In accordance with sector analysis, perpetual DEXs processed greater than $2.6 trillion in trades throughout 2025. These venues are progressively displacing centralized exchanges by providing custody-free leverage and sooner execution.

But, their rise additionally raises questions on transparency, token stability, and the long-term which means of decentralization. Consequently, the sector might evolve right into a sturdy pillar of DeFi or face challenges tied to its design.

Market Surges to Data

Newest Replace

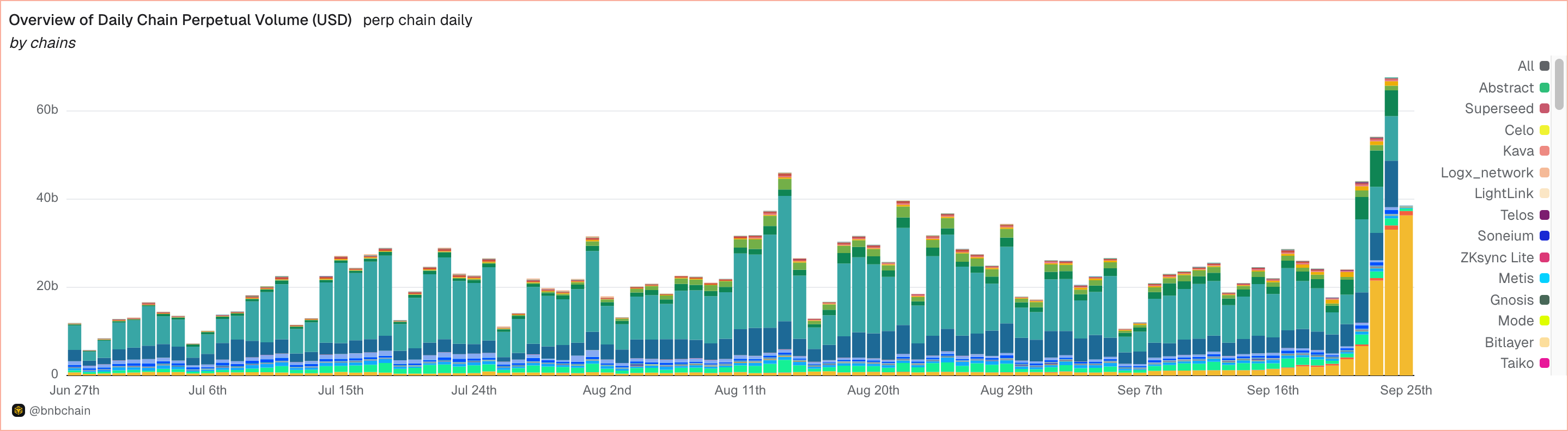

Dune dashboards confirmed day by day perp volumes above $67B in September. Hyperliquid, Aster, and Lighter every cleared $10B, sparking debate on potential wash buying and selling.

Overview of Day by day Chain Perpetual Quantity (USD)|Dune

Background Context

FTX’s collapse shattered belief in CEX custody. As well as, 21Shares likened perps to “renting a home”—versatile however pricey—displaying why they grew to become DeFi’s core engine.

Deeper Evaluation

CoinShares reported 210% progress in 2024, with Hyperliquid volumes up 25x. Jupiter rose 5,176% and Drift 628%. As 21Shares analysis famous, cumulative perp trades hit $2.6T in 2025, up 138%.

Behind the Scenes

Bybit in contrast Hyperliquid’s L1 to Aster’s BNB-first design. ASTER surged 300% post-launch, pushed by CZ. Aster briefly overtook Hyperliquid. Consequently, analysts famous that decentralization is now usually described as an “phantasm”—pace is desk stakes, story decisive.

Business Faces Structural Shift

Wider Influence

Perp DEX share rose from

The highest 4 Perp DEXs comprise 77% of all quantity: pic.twitter.com/8pCkKZsyNv

— DefiLlama.com (@DefiLlama) September 23, 2025

Important Info

Wanting Ahead

OAK Analysis projected Hyperliquid’s share may keep at 4.5% bear, 6% base, and eight% bull. Messari even referred to as it an “on-chain Binance.”

Bitwise’s Max Shannon instructed BeInCrypto that the addressable market may increase far past present ranges. If decentralized perps preserve capturing share from CEXs, annual volumes might attain $20–30 trillion inside 5 years. He famous that leverage and buying and selling churn amplify progress past spot volumes, with institutional adoption and regulatory readability performing as additional catalysts.

Clouds Over Fast Enlargement

Dangers & Challenges

DefiIgnas warned HYPE isn’t FTX or Luna however reflexivity persists. Hayes commented on Aster, whereas others predicted excessive HYPE upside. CZ mentioned darkish swimming pools protect establishments from MEV and liquidation searching however cut back transparency.

Shannon additionally warned that with day by day volumes already surpassing $67B, regulators might view perp DEXs as systemic. He recommended future oversight may mandate registered interfaces, standardized oracles, audited insurance coverage funds, and formalized danger controls—particularly if loss-sharing occasions threaten stablecoins or if open curiosity rivals that of centralized exchanges.

Professional Opinions

Perp DEXs can fail, however not like FTX. Their weak factors are structural relatively than fraudulent, and the dangers are clear and on-chain.

— Max Shannon, Bitwise, instructed BeInCrypto

“Hyperliquid has every little thing it takes to turn out to be the Home of Finance,” analysts said.

— OAK Analysis

“Extra gamers will develop the market dimension sooner. Rising tide lifts all boats,” mentioned CZ on X.

— Binance founder

Perp DEXs are proliferating, supported by advances in execution pace and liquidity depth. Nonetheless, their future will depend on whether or not contributors stability incentives with constant governance and credible token fashions. As well as, if execution continues to enhance however belief weakens, adoption might gradual.

In contrast, if tasks mix sturdy infrastructure with sustainable economics, the sector may turn out to be a central engine of DeFi liquidity and a basis for broader market integration.

The submit The Age of Perpetual DEXs: Development Meets Clouds appeared first on BeInCrypto.