypal’s PYUSD follows at $1.18 billion, climbing 15.56% weekly and 40.26% for the month. First Digital’s FDUSD has slipped out of the highest ten, now holding the eleventh spot with a $1.02 billion market cap. It eked out a 0.08% acquire for the week however tumbled 14.73% over the previous month.