Bitcoin ETF inflows are accelerating the affect of institutional buyers available on the market, reshaping BTC’s provide dynamics and total construction. As these ETFs have flooded into the area, many see this wave of institutional participation as an unprecedented shift in Bitcoin’s narrative. However what if this institutional knowledge might be used not simply to look at the market, however to outperform bitcoin itself?

Who Actually Buys Bitcoin ETFs? Defining ‘Institutional’

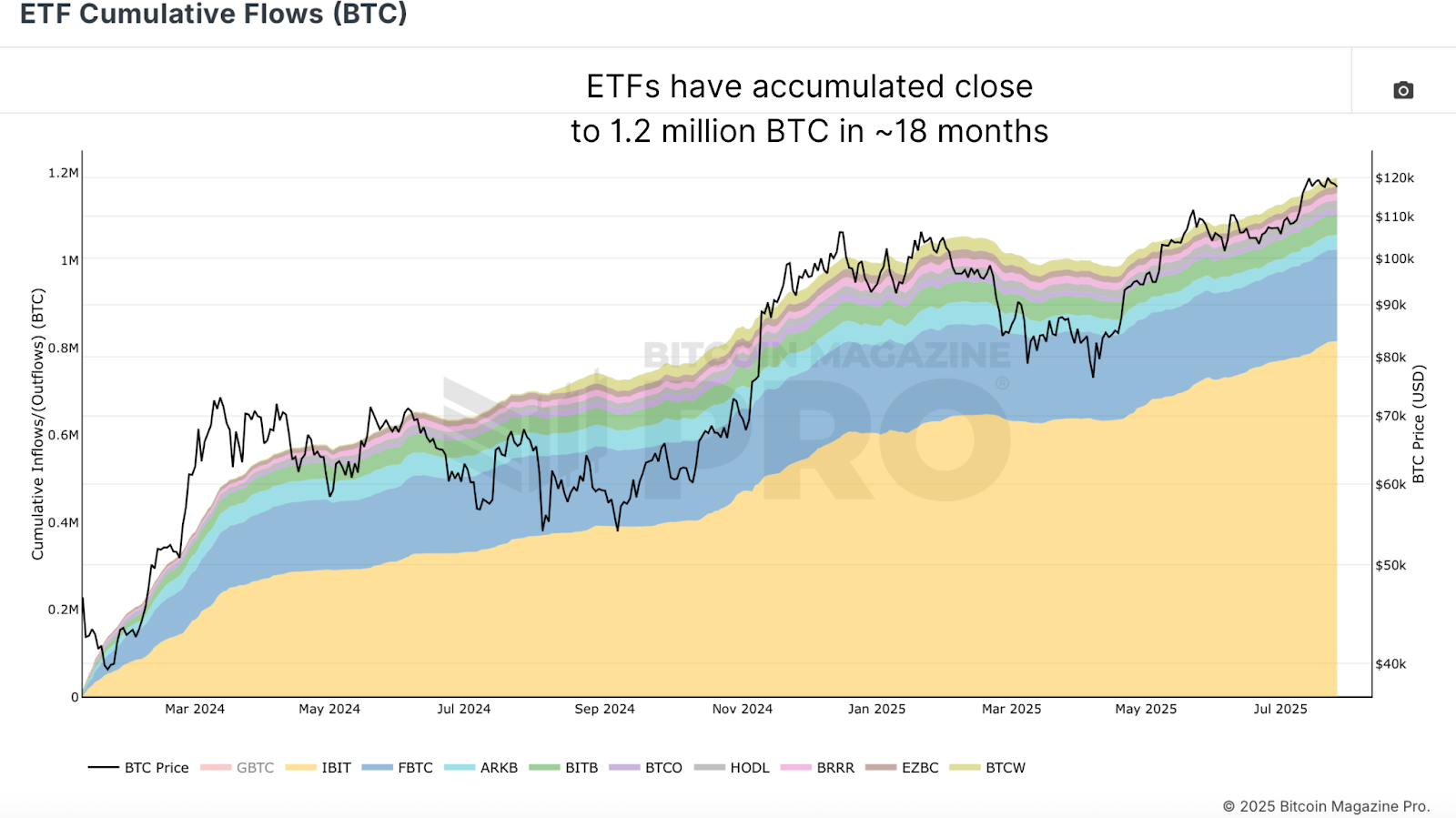

The time period “institutional” is continuously used as shorthand for ETF consumers, however in actuality, these inflows symbolize a mixture of high-net-worth people, household workplaces, and a few precise institutional funds. Maybe solely 30–40% are what we might contemplate true establishments. Regardless, ETF Cumulative Flows have grown exponentially to virtually 1.2 million BTC since January 2024. That’s a transformative quantity, arguably eradicating a significant chunk of obtainable provide from the open market indefinitely.

Determine 1: The exponential development in ETF Cumulative Flows since January 2024. View Dwell Chart

This sort of accumulation, particularly when paired with long-term holding habits from treasury corporations and probably even nation-states, has completely altered Bitcoin’s liquidity profile. These cash could by no means re-enter circulation.

Turning ETF Circulate Information Right into a Worthwhile Bitcoin Buying and selling Technique

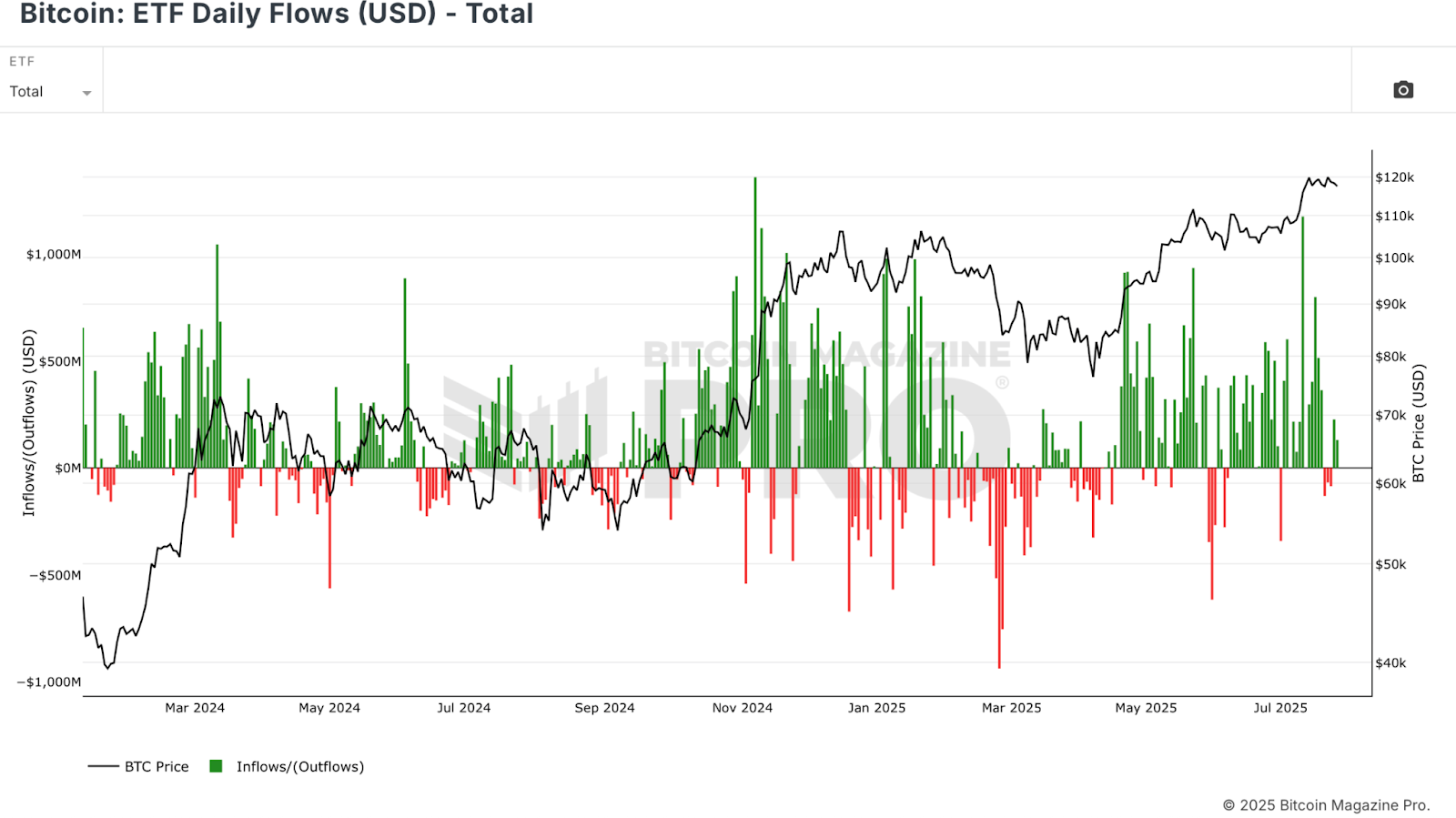

Many assume these ETF contributors are the epitome of good cash, savvy buyers shifting in opposition to the grain to use retail sentiment. However the knowledge tells a distinct story. Evaluation of the ETF Day by day Flows (USD) chart reveals a herd-like habits of shopping for closely into native tops and capitulating at native bottoms.

Determine 2: The ETF Day by day Flows chart illustrates sub-optimal efficiency from institutional merchants. View Dwell Chart

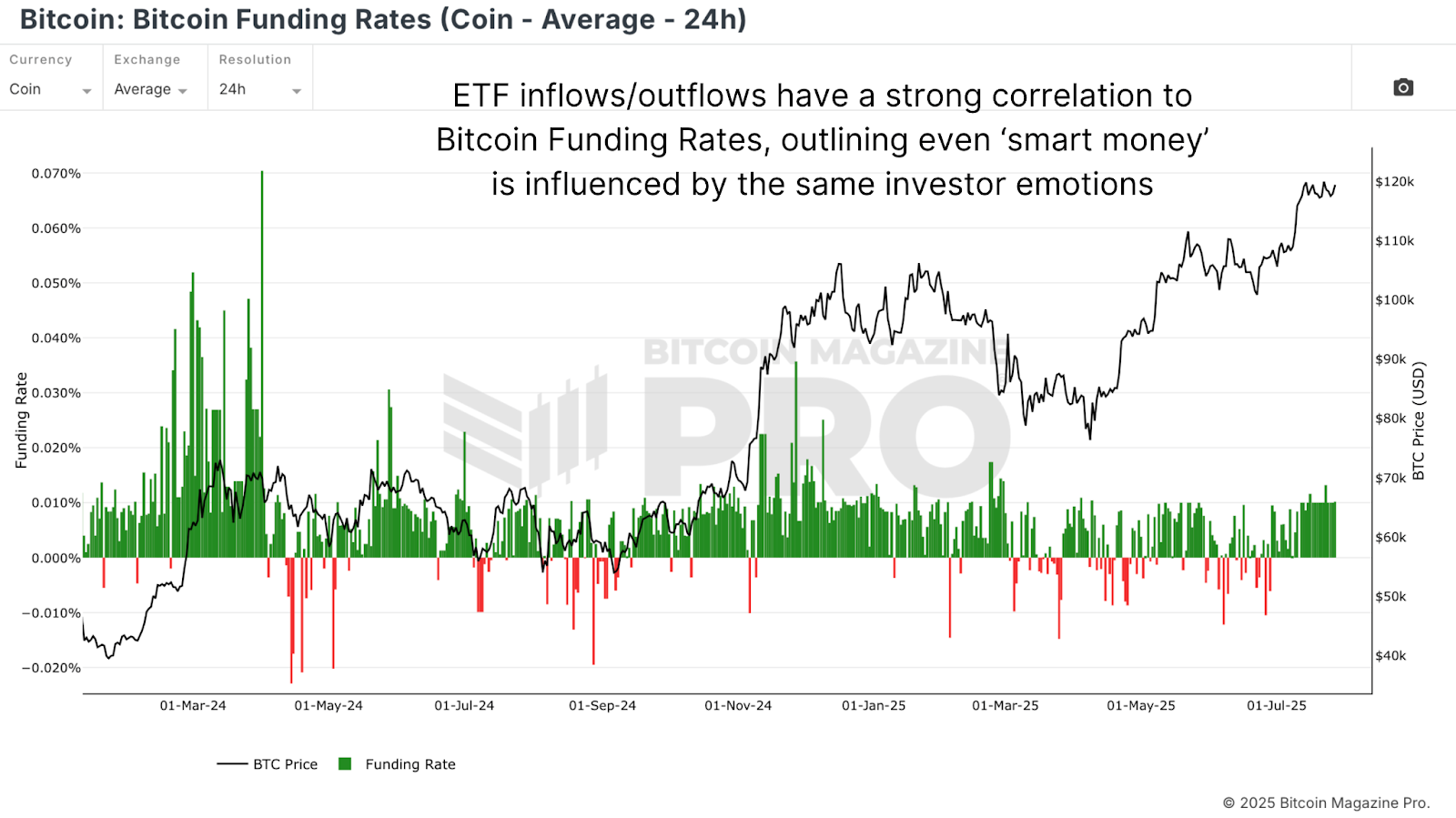

A comparability between ETF Flows and Bitcoin Funding Charges, a retail sentiment barometer, reveals an uncanny synchronicity. Establishments are basically shopping for and promoting in lockstep with retail, not forward of them. This shouldn’t be shocking. Human psychology, cognitive bias, and FOMO don’t cease affecting individuals simply because they handle giant sums of cash. Even treasury departments of huge companies usually find yourself shopping for into bullish euphoria.

Determine 3: ETF habits within the earlier chart mirrors retail sentiment, as depicted by this Bitcoin Funding Charges knowledge. View Dwell Chart

Bitcoin ETF Circulate Technique vs. Purchase-and-Maintain: The Outcomes

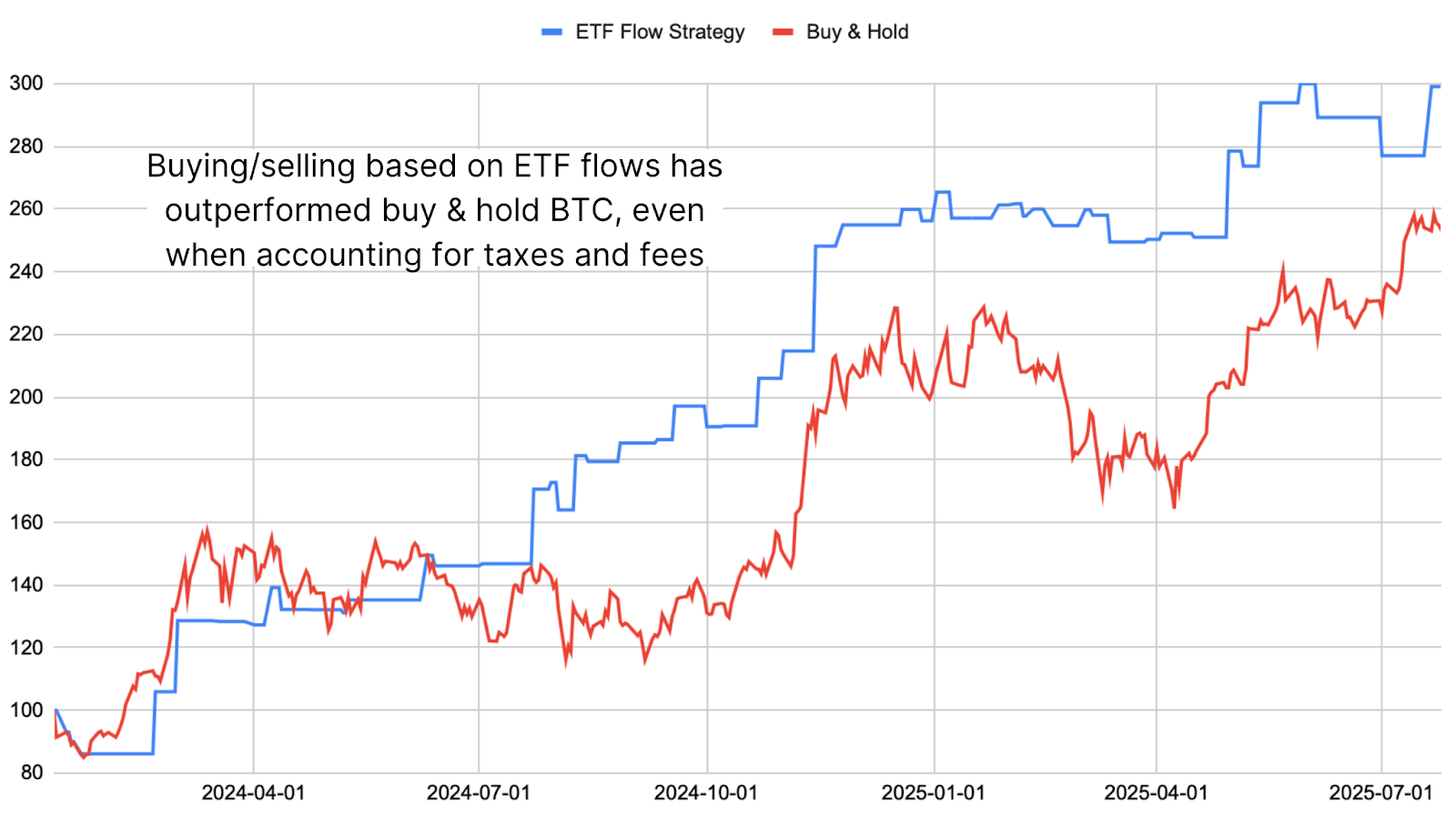

If ETF consumers are merely following the development of shopping for as value will increase and promoting as value decreases, then their inflows and outflows can function a possible entry/exit sign, or higher but, as a momentum indicator when interpreted appropriately. To check this idea, we created a easy technique utilizing ETF stream knowledge by way of the Bitcoin Journal Professional API.

Determine 4: Utilizing historic knowledge, a buying and selling technique primarily based on contrarian alerts from ETF Flows outperformed buy-and-hold.

The logic is easy: purchase Bitcoin when ETFs present inflows, and promote after they present outflows. It isn’t an ideal sign; early trades present drawdowns and a noticeable underperformance in contrast to purchase and maintain, however when this technique is utilized over the total span since ETFs launched, the returns are spectacular. Practically 200% versus roughly 155% for a buy-and-hold technique. Even when factoring in a nominal 20% taxation price on worthwhile trades, the technique nonetheless outperformed.

Ought to You Use a Bitcoin ETF Circulate Technique?

This sort of tactical technique isn’t for everybody. Many Bitcoiners are long-term holders who would by no means contemplate promoting. However for these keen to handle threat and seize edge available in the market, this ETF-based technique provides a strategy to leverage the habits of the large market contributors.

So, does following institutional flows offer you an edge? By itself, most likely not a constant one. Whereas undoubtedly spectacular, it has labored this lengthy, I personally have doubts this may work over a number of cycles. However paired with the broader market context, it turns into a useful gizmo for gauging the development and reinforcing different alerts to compound returns.

Beloved this deep dive into bitcoin value dynamics? Subscribe to Bitcoin Journal Professional on YouTube for extra skilled market insights and evaluation!

WATCH LATEST BITCOIN ANALYSIS

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to skilled evaluation, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your individual analysis earlier than making any funding choices.

This publish This Bitcoin ETF Technique Has Outperformed BTC Purchase-and-Maintain first appeared on Bitcoin Journal and is written by Matt Crosby.