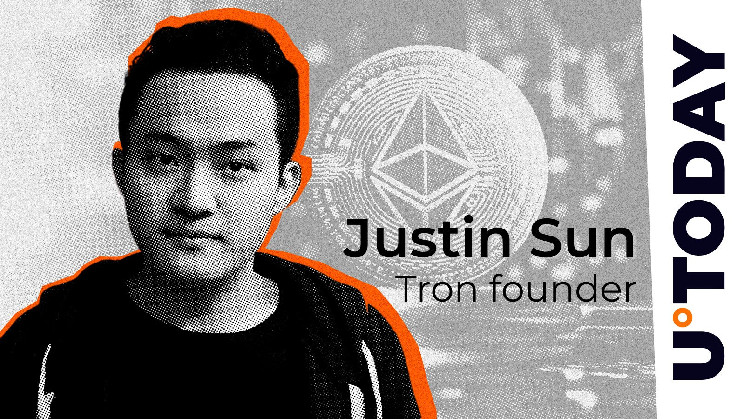

Justin Solar, a crypto billionaire and the creator of the Tron blockchain, has drawn the crypto group’s consideration to a significant subject on Ethereum that he sees as harmful for its close to future.

Solar addresses Ethereum’s leverage subject

Justin Solar believes that Ethereum is dealing with a giant subject of excessive leverage utilized by merchants once they conduct operations with ETH each on centralized and decentralized platforms. The Tron founder tweeted that within the quick time period this drawback is more likely to implode and “trigger losses to protocols and DeFi tasks” on the Ethereum community.

Solar urged the Ethereum workforce to handle this subject at an earlier stage and “resolve among the leverage” quite than watch for the difficulty to peak and explode, hurting Ethereum DeFi customers.

“A negotiated resolution is really helpful,” he tweeted.

Leverage use on Ethereum expands quickly

The difficulty talked about by Justin Solar refers to the truth that extreme leverage in ETH-based buying and selling has been growing considerably these days. Notably that may be seen in spinoff markets, corresponding to choices and perpetual futures. Many merchants have been more and more utilizing as much as 50x (typically even 100x) leverage when buying and selling ETH on massive platforms. This results in extreme dangers of liquidations when value volatility skyrockets.

One other issue boosting this drawback is ETH broadly used as collateral in varied Ethereum-based DeFi protocols. Excessive leverage right here implies that a sudden drop in ETH value could trigger mass liquidation of loans, which might strengthen bearish stress in the marketplace.

Additionally, when leverage turns into too excessive, this may occasionally result in funding charges surging and in return might drive merchants to start out shorting ETH. That is more likely to trigger market corrections.

A commentator responded to Solar’s submit, sharing knowledge that as of immediately, Ethereum’s leverage stands at 5–10x on $50 billion in publicity, which represents roughly11–14% of its $440 billion market cap. This will likely represent important danger since each day liquidation volumes have already risen to $50-$70 million, exhibiting energetic buying and selling based mostly on leverage.

Ethereum rebounds after 15% crash

Over the previous 24 hours, the second largest cryptocurrency Ethereum has crashed by a staggering 15%, dropping to $1,811 earlier immediately. Nonetheless, by now, ETH has rebounded by 6%, barely pairing its losses and is at present buying and selling at $1,920 per coin.

Ethereum right here mirrored Bitcoin’s fall under the $80,000 stage on Monday and the rise that adopted.