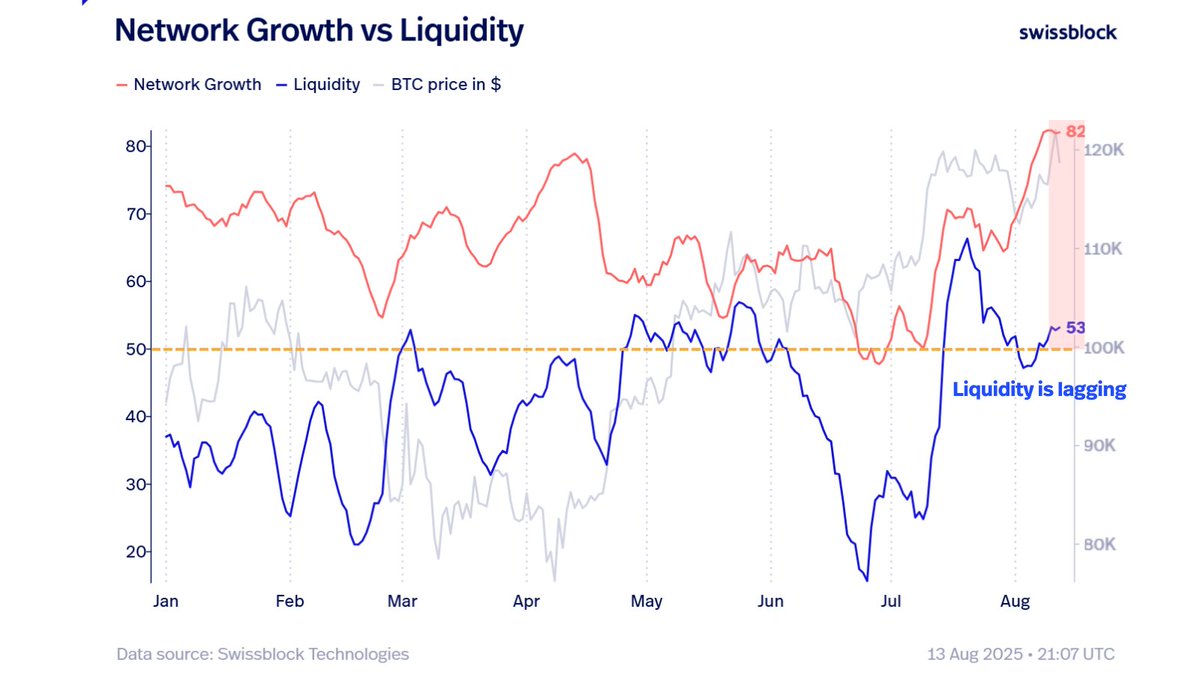

One key ingredient is lacking for Bitcoin (BTC) to soar nicely previous its all-time highs, in accordance with crypto analytics platform Swissblock.

The analytics platform says that the on-chain liquidity metric wants to extend to set off a convincing Bitcoin breakout.

On-chain liquidity refers to how simply and effectively Bitcoin might be purchased or offered with out considerably impacting BTC’s value. A low liquidity setting suggests there are usually not sufficient consumers to soak up promote orders, triggering value declines.

“BTC’s construction is robust, however liquidity is the lacking catalyst for a breakout past ATH (all-time excessive) with conviction. In the meantime, capital rotation into ETH and alts is in full movement, setting the stage for late-cycle altcoin outperformance. The subsequent massive transfer will probably be determined by the place new investor flows select to land.”

Supply: Swissblock/X

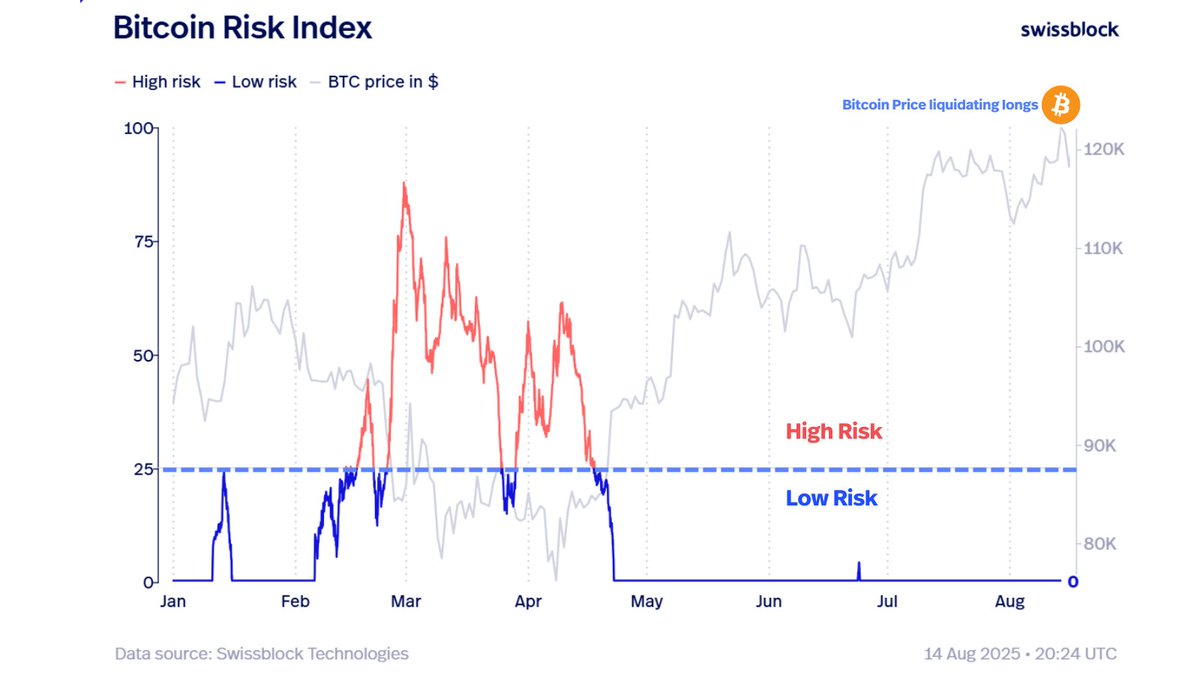

Swissblock additionally says that, based mostly on the Bitcoin Threat Index, the flagship crypto asset stays in a bull market and short-term corrections are golden alternatives for traders.

The metric goals to judge Bitcoin’s present danger setting by aggregating varied knowledge factors, together with on-chain valuation and cost-basis metrics.

“So long as danger stays low, it is a buy-the-dip setting. Bitcoin punishes the over-leveraged within the brief time period, and draw back volatility is rising – however structural danger stays contained. Low-risk regime: dips are alternatives.”

Supply: Swissblock/X

Bitcoin is buying and selling for $117,422 at time of writing, down marginally on the day.

Generated Picture: Midjourney