Anthony Scaramucci, the founding father of SkyBridge Capital and former White Home Communications Director, has constantly positioned himself as one in all Bitcoin’s most vocal supporters.

In early January, he appeared on the Bankless podcast to reaffirm his bullish stance, not simply on Bitcoin, but additionally on a handful of different digital property that he believes have long-term utility.

Scaramucci’s crypto portfolio, primarily based on his public commentary, is structured with 50% allotted to Bitcoin (BTC), whereas the remaining half is cut up evenly throughout Solana (SOL), Avalanche (AVAX), and Polkadot (DOT). Amongst these, Solana stood out as his high decide for a layer-one blockchain on account of its low transaction prices and excessive throughput.

How a lot Scaramucci’s crypto portfolio carried out in H1 2025

To grasp how his funding strategy would have performed out over the primary half of 2025, we modeled a hypothetical $1,000 funding made on January 1, following his allocation technique.

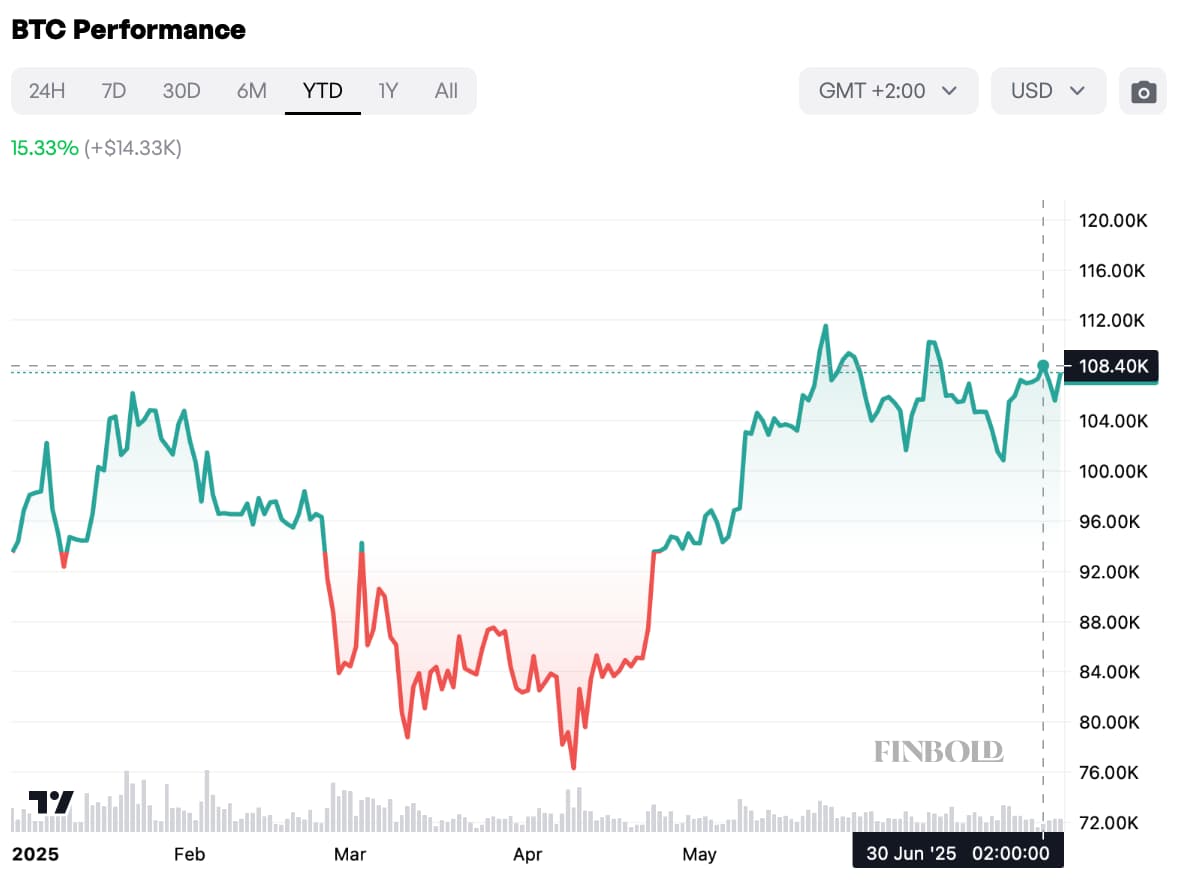

On the time, Bitcoin was buying and selling at $93,510, Solana at $189.45, Avalanche at $37.63, and Polkadot at $6.64. By mid-year, those self same property have been buying and selling at $108,400, $154.94, $17.97, and $3.40, respectively.

Bitcoin, which made up the most important share of the portfolio, delivered a constructive return of over 15%, serving to to partially offset the steep declines elsewhere. Solana ended June down greater than 21%, whereas Avalanche and Polkadot suffered even sharper declines, falling by round 50% every year-to-date.

Altogether, the portfolio was value $880.86 on June 30, representing an 11.9% decline from the preliminary $1,000 funding.