One week after opening a contest to determine the issuer of its first native stablecoin, USDH, Hyperliquid is getting ready for a validator vote on Sunday to pick out the winner in what has rapidly change into one of many trade’s most intently watched group choices.

Hyperliquid, a decentralized change for perpetual futures that launched its personal layer-1 in November 2024, dealt with $330 billion in buying and selling quantity in July with a staff of 11 folks. USDH will function the platform’s first dollar-pegged asset, offering merchants with a steady unit of account and collateral choice inside the Hyperliquid ecosystem.

The vote will determine which firm controls the change’s canonical stablecoin and features entry to billions in stablecoin flows.

The race has already seen twists. On Thursday, Ethena withdrew its bid and endorsed newcomer Native Markets. That leaves Paxos, Frax, Sky, Agora, Curve, OpenEden and Bitgo nonetheless in rivalry.

Associated: DeFi whale loses $40M as Kinto winds down and SwissBorg suffers hack: Finance Redefined

Native Markets

Native Markets was first staff to file a proposal for USDH, which it did on Sept. 5.

Explicitly fashioned to launch a Hyperliquid-native stablecoin, the group pledged to mint USDH instantly on HyperEVM and break up reserve yield evenly between HYPE buybacks and ecosystem progress.

Its plan depends on Stripe’s tokenization platform, Bridge, to handle reserves. This selection received early validator backing but additionally sparked pushback from rivals warning of potential conflicts with Stripe’s blockchain ambitions.

Supply: Haseeb Qureshi

Hyperliquid investor Max Fiege, former Uniswap Labs resident MC Lader and blockchain researcher Anish Agnihotri lead the enterprise.

Native Markets’ present odds on Polymarket: 96%.

Paxos

Additionally on Sept. 5, stablecoin infrastructure firm Paxos submitted a proposal to launch USDH, a Hyperliquid-first stablecoin designed to adjust to each the US Stablecoins Act (GENIUS Act) and the European Union’s Markets in Crypto-Property (MiCA) framework.

The submitting said that 95% of the curiosity generated from USDH reserves could be directed towards shopping for again Hyperliquid’s native token HYPE and redistributing it to validators, customers and accomplice protocols.

Supply: David Weber

“We’re the one agency that has launched and scaled a number of regulated stablecoins, together with Binance USD to $25B+ and PayPal USD to $1B+,” Paxos stated in its announcement.

Paxos additionally pledged to combine USDH into its brokerage platform, already utilized by PayPal and Venmo.

Paxos’ present odds on Polymarket: 4%.

Sky

On Sept. 8, Ethereum decentralized finance (DeFi) pioneer Sky, the issuer of the decentralized stablecoin USDS (previously DAI), submitted its proposal. Sky’s pitch stands out for pledging to make USDH natively multichain through LayerZero, permitting the token to flow into throughout networks from day one.

Supply: Rune Christensen

The staff additionally dedicated to deploying a part of its stability sheet into Hyperliquid, providing the group a 4.85% return on USDH, and direct income towards HYPE buybacks and the Help Fund.

Sky’s present odds on Polymarket: lower than 1%.

Frax Finance

Decentralized finance protocol Frax Finance, issuer of the frxUSD stablecoin, outlined its proposal to difficulty USDH by a partnership with a federally regulated US financial institution, although the financial institution was not named.

The plan would again USDH one-for-one with tokenized US Treasurys, guarantee full GENIUS Act compliance, and recycle the whole treasury yield into Hyperliquid’s ecosystem.

Supply: Frax Finance

Frax described its method as “one thing nobody else will match: give every little thing again to the group.”

Frax Finance’s present odds on Polymarket: lower than 1%.

Agora

Additionally on Sept. 8, Agora, the issuer of the AUSD stablecoin, put ahead a proposal to launch USDH with VanEck as asset supervisor. The bid proposal encompasses a dedication to direct 100% of web income from reserves into HYPE buybacks or the Help Fund.

Agora additionally sharply criticized Native Markets’ reliance on Stripe’s Bridge, warning that Stripe’s plans for its personal Tempo blockchain might create conflicts of curiosity for Hyperliquid.

“If Hyperliquid relinquishes its canonical stablecoin to Stripe, a vertically built-in issuer with clear conflicts, what are all of us even doing? We strongly urge warning towards utilizing Stripe (Bridge) as an issuer,” Nick VanEck, co-founder of Agora, stated on X.

Agora’s present odds on Polymarket: lower than 1%.

The remaining rivals

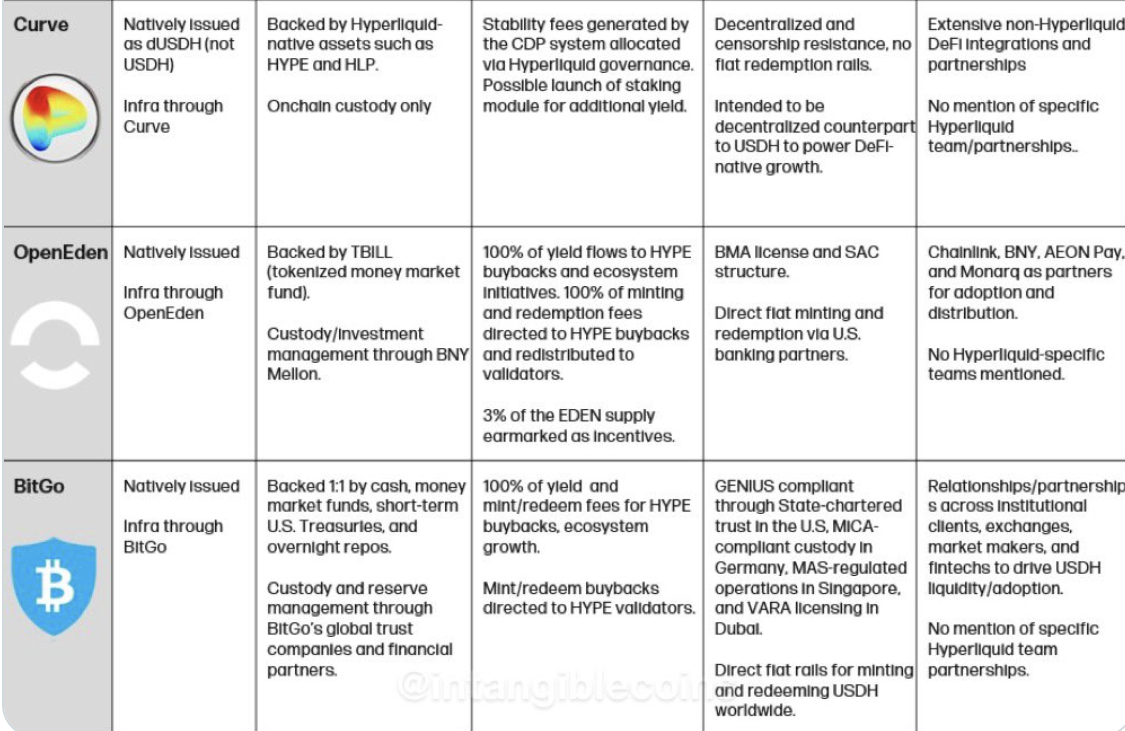

Three last-minute bids had been submitted on Sept. 10, the ultimate day of the proposal window, and haven’t but appeared on Polymarket’s prediction markets.

They got here from Curve, the Ethereum-based decentralized change identified for its stablecoin swimming pools; OpenEden, a real-world asset tokenization platform; and BitGo, a US crypto custodian and belief firm.

Supply: Galaxy Analysis

Associated:BitGo recordsdata for US IPO as crypto custody enterprise surpasses $100B

How the USDH vote will work

The USDH vote marks Hyperliquid’s first main governance determination past routine asset delistings. Voting will happen totally onchain between 10:00 and 11:00 UTC on Sunday, with validator energy decided by the quantity of HYPE tokens staked and delegators free to shift their assist.

A proposal should win two-thirds of the entire stake to go, although the Hyperliquid Basis and staking supplier Kinetiq — which management about 63% of tokens — have pledged to abstain.

The buildup to the vote has coincided with a rally in HYPE, which hit a brand new all-time excessive of $57.30 on Friday, in keeping with information from CoinGecko.

Journal: TradFi is constructing Ethereum L2s to tokenize trillions in RWAs — Inside story